- The RWA sector has attracted vital consideration from institutional traders.

- Chainlink and Ondo are the highest RWA altcoins anticipated to shine in 2026.

- Specialists imagine that the last word set off for the 2026 alt season is the enactment of the CLARITY Act.

Altcoins centered on RWA tokenization, led by Chainlink (LINK) and Ondo (ONDO), are well-positioned to learn from the upcoming 2026 altseason. With geopolitical tensions easing and the US anticipated to move the CLARITY Act, institutional traders led by BlackRock Inc. (NYSE: BLK) wish to tokenize extra real-world belongings.

Chainlink or ONDO for the 2026 alt season?

Why Chainlink (LINK)?

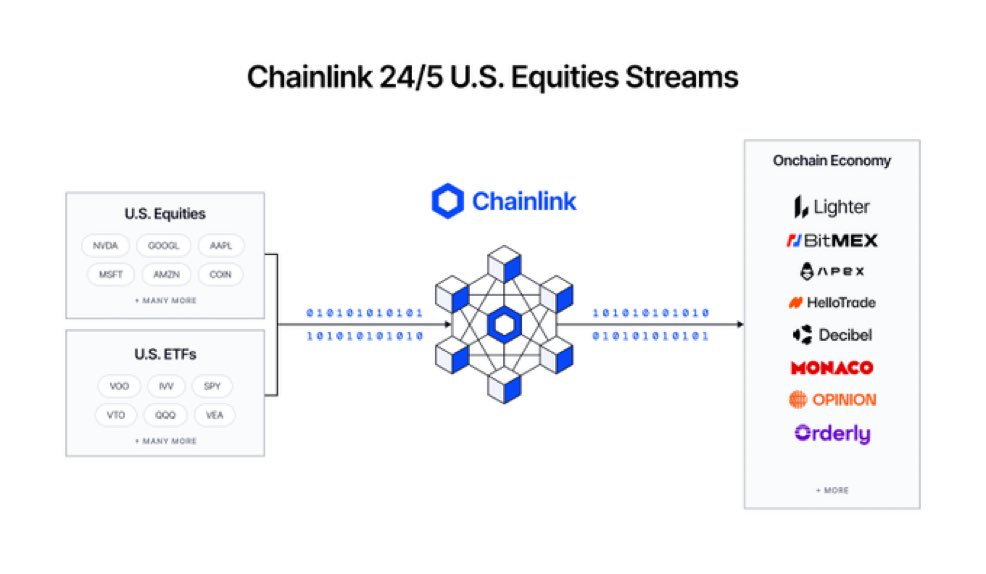

Mainstream world adoption of RWA has considerably elevated progress prospects for LINK and ONDO. Particularly, Chainlink facilitates seamless adoption of RWA belongings throughout the decentralized finance (DeFi) ecosystem.

Basically, Chainlink acts as an information connector and spine that bridges conventional finance and blockchain. That is why Chainlink is utilized by main monetary establishments resembling WisdomTree, ANZ Financial institution, and JPMorgan Chase.

Chainlink has robust world liquidity by means of its itemizing on main crypto exchanges and up to date spot exchange-traded fund (ETF) approval, and the altcoin is well-positioned for a parabolic rise in 2026.

On the time of writing, Chainlink’s LINK had a market capitalization of roughly $8.77 billion and a totally diluted valuation (FDV) of roughly $12.39 billion. The altcoin has seen a 21% enhance in common every day buying and selling quantity, reaching roughly $511 million on the time of writing.

Why ONDO?

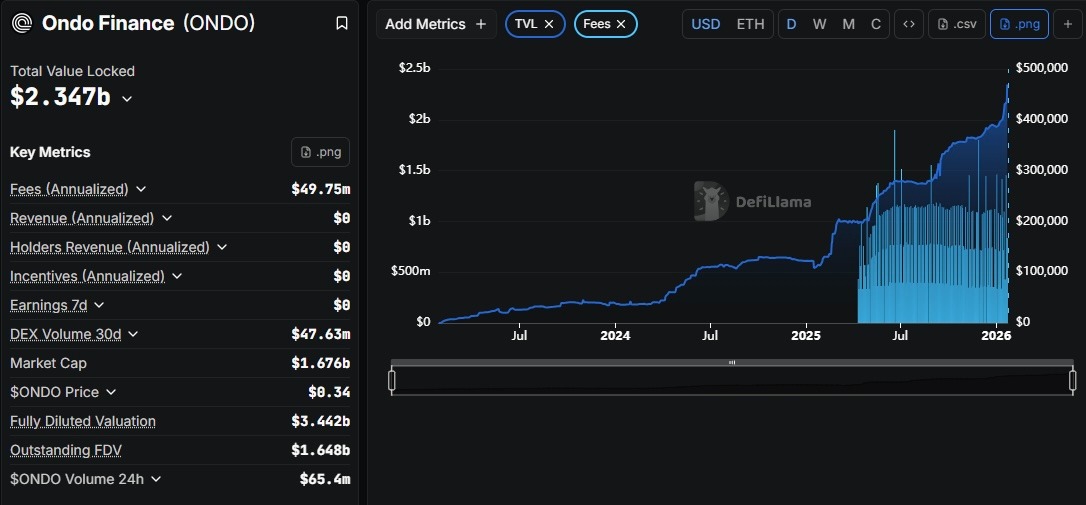

ONDO’s bullish outlook is supported by the robust progress of the Ondo Finance protocol. In line with market information from DeFiLlama, Ondo Finance’s whole worth locked (TVL) has elevated from roughly $222 million originally of 2024 to roughly $2.34 billion on the time of writing.

The ecosystem has grown to 10 supported blockchains and 150 built-in tasks, together with Solana (SOL), with asset administration firms resembling BlackRock and Franklin Templeton leveraging its tokenization framework.

Subsequently, ONDO token market capitalization has grown to roughly $1.66 billion and FDV to roughly $3.42 billion. Over the previous 24 hours, ONDO’s buying and selling quantity jumped by about 8% and remained at about $74 million.

What’s the greater market image?

The precedence and choice of LINK and ONDO will finally be decided by investor desire. Moreover, each tasks have a strong basis and are on the verge of being totally legalized in america by means of the CLARITY Act.

Nevertheless, ONDO is for traders with the next threat tolerance in comparison with LINK, which has matured after a few years of improvement and implementation.

Associated: Chainlink Value Prediction: Hyperlink open curiosity cools as merchants slowly rebuild positions

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply