- The AI mannequin supplies numerous XRP worth predictions for 2026.

- Conservative simulations place XRP close to $2, whereas bullish fashions predict an upside of $8 to $15.

- The long-term view suggests excessive upside potential of as much as $50.

Predicting the value of XRP is inherently tough resulting from market volatility and macroeconomic modifications. A Monte Carlo simulation of the XRP worth that analyzed 10,000 attainable situations exhibits that there’s a 60% chance that XRP will commerce between $1.04 and $3.40 by December 2026.

The median worth is $1.88, suggesting that half of the outcomes are lower than $2. Solely a ten% go above $5.90 represents a uncommon upside state of affairs. Conversely, simulations present a ten% likelihood that XRP will fall under $0.59, primarily if adoption doesn’t develop or broader market circumstances deteriorate.

Monte Carlo simulations depend on historic volatility and anticipated worth tendencies. For XRP, analysts assumed 35% annual upward drift and 90% annual volatility, reflecting its historical past of dramatic fluctuations. Notably, XRP rose from $0.50 to $3.40 within the three months from November 2024 to January 2025, a 570% soar, justifying the excessive volatility assumption.

ChatGPT, Perplexity and Claude supply numerous XRP predictions

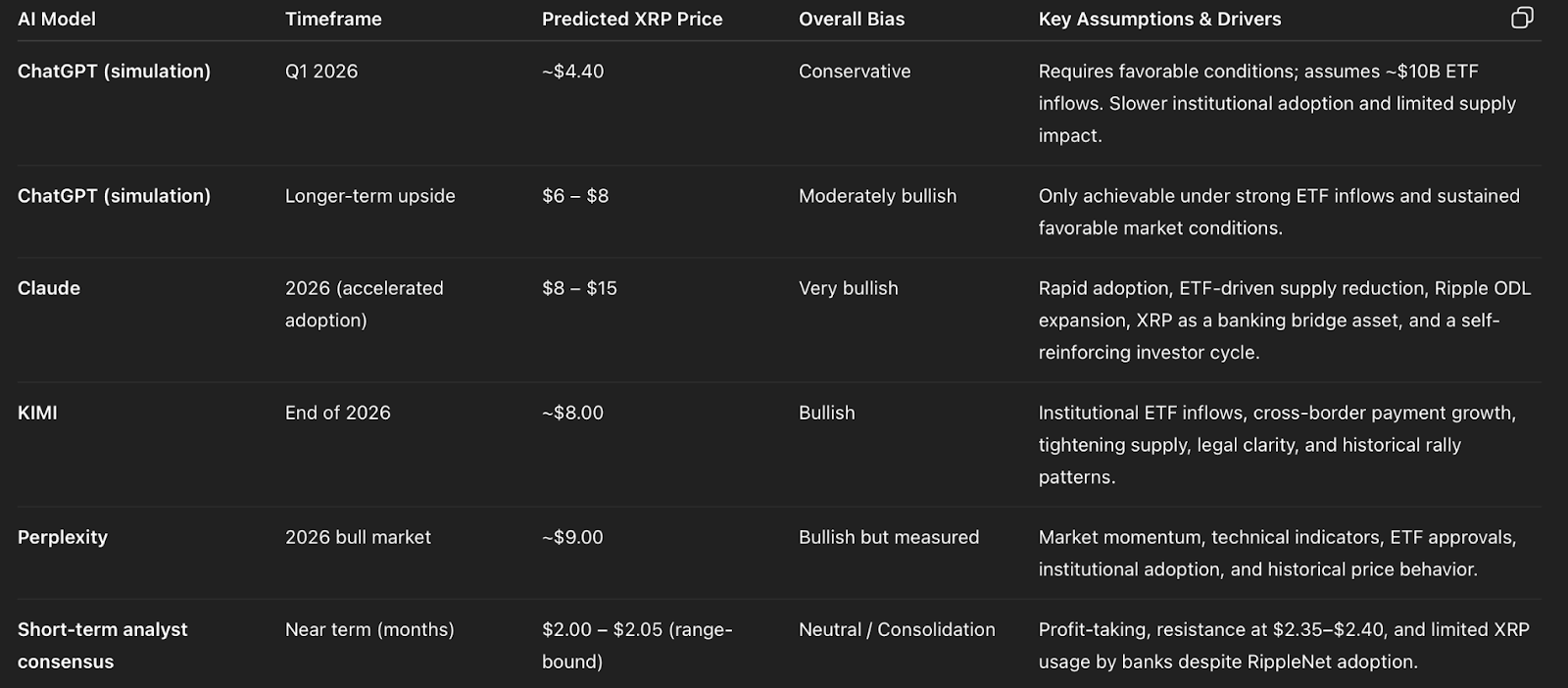

Totally different AI fashions supply contrasting views on XRP’s potential. The ChatGPT-based simulation is conservative, predicting a variety of $6 to $8 solely below favorable $10 billion ETF influx circumstances. We predict that XRP will attain round $4.40 by the primary quarter of 2026.

Claude, KIMI, and Perplexity AI are extra bullish. Claude predicts that XRP may attain $8 to $15 if adoption accelerates and ETFs cut back provide. This highlights the potential of Ripple’s on-demand liquidity community and XRP to function a bridging asset for banks.

Claude envisions a self-reinforcing cycle during which rising costs entice investor consideration, resulting in additional adoption. This mannequin is extra aggressive than different fashions and depends on a number of favorable circumstances aligning.

Equally, KIMI predicts that XRP may attain $8 by the top of 2026. This highlights the function of institutional inflows by way of spot ETFs and the potential for broader cross-border adoption. KIMI posits that sturdy demand from buyers and establishments may tighten provide and put upward strain on XRP. We additionally consider Ripple’s continued authorized readability and historic worth will increase.

In an analogous model, Perplexity predicts that XRP may rise to $9 throughout the 2026 bull market. The mannequin considers market momentum, technical indicators, and ETF approvals as catalysts. Perplexity highlights XRP’s previous efficiency and institutional adoption as key drivers whereas presenting a bullish state of affairs that is still inside real looking possibilities.

Quick-term forecasts recommend that XRP will commerce in a sideways vary, consolidating between $2.00 and $2.05, with resistance close to $2.35 and $2.40. Analysts word that speedy beneficial properties could possibly be restricted by revenue taking and the truth that many banks are utilizing RippleNet with out proudly owning XRP.

Grok affords a long-term view

xAI’s Grok supplies a long-term view. Though short-term predictions are per different fashions, Grok means that XRP may attain $50 by 2030. This assumes continued adoption by establishments, supportive regulation, and elevated use in cross-border funds.

This highlights the ETF’s efficiency, with $1.3 billion in belongings below administration within the first 50 days of XRP ETF launch, noting continued inflows as a key driver.

The platform additionally mentions Ripple’s enlargement, together with the acquisition of GTreasury and Ripple Prime, approval from the British Digital Cash Affiliation, and new partnerships. Capturing even a small portion of the $120 trillion world cross-border funds market may additional help demand for XRP.

Moreover, macro circumstances corresponding to potential Federal Reserve financial easing and the maturation of the crypto market may create favorable circumstances for XRP to outperform different altcoins.

Potential market influence

XRP’s anticipated volatility might influence broader investor conduct. Giant-scale capital inflows from institutional buyers and XRP worth fluctuations might influence danger urge for food and immediate changes to inventory and commodity portfolios. Giant actions in main cryptocurrencies have traditionally impacted inventory and commodity markets as buyers rebalance their danger exposures.

Associated: Whereas Zcash struggles, XRP and Solana expertise an institutional increase

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t chargeable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply