- PEPE defends 0.618 Fib and regains Ichimoku base, suggesting cautious bullish momentum

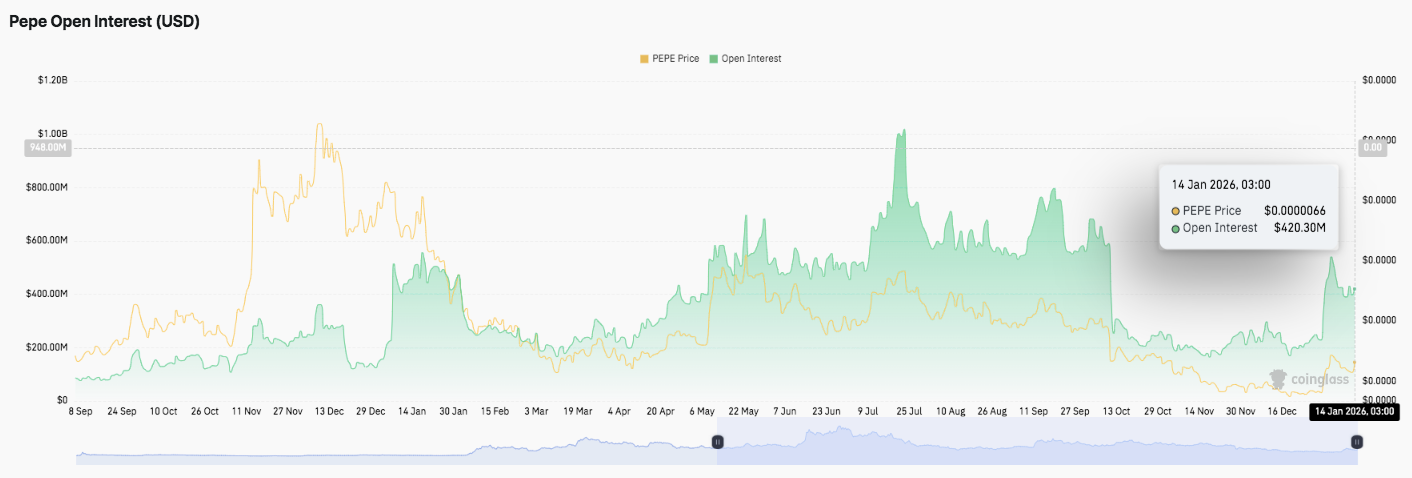

- Open curiosity stabilizes round $420 million, suggesting selective re-leverage for breakout

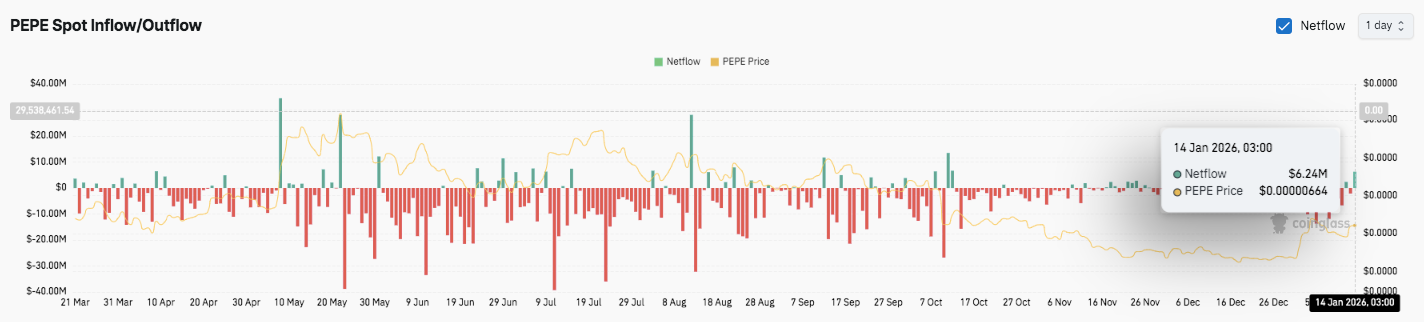

- Spot flows ease promoting strain as intermittent inflows counsel early accumulation stage

Pepe (PEPE) has entered a cautious restoration section after stabilizing above a key technical stage on the 4-hour chart. Latest value actions counsel that patrons are attempting to regain momentum whereas sellers are dropping short-term management. Market members are actually watching to see if this rebound develops right into a broader sustained motion.

Value Construction Exhibits Bettering Quick-Time period Momentum

PEPE not too long ago defended the 0.618 Fibonacci retracement round $0.00000581, which served as a key inflection level. After sustaining this stage, the worth returned above the Ichimoku cloud normal. This motion usually signifies an enchancment in short-term development circumstances. Subsequently, merchants presently view this construction as cautiously bullish on decrease time frames.

Instant resistance is situated close to $0.00000649, coinciding with the 0.786 Fibonacci stage. A decisive break above this zone might push the worth again to $0.00000727.

This area was closely trafficked and stays an vital take a look at for patrons. Nevertheless, the upside momentum is prone to wane except buying and selling volumes clearly develop.

On the draw back, $0.00000581 has moved to first-line help. If it fails there, the worth might strategy $0.00000545. Additional weak spot might expose the $0.00000503 space, which coincides with deeper structural help. Subsequently, the bullish outlook weakens as soon as the worth breaks under the cloud and loses the $0.00000500 deal with.

Open curiosity suggests warning in re-leveraging

Derivatives knowledge provides one other layer to the outlook. PEPE open curiosity has gone by phases of growth and contraction. Within the second half of 2024, leverage steadily elevated as costs trended upward. This accumulation was subsequently unwound during times of sharp volatility, resulting in widespread deleveraging.

In mid-2025, open curiosity rose once more as costs remained strong. This divergence suggests speculative positioning relatively than sturdy spot demand. The inventory continued to say no sharply as a result of deterioration in danger sentiment.

Lately, open curiosity has held regular at practically $420 million. This stability signifies new participation, though merchants seem like extra selective. Moreover, leverage presently seems to be positioning itself for a breakout relatively than chasing momentum.

Spot stream offers hints for early stabilization

Spot stream knowledge offers extra context. For many of the historic interval, PEPE skilled continued web outflows reflecting secure distributions. Clusters of large-scale outflows as a result of low costs and declining confidence. However that development is beginning to wane.

Latest periods have seen diminished promoting strain and intermittent capital inflows. Specifically, the $6.24 million influx on January 14 suggests renewed curiosity. Moreover, a lower in energetic outflow suggests stabilization relatively than capitulation.

If the influx continues, the opportunity of accumulation will enhance. Till then, PEPE stays in transition, balancing restoration momentum with lingering warning.

PEPE value technical outlook

The important thing ranges of PEPE stay properly outlined as costs commerce throughout the growing restoration construction.

The upside stage lies at $0.00000649 as the primary hurdle, adopted by $0.00000727 as the subsequent main goal. A sustained breakout above this zone might open up room for a better extension, however it’s nonetheless vital to verify the momentum.

On the draw back, fast help lies at $0.00000581, which coincides with a key Fibonacci retracement. Beneath that, $0.00000545 and $0.00000503 type a deeper demand zone. The higher resistance close to $0.00000649 acts as a reversal stage for a stronger bullish continuation.

The technical scenario means that PEPE is stabilizing after a correction section, and the worth has regained the Ichimoku cloud on the 4-hour chart. This construction signifies elevated momentum relatively than fatigue. Directional indicators additionally point out a reestablishment of development power.

Will PEPE rise additional?

The PEPE value outlook relies on whether or not patrons are capable of defend $0.00000581 in opposition to resistance at $0.00000649. A profitable breakout might enhance volatility in the direction of $0.00000727.

Nevertheless, if the present help can’t be sustained, the restoration will weaken, leaving us uncovered to decrease ranges round $0.00000545 and $0.00000503. For now, PEPE is buying and selling in a pivotal zone, with affirmation from quantity and flows prone to decide the subsequent decisive transfer.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not answerable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply