- Quick-time body bearish construction limits PI good points regardless of short-term pullbacks

- Upcoming PI token unlocking will increase near-term provide threat and stress sentiment

- Progress in real-world adoption may soften the draw back, however is unlikely to offset the short-term selloff

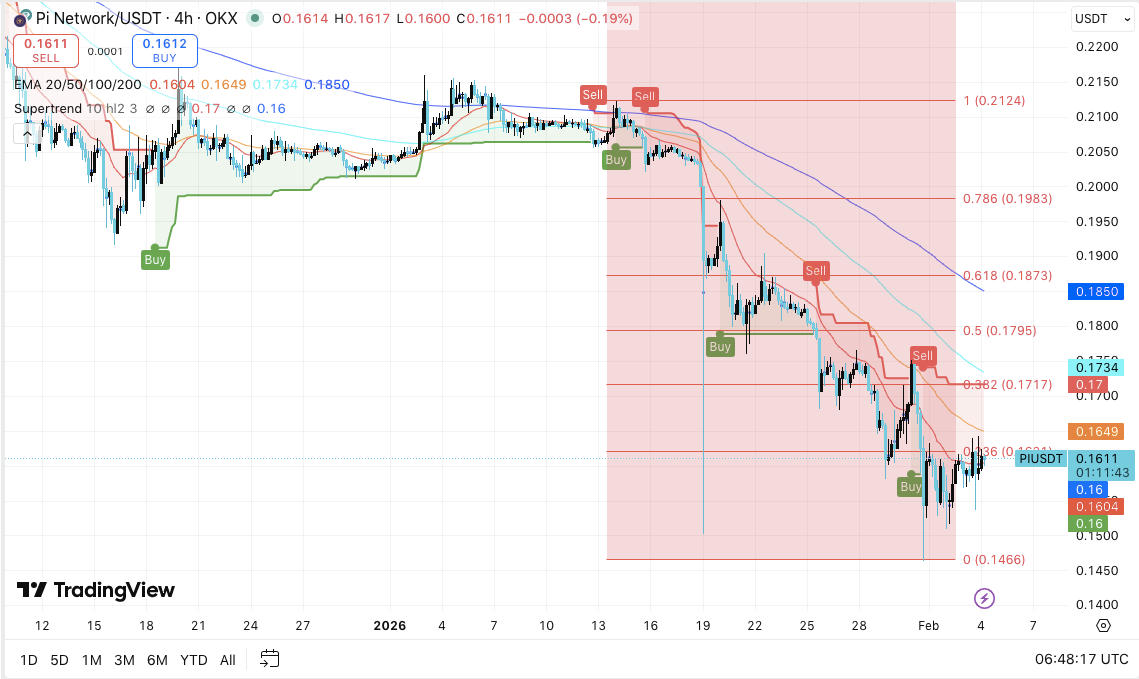

Pi (PI) continues to commerce beneath stress as technical weaknesses on shorter time frames collide with upcoming token unlocks. On the 4-hour chart, PI reveals a persistent bearish construction with sellers nonetheless controlling worth motion regardless of a short-term pullback. Consequently, merchants stay cautious as they watch whether or not wider real-world adoption can offset short-term provide dangers.

Bearish construction limits good points

PI stays locked in a short-term downtrend, buying and selling under all main 4-hour exponential transferring averages. This alignment not solely confirms the bearish momentum but additionally signifies a scarcity of power in current makes an attempt to maneuver greater. The pullback from the $0.146 to $0.150 demand zone seems to be a correction and failed to draw any significant follow-through.

Market construction reinforces this view. Because the PI was rejected round $0.21, it has clearly seen a collection of highs and lows. Moreover, momentum indicators point out that sellers are constantly assembly overhead ranges. The supertrend sign stays damaging and the rally is attracting promoting curiosity somewhat than new demand.

The value continues to stall with instant resistance close to $0.164-$0.165. Past that zone, $0.171 to $0.172 represents a significant Fibonacci provide space. Due to this fact, analysts predict an preliminary rejection if costs check the realm.

Stronger resistance seems between $0.179 and $0.180, adopted by trend-defining resistance close to $0.187. Continued motion above that stage helps stabilize the construction.

On the draw back, $0.158 to $0.160 will act as near-term help. Nevertheless, if this space will not be sustained, it’s unlikely to retest the $0.150 to $0.147 vary.

Token unlocking will increase provide threat

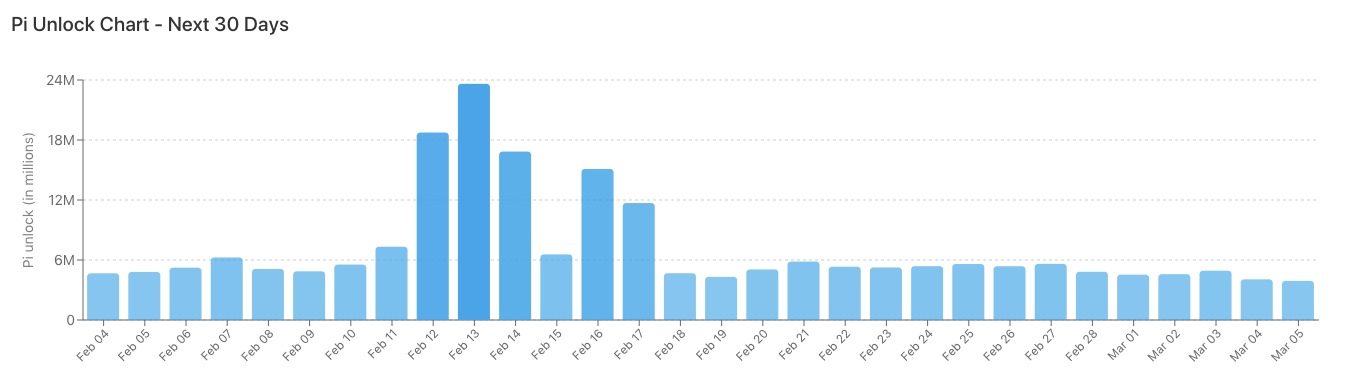

Token provide dynamics add additional stress. Based on Piska information, greater than 5.08 billion PIs are presently locked, valued at roughly $820 million. Moreover, roughly 215.6 million PIs are anticipated to be unlocked over the subsequent 30 days. This determine represents roughly 4.24% of the locked provide.

RELATED: Dogecoin Value Prediction: Musk Moon’s Feedback Keep Flat as DOGE Struggles to Keep $0.10

Each day unlocks averaged over 7.18 million PI, equal to roughly $1.16 million. Importantly, the most important single-day unlock anticipated on February thirteenth may lead to greater than 23.6 million PIs in circulation. Due to this fact, merchants stay cautious of potential promoting stress round that interval.

Deployment narrative offers long-term help

However Pi Community continues to drive the real-world utility narrative. The mission not too long ago enabled PI funds on Mobix, a platform that helps the acquisition of electronics, automobiles, and client items. Moreover, this integration aligns with Pi Community’s ongoing open mainnet transition.

Technical outlook for Pi (PI) worth

Pi’s key ranges stay effectively outlined for the short-term buying and selling window.

On the upside, the primary hurdle will probably be between $0.164 and $0.165, with the short-term EMA concentrated. A clear break above this zone may result in a transfer in direction of $0.171-$0.172 after which $0.179-0.180. The $0.187-$0.188 stage stays an essential resistance stage for a reversal for medium-term stabilization.

On the draw back, help will probably be at $0.158 to $0.160 in the meanwhile. Failure to maintain this space dangers retesting the $0.150 to $0.147 demand zone. Beneath $0.146, PI will probably be uncovered to a decline in liquidity pockets. The technical construction reveals that the PI is trending decrease inside a bearish channel the place the bull market continues to face promoting stress.

Will pi enhance?

Pi’s worth outlook will depend on whether or not patrons can defend $0.158 lengthy sufficient to problem the $0.172-$0.180 resistance cluster. Bias continues to development again promoting till PI regains quantity help at $0.187. Volatility might enhance as costs are compressed between help and resistance ranges.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be accountable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply