- Brief-term bias reverses to bullish above $0.35 as momentum and construction improves

- Whereas ADX and DMI affirm development energy, consumers take management in the event that they maintain above $0.33

- Rising open curiosity and whale inflows recommend conviction regardless of partial deleveraging

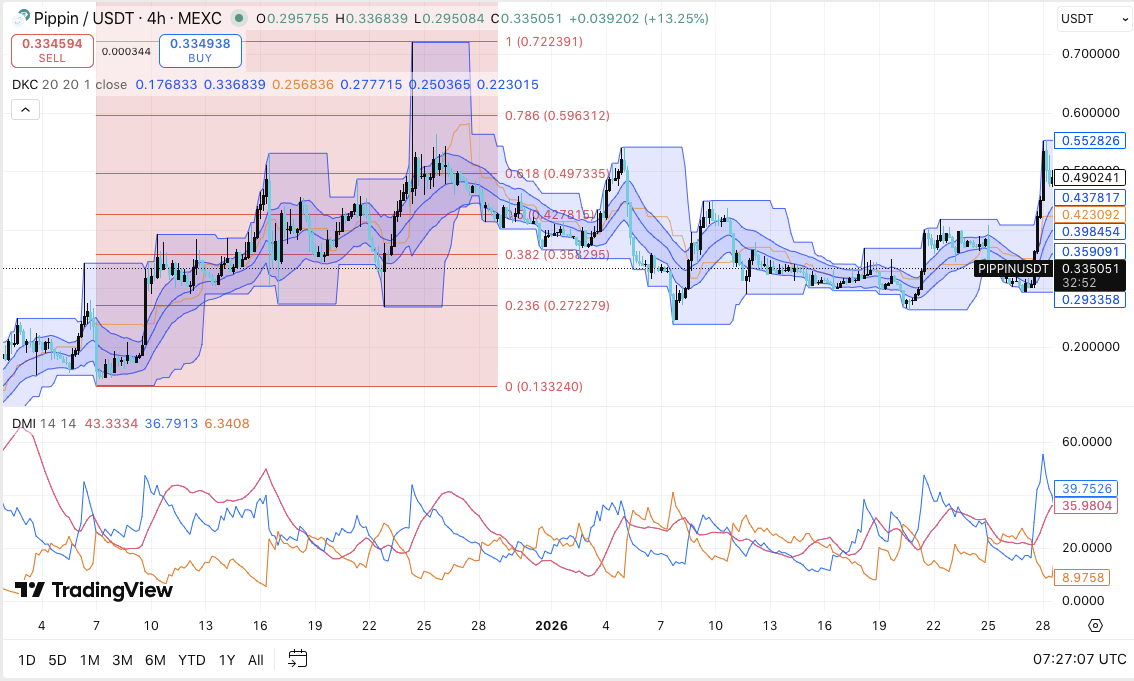

Pippin returned to merchants’ focus after a pointy restoration on the 4-hour chart signaled a transparent change in short-term momentum. The token has proven robust impulsive actions, with its value growing by greater than 13% in a single session.

This advance signaled a notable change in construction as PIPPIN broke above a key technical stage that had been proscribing value motion for a number of weeks. Because of this, market contributors are actually assessing whether or not this rebound is more likely to develop right into a broader continued motion.

Breakout resets short-term construction

The latest rally has pushed PIPPIN above the $0.335 to $0.350 zone that beforehand restricted upside. This breakout modified the short-term bias and positioned the worth above the essential shifting common.

This transfer, along with bettering momentum, means that consumers are actually extra assured and holding to larger ranges. Sustaining above $0.33 maintains the bullish construction and reduces the chance of an instantaneous reversal.

Moreover, value has returned to the midpoint of the volatility band, which regularly displays bettering development situations. DMI measurements assist this view, because the energy within the optimistic course exceeds the adverse strain.

Moreover, a rise in ADX readings signifies growing development energy somewhat than a short-term pullback. Subsequently, if consumers keep management, technical indicators align in favor of additional upside.

On the upside, merchants shall be waiting for resistance close to $0.39, adopted by a tighter cluster between $0.42 and $0.43. A daring breakout of this space might result in larger targets round $0.49-$0.55. These ranges correspond to early swing highs and volatility limits. Subsequently, if there’s a breakout, there’s a chance {that a} new wave of contributors will collect.

Associated: Shiba Inu Worth Prediction: SHIB Check Implements Help at $0.000006 Regardless of Burn Price Leaping 2,097%

Nonetheless, draw back dangers nonetheless exist. Preliminary assist is discovered close to $0.33, adopted by $0.30. A retracement in direction of $0.27 or $0.28 would nonetheless be inside a wholesome decline. Nonetheless, shedding that zone would weaken the bullish setup and produce the main focus again to vary situations.

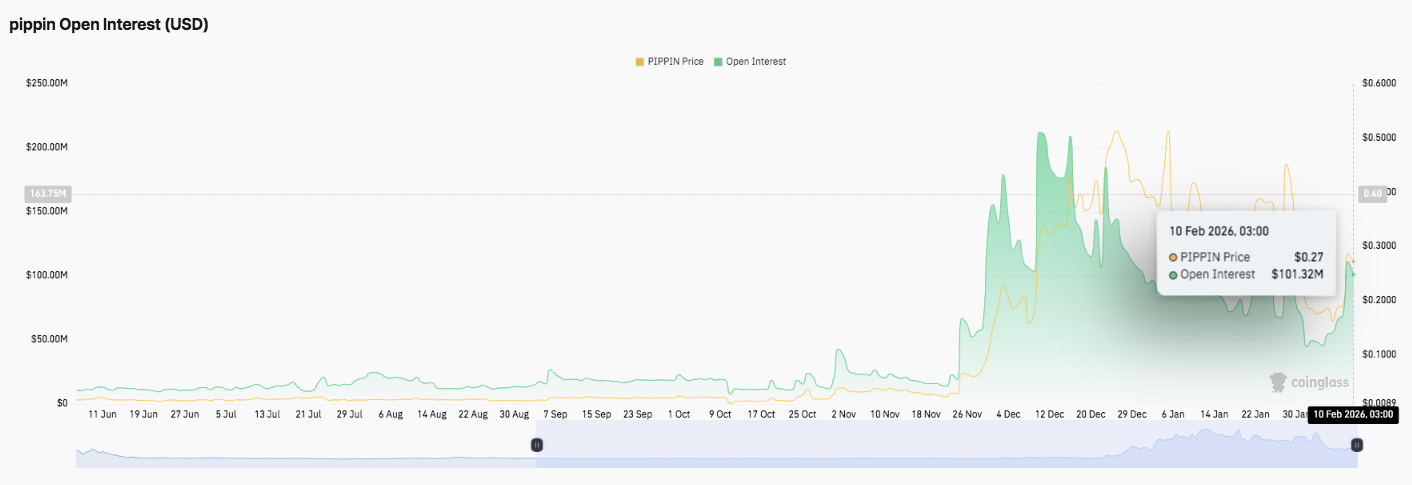

Including context with open curiosity and whale exercise

Open curiosity tendencies present additional perception into present positioning. Open curiosity remained flat for many of mid-2025, reflecting restricted speculative curiosity.

Importantly, exercise spiked in late November, peaking at over $200 million, as leverage expanded together with value. Since then, open curiosity has calmed down however continues to be up almost $100 million. This sample suggests a partial deleveraging somewhat than an entire reset.

On-chain flows additionally present perception into latest positioning. In accordance with Nansen information, PIPPIN led the Solana-based meme asset with a whale of $2 million in web inflows in 24 hours. Moreover, different tokens have seen selective accumulation somewhat than widespread danger urge for food.

Technical outlook for PIPPIN value

PIPPIN trades inside a newly established short-term bullish construction, so the important thing ranges are nonetheless clearly outlined.

Upside ranges to look at embody the primary hurdle at $0.39, adopted by a resistance cluster between $0.42 and $0.43. If a breakout above this zone is confirmed, the worth might broaden in direction of $0.49 and $0.55, in keeping with the earlier swing excessive and the growth of the volatility band.

On the draw back, speedy assist lies at $0.33, which marks the earlier breakout zone. Holding this stage will preserve the bullish bias intact. Beneath that, $0.30 acts as secondary assist, however a deeper decline to $0.27-$0.28 nonetheless suits in with a wholesome retracement. Dropping this decrease band weakens the construction and will increase draw back danger.

The technical state of affairs means that PIPPIN is shifting from consolidation to development continuation. Momentum indicators favor consumers, with value rising above main averages and bettering development energy.

Will PIPPIN proceed to rise additional?

The short-term trajectory will depend upon whether or not consumers generate sufficient follow-through to defend $0.33 and problem $0.42-0.43. Sustained inflows and steady open curiosity will result in managed positioning somewhat than depletion.

Nonetheless, failure to maintain $0.33 might delay the transfer to the upside and expose decrease assist. For now, PIPPIN stays within the crucial zone, the place approval will decide the subsequent leg.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be liable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply