- Quant surged 8.35% throughout the day, breaking above the 20-day, 50-day, and 100-day EMAs as patrons regained management after a months-long downtrend.

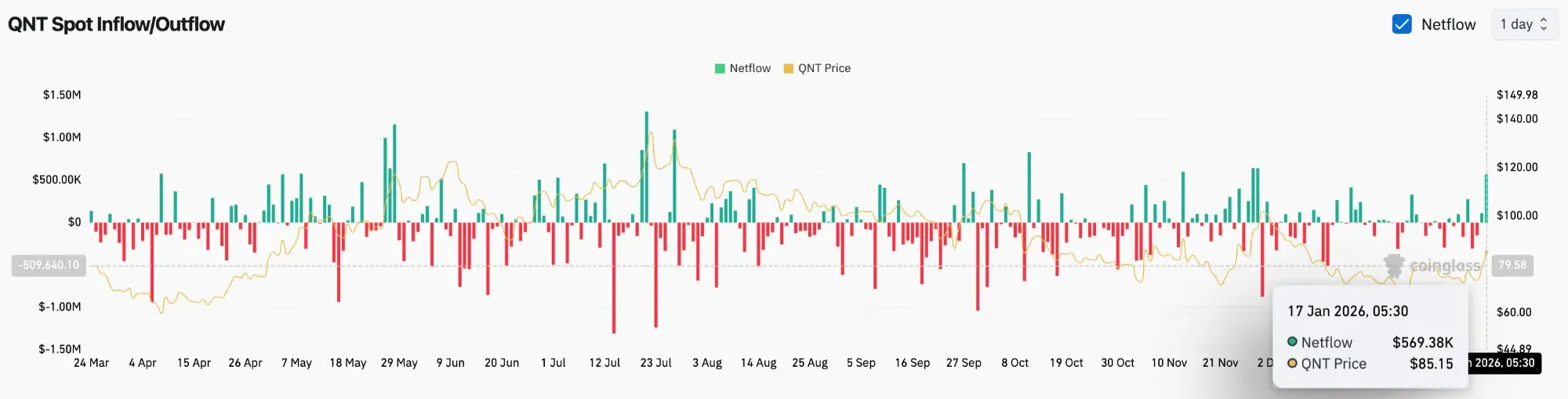

- Inflows from spot exchanges reached $569,380, indicating continued accumulation as merchants pull QNT from exchanges and into chilly storage.

- Company partnerships with HSBC, Barclays, and Dentsu Analysis Institute proceed to drive institutional curiosity in Overledger infrastructure.

The Quant worth at the moment is buying and selling round $84.98 after registering a single session improve of 8.35%. This rally decisively broke above the 100-day EMA for the primary time since October, and short-term momentum is shifting again towards patrons as spot flows flip constructive.

Accumulation of spot influx alerts

Forex stream knowledge confirms that there’s basic help for this rally. QNT recorded web inflows of $569,380 on January 17, in response to Coinglass. It is a notable reversal from the distribution sample that dominated This autumn 2025.

Constructive web flows often point out accumulation. As cash transfer from exchanges to personal wallets, the accessible provide on the order ebook decreases. This dynamic helps rising costs and limits the draw back throughout corrections.

This inflow comes similtaneously renewed consideration to Quant’s place as an organization. Quite than promoting on energy, merchants look like repositioning forward of potential catalysts.

Company partnerships drive sentiment

Quant’s basic background continues to be stronger than most mid-cap altcoins. Latest stories have highlighted the undertaking’s partnerships with main UK banks akin to HSBC, Barclays and Lloyds to develop tokenized pound deposit infrastructure.

In Japan, a partnership with Dentsu Analysis Institute will goal institutional stablecoins and programmable cost techniques. These partnerships leverage Overledger OS, which connects over 45 blockchains whereas sustaining ISO 20022 compliance.

The interoperability market is projected to achieve $19.59 billion by 2032. Quant’s give attention to institutional clients relatively than retail purposes creates a defensible area of interest that opponents akin to LayerZero have but to straight problem.

This basic energy explains why QNT tends to outperform throughout broad altcoin rallies. Institutional narratives entice capital from funds that keep away from speculative tokens.

Value break above EMA cluster

On the day by day chart, the quant has been buying and selling in a descending channel since its July excessive close to $135. This construction produced a collection of lows and every rally failed to fulfill the overhead resistance.

Right this moment’s transfer modifications that sample. The value broke above the 20-day EMA of $76.60, 50-day EMA of $78.42, and 100-day EMA of $82.67 in a single session. The breakout candlestick exhibits robust follow-through with an intraday excessive of $86.65.

The present main ranges are:

- Rapid resistance: $88.01 (200 EMA)

- Channel resistance: $90 to $92

- Brief-term help: $82.67 (100 EMA)

- Breakdown degree: $76.60 (20 EMA)

- Tremendous pattern help: $68.05

The Supertrend indicator turned bullish a number of weeks in the past at $68.05 and continues to help the restoration thesis. So long as worth stays above this degree, the broader pattern favors patrons regardless of the downward channel construction.

Bulls take a look at 200-day EMA

The 200-day EMA of $88.01 is the following main hurdle. This degree has acted as resistance since September, rejecting a number of makes an attempt to maneuver larger across the $88-$90 zone.

A day by day shut above $88 would point out that patrons have regained pattern management. This transfer may also break the highest of the descending channel, paving the way in which for $100 and finally $110.

Failure to clear $88 will trigger the construction to stay within the channel. In that situation, a break above the EMA cluster can be a rescue bounce relatively than a pattern reversal, and merchants would anticipate a pullback to check the $82 help.

The amount determines which situation is deployed. The present rally exhibits confidence, however the follow-through over the following 48 hours is extra essential than the preliminary breakout.

Outlook: Will quants proceed to rise?

That is the primary time in current months that the scenario has favored the bulls. Spot inflows, company catalysts, and a transparent break above the EMA cluster create a constructive backdrop for a continuation.

- Bullish case: A breakout is confirmed when the closing worth of the day is above $88 and the goal is $100. Continued inflows and a break above the $92 channel resistance will open the door to $110.

- Bearish case: If rejected on the 200 EMA, the value will return to the take a look at $82. Dropping the 100 EMA will flip the momentum bearish and expose the help at $76.

Quant is within the choice stage. The subsequent transfer will rely upon whether or not patrons are capable of take in the promoting stress on the 200-day EMA and switch this breakout right into a sustained pattern reversal.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be accountable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to carry out due diligence earlier than taking any motion associated to our firm.

Leave a Reply