Value tendencies are in a fragile stability that neither bulls nor bears have clear management over, and the Ripple cryptocurrency sits proper in the course of its latest vary.

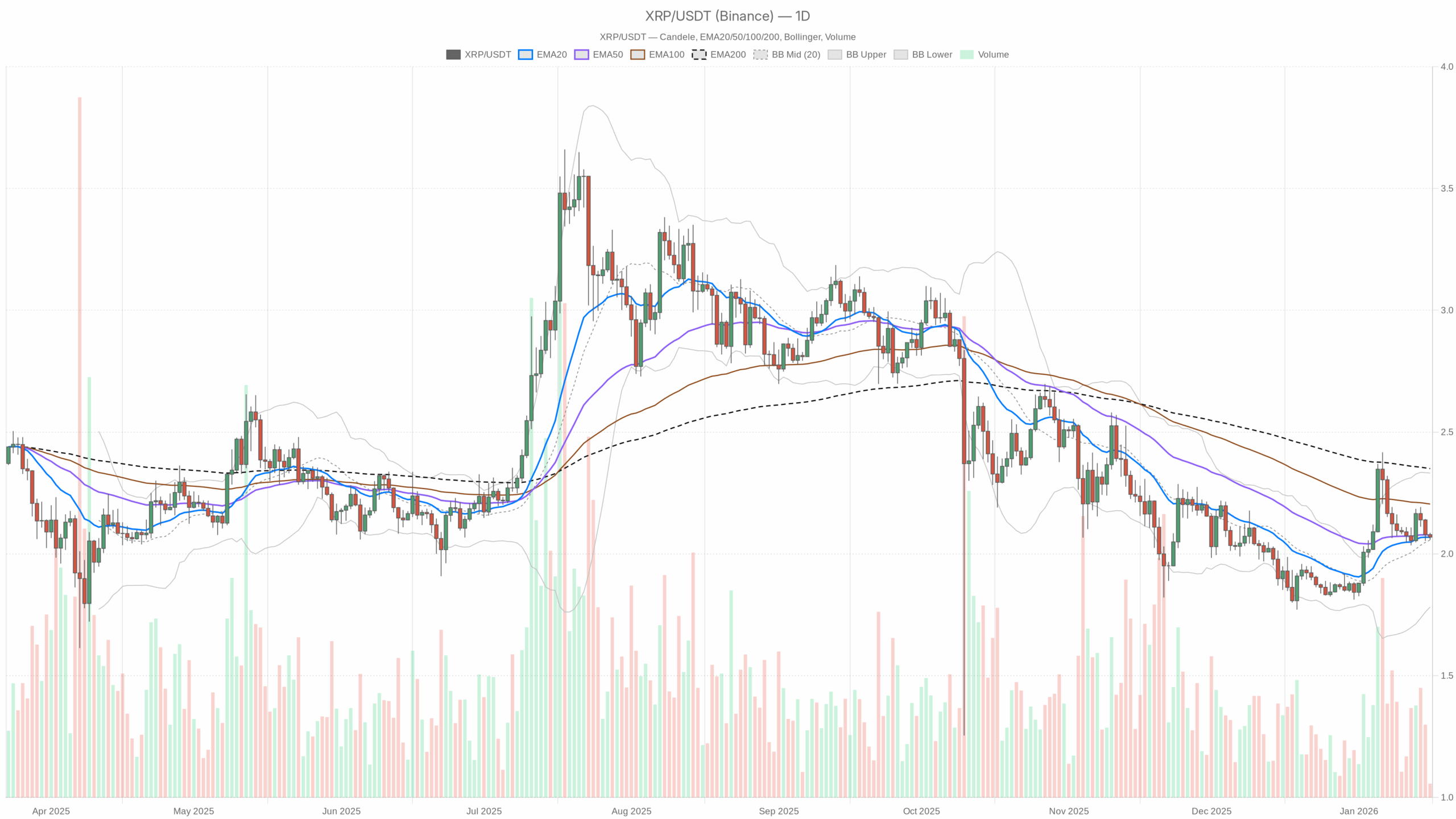

Important state of affairs for every day charts: Impartial bias with slight draw back pattern

The every day timeframe defines the macro bias, which is greatest described presently as: Impartial tilted barely downward. Though the value is barely beneath the 50-day EMA and properly beneath the 200-day EMA, the value is linked to the short-term pattern (20 EMA). Moreover, momentum is flat, leaving room within the volatility bands in each instructions.

Each day pattern construction (EMA20/EMA50/EMA200)

– Value (D1 closing value): $2.07

– EMA 20: $2.07

– EMA 50: $2.08

– EMA200: $2.35

The value is precisely on the 20-day EMA and 1 cent beneath the 50-day EMA. This can be a short-term equilibrium, however slightly below the mid-trend line. The actual drawback is that the 200-day EMA has risen to $2.35. XRP is buying and selling properly beneath its long-term pattern, so the bigger construction is being held in a correction part or post-upend digestion part quite than a full-blown uptrend.

What this implies: By way of tendencies, the Ripple cryptocurrency sits inside a consolidation pocket inside a broader, still-repairing construction. Though the short-term pattern (20 EMA) has not damaged, the long-term pattern (200 EMA) continues to be above the value and is appearing as an overhang. Bulls don’t have any pattern benefit. At greatest, they’ll solely be managed within the quick time period inside a bigger side-to-side setting.

Each day RSI (Momentum)

– RSI 14 (D1): 50.87

RSI, parked close to quantity 51, is as middle-of-the-road because it will get. Neither overbought nor oversold, there is no such thing as a sturdy momentum impulse both approach.

What this implies: The earlier motion has subsided and the market is now in wait-and-see mode. Momentum doesn’t encourage a brand new breakout or sign capitulation. This at the moment helps a imply reversion or vary buying and selling background quite than a pattern following background.

Each day MACD (pattern momentum affirmation)

– MACD line: 0.03

– Sign line: 0.03

– histogram: 0.00

MACD is actually flat. The traces and indicators overlap and the histogram is zero.

What this implies: The market is in a interval of transition. There is no such thing as a clear bullish or bearish momentum on the every day chart. That is precisely the type of background the place the following impulsive transfer can break in both path and is prone to catch laggard merchants leaning too far in a single path.

Each day Bollinger Bands (vary and volatility context)

– Mid band: $2.06

– Higher band: $2.33

– Decrease band: $1.78

– shut: $2.07 (mainly mid-band)

The value is situated proper within the center band, with a long way between each the higher and decrease bands.

What this implies: XRP We’re within the midst of latest volatility. Barring an excessive technical transfer, there’s room for a transfer in the direction of $2.33 or $1.78. This concept helps the concept it is a midpoint quite than an finish of the spectrum. The actual alternatives often seem nearer to the band than within the middle.

Each day ATR (volatility)

– ATR 14 (D1): $0.11

If XRP is round $2.07, a every day ATR of $0.11 means a median every day swing of round 5-6%.

What this implies: Volatility is current however not explosive. That is typical post-move digest volatility. That is sufficient vary to reward good entries, however not in a state of affairs the place a 20-30% transfer in a single day is regular.

Each day pivot stage (short-term reference)

– Pivot level (PP): $2.07

– R1: $2.08

– S1: $2.06

The value is true on the every day pivot, with R1 and S1 simply 1 cent aside on either side.

What this implies: Day-after-day, XRP actually trades at its intraday equilibrium stage. There is no such thing as a apparent directional bias as a result of pivot. For now, it is extra helpful as a really native reference level for intraday merchants than a macro bias.

Intraday construction: short-term pressures and every day equilibrium

The shorter timeframes are reasonably bearish and collide with impartial every day circumstances. Nonetheless, the strain will not be aggressive and continues to be managed.

1 hour chart (H1) – gradual downtrend, cooling momentum

– Value (finish of first half): $2.07

– EMA 20: $2.08

– EMA 50: $2.09

– EMA200: $2.11

– RSI14: 39.56

– MACD: Line -0.01, Sign -0.01, Histogram 0.00

– Bollinger Mid: $2.08 (up $2.10, down $2.06)

– ATR 14 (H1): $0.01

– Pivot H1 (PP/R1/S1): $2.07 / $2.07 / $2.07

Costs for the primary half of the yr are buying and selling beneath All three EMAs (20, 50, 200). This can be a typical short-term downtrend construction. A pullback to the EMA is prone to promote till confirmed in any other case. An RSI close to 40 signifies delicate bearish strain, however not a washout. The MACD is adverse however flat, according to a gradual decline quite than a collapse.

What this implies: Through the day, XRPUSDT There may be momentum promoting, however the promoting is managed and never panic-driven. So long as value stays beneath the H1 200 EMA (roughly $2.11), the intraday bias stays on the bullish facet, even when the every day nonetheless appears impartial.

15 minute chart (M15) – narrowband micronoise

– Value (near M15): $2.07

– EMA 20: $2.07

– EMA 50: $2.07

– EMA200: $2.09

– RSI14: 44.03

– MACD: Line 0.00, Sign 0.00, Histogram 0.00

– Bollinger Mid: $2.07 (up $2.08, down $2.06)

– ATR 14 (M15): ~0.00

– Pivot M15: PP $2.07 (R1/S1 additionally $2.07)

The 15-minute chart is flat. The EMAs are stacked on high of one another, the MACD has no pulse, the ATR is mainly zero in the mean time, and the value is fluctuating inside a 1-2 cent band.

What this implies: in a really quick time period XRP A fine-grained integration is going down. One of these compression is commonly preceded by elevated volatility, however the path will depend upon which of the close by H1 constructions breaks out first, roughly beneath $2.06 or above $2.10-$2.11.

Market circumstances: Threat urge for food subdued

The market capitalization of cryptocurrencies has decreased by roughly 1.35% prior to now 24 hours. BTC The management price is excessive at roughly 57.5%. This can be a traditional setup the place capital prefers the relative security of Bitcoin over chasing altcoins. A Worry and Greed Index of 49 confirms a impartial danger temper, neither panic nor euphoria.

What this implies for Ripple crypto: Whereas the macro backdrop will not be hostile, it’s also not significantly supportive of an aggressive altcoin rally. for XRP A significant transfer up from right here will doubtless require both a market-wide risk-on rotation from BTC to the majors, or a particular XRP-led catalyst.

XRPUSDT state of affairs

Bullish state of affairs for Ripple cryptocurrency

The bullish path assumes that the every day impartial construction resolves to the upside and the intraday downtrend is compressed.

The important thing steps required for bulls are:

1. Holds the $2.00-$2.06 help space. This space is successfully the decrease half of the present every day midrange, near the underside of the H1 Bollinger Band. If we are able to make a clear protection right here, we are going to see that the bullish shopping for continues to be energetic.

2. Recovering the intraday pattern for the primary half of the yr: Value must regain the 20/50 EMA cluster round $2.08-$2.09 and, extra importantly, maintain above the 1H 200 EMA round $2.11. If that occurs, the short-term construction will reverse from a promoting rebound to a shopping for pattern.

3. Each day momentum turns: If the RSI begins to interrupt into the excessive 50s or low 60s and the MACD returns to clear constructive territory, the every day chart will transfer from impartial to bullish and the higher Bollinger Band at $2.33 will change into a practical magnet.

Upside potential on this state of affairs: The primary goal is a every day excessive round $2.33, which can be beneath the 200-day EMA of $2.35. That zone is an enormous take a look at. If the value is ready to definitively shut above the 200-day EMA, the long-term story for the Ripple cryptocurrency will change from a correction to a brand new uptrend try, with a better vary above $2.35.

What invalidates the bullish case: A continued break and every day shut beneath the $2.00 deal with will weaken the argument that that is only a midrange pause. If the RSI stays beneath 40 for the primary half of the yr and the value continues to respect the 200 EMA as resistance, the bears are prone to regain structural management.

Ripple Cryptocurrency Bearish State of affairs

The bearish line depends on the truth that whereas the every day construction is already adverse, the every day is solely impartial, leaving room for downward correction.

The principle steps required by the bear are:

1. Reject makes an attempt over $2.08-2.10: So long as value is restricted beneath the H1 EMA cluster, particularly beneath $2.11 (H1 200 EMA), any pullback is simply gas for the following leg decrease.

2. Transfer costs away from every day pivots: Holding beneath the every day pivot of $2.07, a clear transfer beneath $2.06 would point out that the equilibrium is tipping downward.

3. Lower in every day train: If the every day RSI stays within the low 40s and the MACD turns extra clearly adverse, the impartial regime will start to show into a correct downtrend. At that time, the decrease every day Bollinger Band round $1.78 serves as a possible vacation spot.

Draw back potential on this state of affairs: The primary apparent draw back zone is the underside third of the present Bollinger envelope, roughly $1.90 to $1.80. Testing the decrease certain round $1.78 wouldn’t be too excessive from a volatility perspective. A pullout beneath it could open the door to a deeper correction, however for now the information solely helps a transfer in the direction of the band, not essentially via it.

What invalidates the bearish case: if XRP If we are able to get well and maintain above $2.11 within the first half (clearing the 200 EMA), after which push the every day shut above $2.20 because the RSI rises, the intraday downtrend argument will disappear. At that time, the bears lose their structural benefit and danger being squeezed in the direction of the higher finish of the every day scale.

Eager about positioning and danger

XRP is at the moment in a traditional no man’s land on the every day chart. It isn’t low cost sufficient to scream worth, and it isn’t sturdy sufficient to warrant pursuit. Pattern followers think about the asset to nonetheless be beneath the 200-day EMA. A mean-reverting dealer will see an intermediate value that doesn’t introduce important asymmetry both approach.

The actual battle is impartial on a regular basis and bearish intraday construction. In case you are bullish on the Ripple cryptocurrency, you wish to see the intraday promoting strain subside and the H1 pattern reverse. In case you are bearish, you’d wish to see the every day neutrality ultimately break and momentum decline.

Volatility is average, the general crypto market is in a impartial temper, and with BTC dominating, macro modifications in danger urge for food or asset-specific information could cause surprises. In this kind of setting, place sizing and whipsaw tolerance change into much more vital than standard, as overconfident leverage on either side tends to be punished when markets are caught close to equilibrium, till a transparent pattern reemerges.

If you wish to monitor the market utilizing skilled charting instruments and real-time information, you may open an account at: make investments Utilizing associate hyperlinks:

Open an Investing.com account

This part incorporates sponsored affiliate hyperlinks. We could earn commissions at no extra value to you.

Disclaimer: This evaluation is for informational and academic functions solely and doesn’t represent funding, monetary, or buying and selling recommendation. Cryptocurrency markets are extremely risky, so it is best to do your individual analysis and thoroughly assess the dangers earlier than making any buying and selling choices.

In abstract, XRP is at a technical crossroads with every day equilibrium and bearish intraday strain, and the following break from this stability will decide the following important transfer.

Leave a Reply