- The US Senate invoice intends to categorise community tokens as a commodity.

- Policymakers have additionally indicated that tokens with ETFs and ETPs usually are not securities.

- Wall Road analysts consider the passage of the Readability Act might be a big catalyst for the 2026 various season.

The newly launched Senate Financial institution draft market construction classifies community tokens as a commodity. The Digital Asset Market Transparency Act, which presently has bipartisan assist, goals to position community tokens resembling XRP, Cardano (ADA), Dogecoin (DOGE), and Solana (SOL) in the identical class as Bitcoin (BTC) and Ethereum (ETH).

Draft transparency regulation classifies community tokens as merchandise

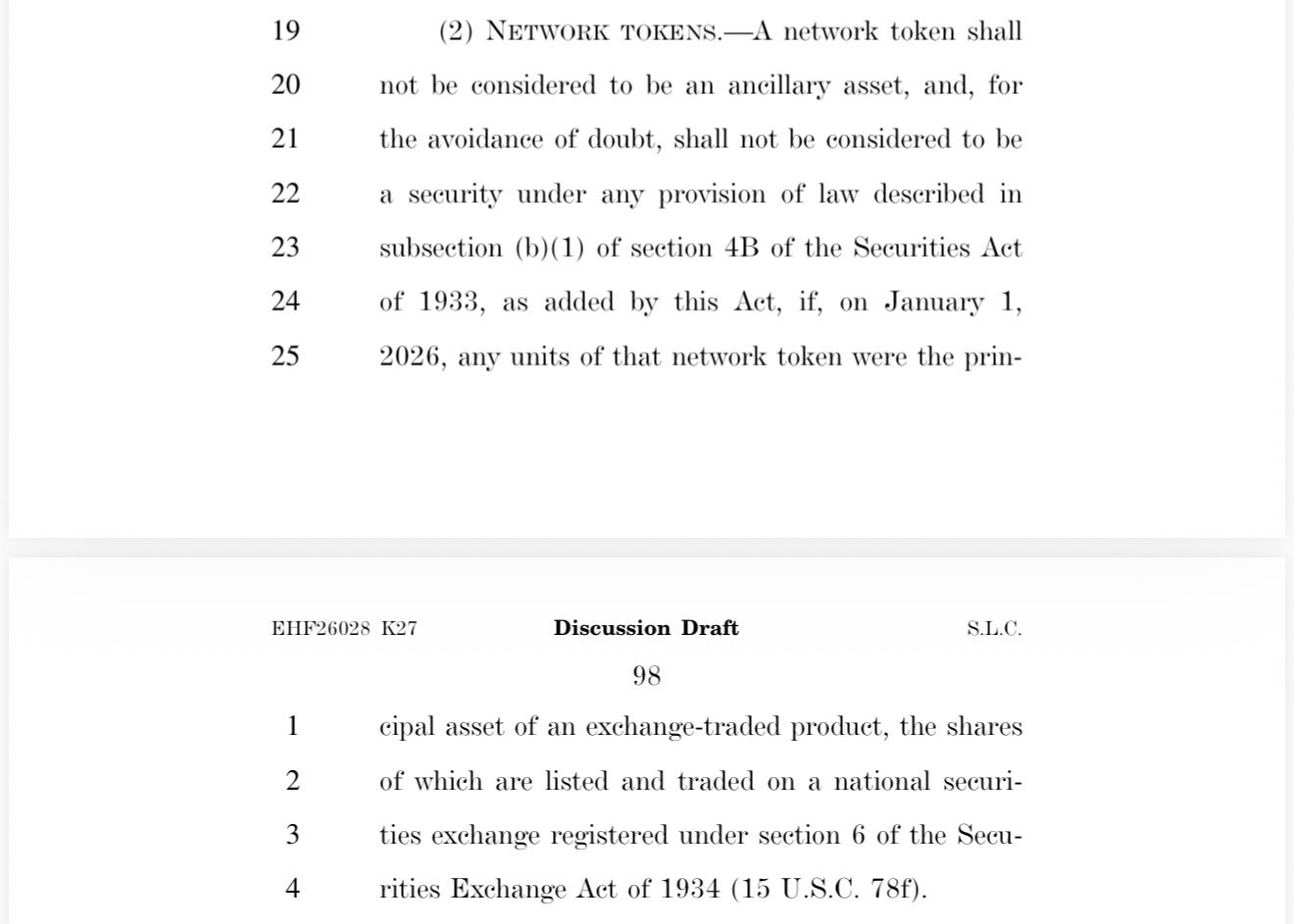

In accordance with web page 98 of the draft Senate Transparency Act, community tokens shall not be labeled as ancillary property. If adopted as is, community tokens would fall underneath the jurisdiction of the Commodity Futures Buying and selling Fee (CFTC) fairly than the Securities and Trade Fee (SEC).

The Senate draft would override all present securities legal guidelines based mostly on the Howie take a look at and classify community tokens in the identical manner as gold and Bitcoin. Most significantly, the Senate draft states that even when a crypto token is the underlying asset of a U.S. exchange-traded fund ETF, it’s nonetheless not a safety asset.

As such, the vast majority of crypto community tokens that obtained SEC clearance for spot ETF buying and selling in 2025 stay outdoors the SEC’s jurisdiction. Due to this fact, if the invoice is adopted as is within the close to future, crypto initiatives with important decentralization will profit from the Readability Act.

Supply: Senate

What’s subsequent?

The Senate Banking Committee, led by Chairman Tim Scott, is scheduled to vote on the draft invoice on Thursday, January 15, 2026. In accordance with Sen. Cynthia Lummis, the invoice presently has bipartisan assist, indicating it might be handed earlier than the tip of the primary quarter.

Following the Senate’s draft settlement, SEC Chairman Paul Atkins mentioned the SEC is able to work with the CFTC. Moreover, each companies have been working to assist President Donald Trump make america the crypto capital of the world.

Patrick Witt, a member of President Trump’s Digital Asset Advisory Council, subsequently urged the cryptocurrency neighborhood to belief the method of enacting the Readability Act.

“Do not panic. Keep engaged and belief the method. Transparency is on the best way,” Witt mentioned.

Is the alt season subsequent?

Cryptocurrency markets are gaining bullish momentum following the promulgation of the Readability Act forward of Thursday’s worth enhance. The market capitalization of cryptocurrencies has elevated by 1.3% prior to now 24 hours, reaching roughly $3.2 trillion on the time of writing.

In accordance with Cardano founder Charles Hoskinson, the anticipated 2025 Various Season didn’t happen attributable to delays in passing the bipartisan Readability Act within the Senate. Due to this fact, it’s extra possible that the 2026 alt season will happen amidst the continued capital rotation.

Associated: US crypto invoice approaches markup as key disputes stay unresolved

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t answerable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply