- SHIB holds agency above 200 EMA as near-term weak point checks bullish conviction

- Failure to carry $0.00000850 might expose SHIB to deeper Fibonacci draw back strain

- Derivatives buying and selling with out bodily affirmation will increase, SHIB continues to commerce inside a spread

Shiba Inu value developments are exhibiting clear indicators of stabilization after a pointy rise earlier this month. The SHIB/USD pair has entered a correction section, reflecting a decline in momentum throughout the broader meme coin market.

After reaching an area peak round $0.00001000, the worth began forming decrease highs on the 4-hour chart. Consequently, merchants at the moment are monitoring whether or not this decline alerts a wholesome value transfer or the start of deeper draw back strain.

Along with short-term weak point, SHIB continues to commerce above long-term pattern assist. The 200-period exponential transferring common round $0.00000810 stays intact. Subsequently, regardless of latest promoting strain, the broad restoration construction stays in place. Nevertheless, the short-term common decline means that bulls face short-term challenges.

Technical construction exhibiting combined alerts

From a technical perspective, SHIB just lately fell beneath the 20 EMA by roughly $0.00000878. Moreover, the worth is at the moment hovering across the 50 EMA close to $0.00000850. This positioning suggests near-term bearish management whereas long-term patrons stay energetic.

Importantly, the $0.00000850 zone acts as instant assist and is in keeping with the short-term pattern stability. A sustained transfer beneath $0.00000810 might weaken the market construction and enhance draw back danger.

Consequently, the subsequent draw back goal might seem round $0.00000755, which coincides with the important thing Fibonacci retracement. Under that degree, $0.00000682 represents an enormous swing low and invalidation level.

On the upside, SHIB must regain $0.00000885 for sentiment to vary. Moreover, a break above $0.00000900 might reopen the trail in the direction of the $0.00000935 and $0.00001000 areas.

Derivatives exercise displays short-term buying and selling

SHIB futures information highlights elevated speculative conduct moderately than sustained conviction. Open curiosity has traditionally spiked throughout speedy value expansions, typically exceeding $500 million. Nevertheless, these spikes typically slacken as momentum wanes. Consequently, leverage-driven rallies are usually short-lived.

Latest buying and selling exhibits that the worth has remained range-bound whereas the open curiosity has rebounded in the direction of $109 million. This divergence suggests new derivatives exercise with no clear path. Subsequently, short-term merchants proceed to dominate value developments.

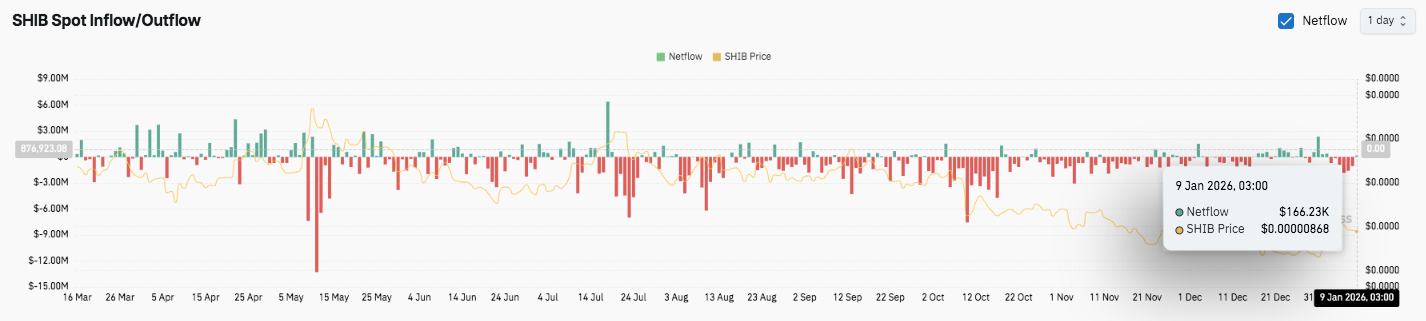

Spot move exhibits cautious sentiment

Spot market information additional helps the defensive posture of members. Outflows have constantly exceeded inflows in latest months. Could, July, and October noticed giant spikes in withdrawals coincided with notable value declines.

Latest inflows amounted to about $166,000, however the quantity stays modest. Moreover, in comparison with the preliminary distribution stage, inflows lack follow-through. Consequently, the accrued sign stays restricted.

Technical outlook for Shiba Inu costs

Shiba Inu value is buying and selling at an essential inflection level because the technical degree narrows right into a slim vary. This construction signifies compression and suggests {that a} interval of elevated volatility could also be on the horizon.

On the upside, instant resistance ranges are positioned at $0.00000885, $0.00000935, and $0.00001000. A confirmed breakout above this zone might pave the best way to $0.00001150 and $0.00001200. These ranges point out earlier distribution zones and psychological boundaries.

On the draw back, $0.00000850 stays the primary line of protection for patrons. Under that, the $0.00000810 space close to the 200 EMA serves as essential pattern assist. If losses at this degree proceed, SHIB may very well be uncovered to deeper draw back targets of $0.00000755 and $0.00000682. So long as costs stay above their long-term averages, the broader construction stays favorable to the restoration.

Technically, SHIB seems to be swirling inside a tightening vary, reflecting indecision amongst patrons and sellers. Momentum indicators stay subdued, however quantity lacks robust path. Subsequently, a decisive transfer past the present vary could cause an acceleration of value actions.

Will the Shiba Inu purpose even larger?

The short-term outlook will depend on whether or not patrons can defend the $0.00000810 to $0.00000850 assist zone. Holding this space will enable SHIB to problem the resistance cluster between $0.00000885 and $0.00000935. Robust inflows and bettering momentum might lengthen good points in the direction of $0.00001000 and above.

Nevertheless, if assist can’t be maintained, there’s a danger that the combination basis will collapse and management will return to the vendor. For now, SHIB stays within the vital zone, the place affirmation will decide the subsequent directional transfer.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be liable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply