- Shiba Inu rose 4.63% to $0.00000587 after rebounding 15% from the session low of $0.0000050 amid Bitcoin’s sell-off under $65,000.

- Regardless of the widespread market carnage that despatched BTC down over 50% from its October excessive, spot outflows stay contained at $1.14 million.

- A restoration would require a return to $0.00000711, however an in depth under $0.0000050 would open the draw back in direction of the $0.0000040 demand zone.

Shiba Inu value is buying and selling round $0.00000587 right this moment after rebounding from session lows of $0.0000050, the bottom since early 2024. The rally got here as Bitcoin crashed under $61,000, down greater than 50% from its all-time excessive of $126,080 simply 4 months in the past.

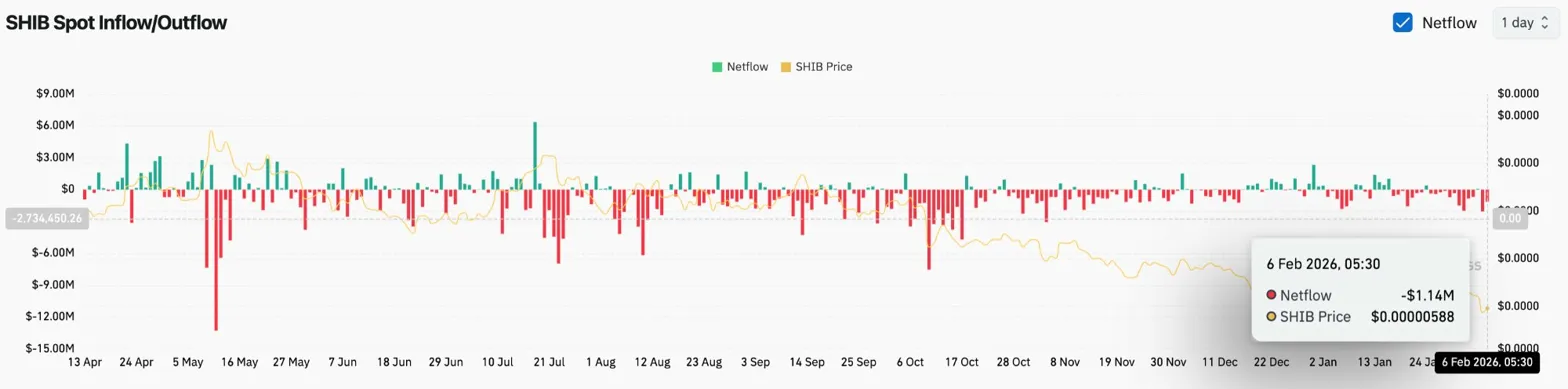

Spot outflow stays modest at $1.14 million

In keeping with Coinglass information, spot outflows on February sixth have been $1.14 million, a comparatively subdued quantity given the general market panic. The small quantity of outflows means that SHIB holders are usually not in a rush to exit regardless of the crash, and will maybe point out that capitulation has already occurred at greater ranges.

Stream patterns over the previous month haven’t seen the large-scale surge in circulation seen with Bitcoin and Ethereum, with constant small outflows. If the promoting strain is much less extreme than the general market throughout a crash, it might point out that weak palms have already exited.

Day by day chart reveals multi-month help take a look at

On the each day chart, Shiba Inu broke by means of a number of help ranges and examined the $0.0000050 zone, which represents vital long-term help. The value is effectively under all 4 main EMAs, with the 20-day at $0.00000711, the 50-day at $0.00000770, the 100-day at $0.00000844, and the 200-day at $0.00000985.

Parabolic SAR is situated at $0.00000683, indicating the primary resistance stage of the restoration. The distinction between the present value of $0.0000058 and the closest EMA of $0.0000071 signifies how far the market is from significant technical resistance.

The present value is down greater than 60% from its August 2025 excessive of round $0.0000155. The $0.0000050 stage represents the final main help earlier than the 2024 accumulation zone round $0.0000040.

Bollinger Bands breakdown reveals oversold situations

On the 2-hour chart, SHIB broke by means of the decrease Bollinger Band at $0.0000054 in the course of the February 5 decline and has since recovered. The 20-period SMA is situated at $0.0000061, offering rapid resistance to a pullback.

The RSI fell to 29.15 in the course of the crash, which has traditionally been extremely oversold territory, a minimum of previous to a bailout rally. The indicator recovered barely to 37.41 as the worth stabilized above $0.0000058.

Bollinger Bands widened considerably in the course of the crash, reflecting elevated volatility. The higher band at $0.0000069 represents the primary significant resistance zone and coincides with the decrease certain of the earlier consolidation vary.

Bitcoin collapse causes your complete market to fall

The widespread decline in cryptocurrencies has reached historic proportions. Bitcoin fell under $70,000 for the primary time in additional than a 12 months, however the decline has since accelerated, pushing the worth to $60,256, the best stage since October 2024.

Collapse is brought on by a mixture of a number of elements. Geopolitical instability over the U.S. detention of Venezuelan President Nicolás Maduro and President Trump’s threats to Greenland have pushed traders to conventional protected havens. Gold and silver soared to historic highs, and cryptocurrencies crashed.

Regardless of Warsh’s optimistic views on cryptocurrencies, Trump’s nomination of Kevin Warsh as Federal Reserve Chairman added to the strain. Analysts at Deutsche Financial institution attributed the decline to massive withdrawals from institutional ETFs, together with a decline in tech shares, which despatched the Nasdaq down 4.8% over the week.

SHIB has fallen in step with the broader market, however whereas Bitcoin has struggled to maintain above $65,000, it has proven relative resilience to the pullback, recovering 15% from its intraday low.

Outlook: Will the Shiba Inu enhance?

The development stays bearish whereas Bitcoin continues to say no, however the help take a look at at $0.0000050 brings the potential for a rescue rebound.

- Bullish case: A each day shut above $0.00000711 signifies a retrieval of the 20-day EMA and a maintain on the crash low. This may require Bitcoin to stabilize above $65,000 and for danger urge for food to return to speculative belongings.

- Bearish case: If the worth closes under $0.0000050, the 2024 help construction will collapse and the $0.0000040 demand zone can be uncovered. With Bitcoin down 50% from its highs and no memecoin catalyst in sight, that situation stays possible if the macro sell-off continues.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be liable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply