- Shiba Inu is buying and selling at $0.00000785, consolidating beneath the 20-day and 50-day EMAs as derivatives merchants present renewed curiosity.

- Open curiosity rose 2.11% to SHIB 10.85 trillion ($87.94 million), suggesting speculative positions after weeks of stagnation.

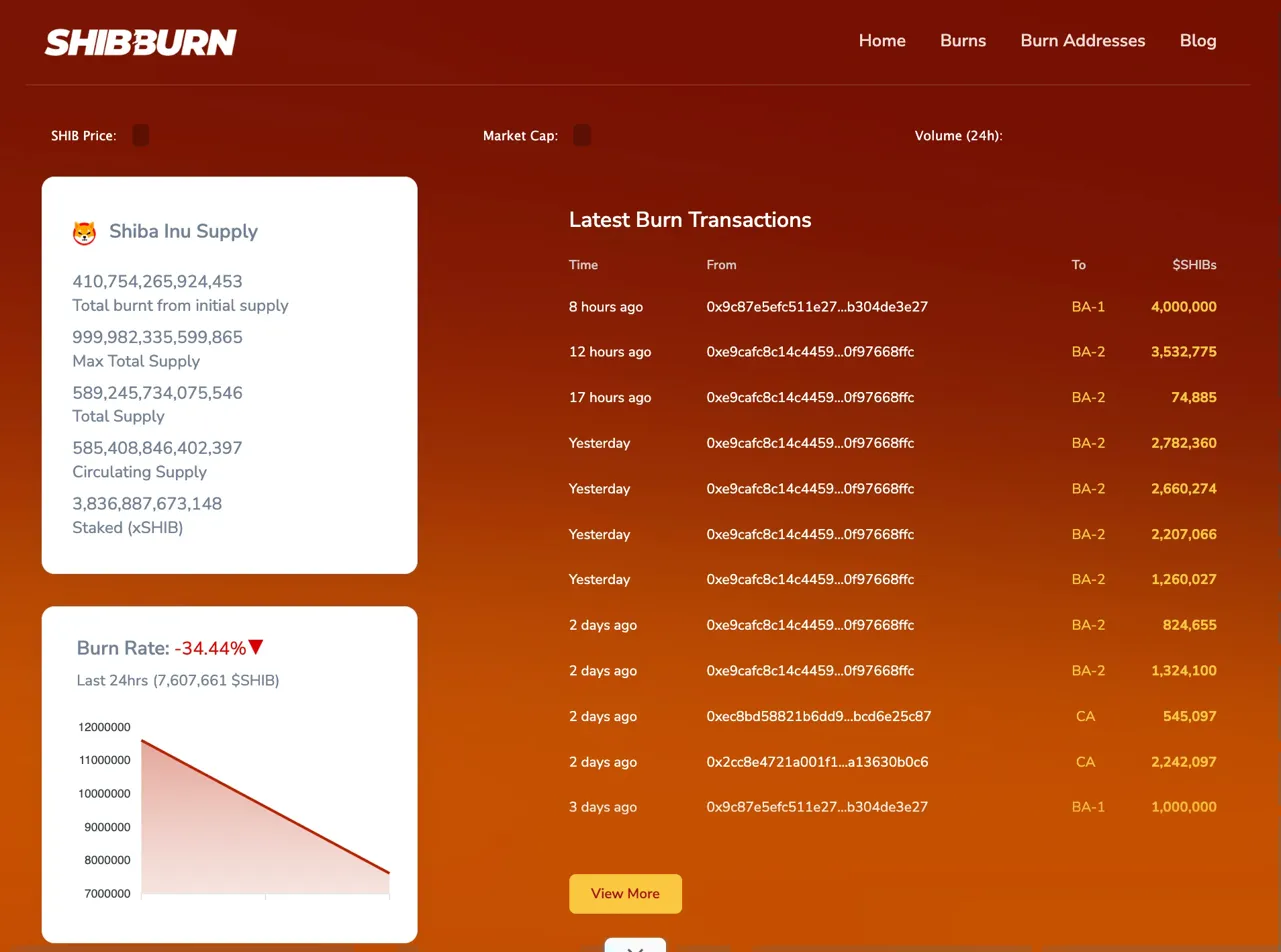

- The upward triangle sample on the 30-minute chart suggests a possible breakout, whereas the 34.44% decline in burn price displays a decline in community exercise.

After weeks of sideways motion, the Shiba Inu worth is buying and selling close to $0.00000785 as we speak as derivatives merchants start to vary their positions. Whereas open curiosity is rising, an ascending triangle sample has emerged on a shorter time-frame, creating situations for a potential breakout from the present vary.

Merchants return and open curiosity rises

Derivatives information is as soon as once more displaying speculative curiosity. Open curiosity elevated by 2.11% to SHIB 10.85 trillion (equal to $87.94 million). This improve signifies that merchants are opening new positions slightly than sitting on the sidelines.

When OI rises throughout a consolidation, it typically precedes a directional transfer. Merchants are betting on the subsequent leg, and when the value breaks out of the vary, the buildup creates situations for volatility.

Nevertheless, over the previous 12 hours, futures flows turned adverse, with a internet quantity of $251,000 being withdrawn from the by-product contract. The discrepancy between the rise in OI and the lower in stream means that the positioning is altering, however confidence stays combined.

Burn price decreases as community exercise decreases

Based on Shibburn’s on-chain information, the burn price decreased by 34.44% prior to now 24 hours, with solely 7.6 million SHIB despatched to invalid wallets. This lower displays a lower in community exercise through the integration section.

The full burning provide will attain 410.75 trillion tokens, up from an preliminary most provide of roughly 100 billion. The quantity of circulating provide is $585.4 trillion, with $3.83 trillion invested as xSHIB.

Though burn is necessary for long-term provide dynamics, it hardly ever causes short-term worth modifications. This decline in charges means that ecosystem exercise slowed through the adjustment interval, in keeping with widespread market uncertainty.

Worth is trapped beneath the EMA cluster

On the each day chart, SHIB is buying and selling inside a descending channel that has capped the value since September highs round $0.0000145. A sequence of lows continues, with every try to maneuver larger failing to decrease the upward resistance.

Worth is beneath all 4 EMAs, confirming the bearish construction.

- Fast resistance: $0.00000818 (20 EMA)

- Secondary resistance: $0.00000828 (50 EMA)

- Major resistance degree: $0.00000892 (100 EMA)

- SAR resistance: $0.00000917

- Development resistance: $0.00001028 (200 EMA)

- Present help: $0.0000075

- Breakdown goal: $0.0000065

Parabolic SAR stays bearish at $0.00000917 and is presently properly above the value. Recovering this degree would require a 16% rally, signaling a major change in momentum.

Forming an ascending triangle on the decrease time-frame

A shorter timeframe signifies a extra constructive sample is forming. On the 30-minute chart, SHIB has shaped an ascending triangle for the reason that January 19 low. The worth will make larger lows, however resistance is holding regular round $0.0000080.

The RSI is impartial at 43.05, however has recovered from the oversold situations suffered through the latest selloff. The MACD has a constructive histogram with a slight bullish bias, suggesting short-term momentum is in favor of consumers.

Triangle patterns normally resolve with a breakout within the route of the earlier development, which is bearish. Nevertheless, an ascending triangle also can point out a reversal sample if it kinds on the finish of a correction.

Above $0.0000080, the 20EMA targets $0.00000818. A break beneath $0.0000075 confirms a continued decline in the direction of $0.0000065.

Outlook: Will the triangle break larger?

The setup reveals conflicting indicators. The rise in OI suggests merchants predict a transfer, however the macro construction stays bearish. Whereas each day traits favor sellers, ascending triangles current short-term alternatives.

- Bullish case: The worth breaks out of the triangular resistance at $0.0000080 and retakes the 20 EMA at $0.00000818. An in depth above $0.0000083 targets the 100 EMA at $0.00000892.

- Bearish case: The triangle help at $0.0000075 fails, confirming that the descending channel stays in management. A each day shut beneath $0.0000075 targets $0.0000065 and will lengthen in the direction of $0.0000060.

The Shiba Inu is at a choice level between a short-term restoration or a continuation of the development. The following 48 hours will decide whether or not the rise in OI results in a breakout or one other failure.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t chargeable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply