- Solana has fallen beneath $100 because of widespread weak point within the crypto market and bearish indicators from derivatives.

- Community utilization reaches document ranges, with practically 150 million transactions per day.

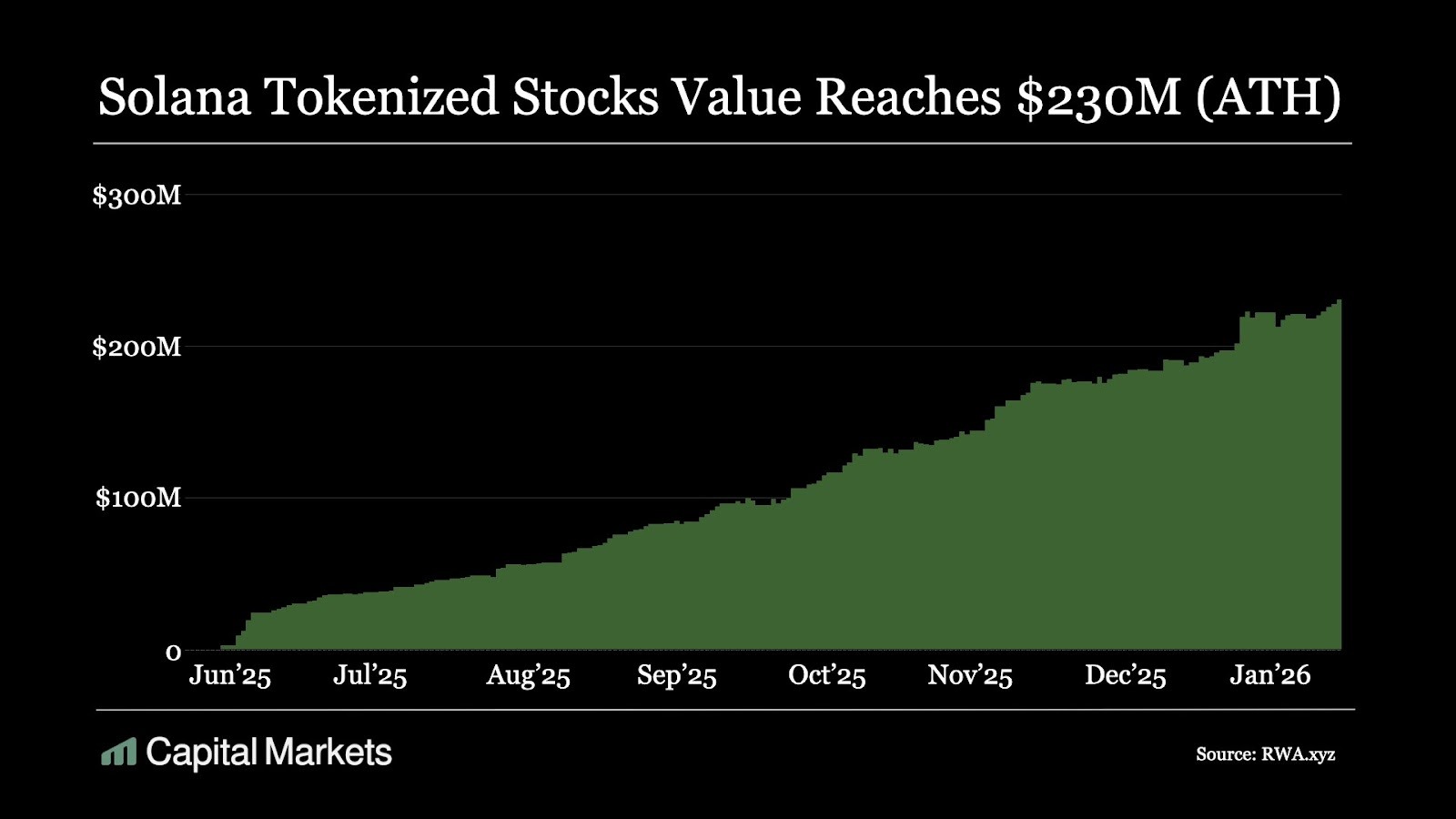

- Solana’s tokenized shares rose to a brand new excessive of roughly $230 million.

On Wednesday, Solana fell beneath $100 amid widespread losses within the crypto market. This decline occurred regardless of document buying and selling exercise and elevated use of tokenized shares on the community. Merchants centered on weakening demand, derivatives outflows and bearish technical indicators.

Worth drop displays widespread crypto sell-off

Solana is buying and selling at $97 at press time, down greater than 6% up to now 24 hours. The transfer adopted a pointy decline in digital property typically as traders lowered danger publicity amid rising volatility.

SOL is at present down about 23% over the previous week and greater than 50% on a yearly foundation. Market sentiment stays fragile, with the crypto worry and greed index at 14 on Wednesday, a degree reflecting intense danger aversion.

Institutional investor demand stays subdued

Flows into Solana-related funding merchandise have remained restricted in current weeks. In accordance with the info, institutional inflows haven’t exceeded $9 million per day over the previous two weeks, with a number of periods recording web outflows.

The Solana-focused exchange-traded fund recorded $1.24 million in inflows on Tuesday, and added $5.58 million in inflows on Monday. Whereas constructive, this quantity continues to be modest in comparison with Solana’s early years when market dimension and demand have been sturdy.

Derivatives knowledge suggests bearish positioning

Futures market exercise reveals waning confidence amongst leveraged merchants. Solana’s open curiosity decreased by 1.24% in 24 hours to $6.37 billion, indicating capital withdrawal because of place unwinding and deleveraging.

Liquidation knowledge reveals a transparent imbalance. Lengthy-term liquidations totaled $22.31 million and short-term liquidations totaled $4.39 million throughout the identical interval. The OI-weighted funding ratio additionally turned damaging additional, indicating that merchants are paying cash to take care of brief publicity. These indicators counsel that bearish sentiment continues to dominate near-term positioning.

On-chain exercise reaches new highs

In distinction to cost fluctuations, Solana’s community utilization continues to develop. Blockchains processed about 150 million transactions on Tuesday, the very best single-day complete ever, in keeping with Blockworks knowledge. Common throughput reached roughly 1,743 transactions per second.

Earlier this week, the variety of each day transactions exceeded 109 million, the very best degree in two years. This knowledge reveals that consumer exercise on the community stays sturdy regardless of falling market costs.

DeFi development strengthens community foundations

Decentralized finance exercise on Solana can be growing. Complete community locks reached an all-time excessive of 73.4 million SOL, equal to just about $7.5 billion at present costs. This represents an 18% weekly improve and exceeds the earlier peak recorded in mid-2022.

Decentralized alternate exercise adopted an identical pattern. Weekly buying and selling quantity reached a 12-month excessive, and each day buying and selling quantity rose to an eight-month excessive. Analysts usually view sustained DeFi utilization as an indication of continued engagement with the community.

Tokenized shares acquire momentum with Solana

Past DeFi, Solana is increasing its function in tokenized conventional property. In accordance with knowledge from Capital Markets, Solana’s tokenized shares reached an all-time excessive of roughly $230 million.

Development was steady from mid-2025 and accelerated in direction of the tip of the yr. Platforms corresponding to Ondo Finance, xStocks, Superstate, and Remora Markets contributed to this enlargement, supported by Solana’s low charges and steady buying and selling entry.

Technical outlook stays cautious

Solana (SOL) is buying and selling beneath its main shifting averages. The 50-day shifting common is $127, the 100-day shifting common is $139, and the 200-day shifting common is $153. Though the short-term common is trending downward, the long-term common continues to be a lot increased, indicating that the general downward pattern is maintained.

The momentum is weak. The each day RSI is round 28, which means the SOL is oversold, and the MACD is beneath the sign line, indicating continued bearish stress. Oversold circumstances can dampen promoting, however don’t assure a rebound.

Key ranges to observe: A decline beneath $95 might head in direction of $85, however above $100 would ease near-term stress. Resistance is between $113 and $115, and the 50-day EMA is at $127. These circumstances must be cleared for SOL to change into bullish.

Associated: Solana Worth Prediction: Jupiter Polymarket Trades Rise Ecosystem Sentiment, SOL Rebounds From $95 Low

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t answerable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply