- Solana fell under each the 20-day and 50-day EMA as sellers compelled a decline of three.19% in a single session.

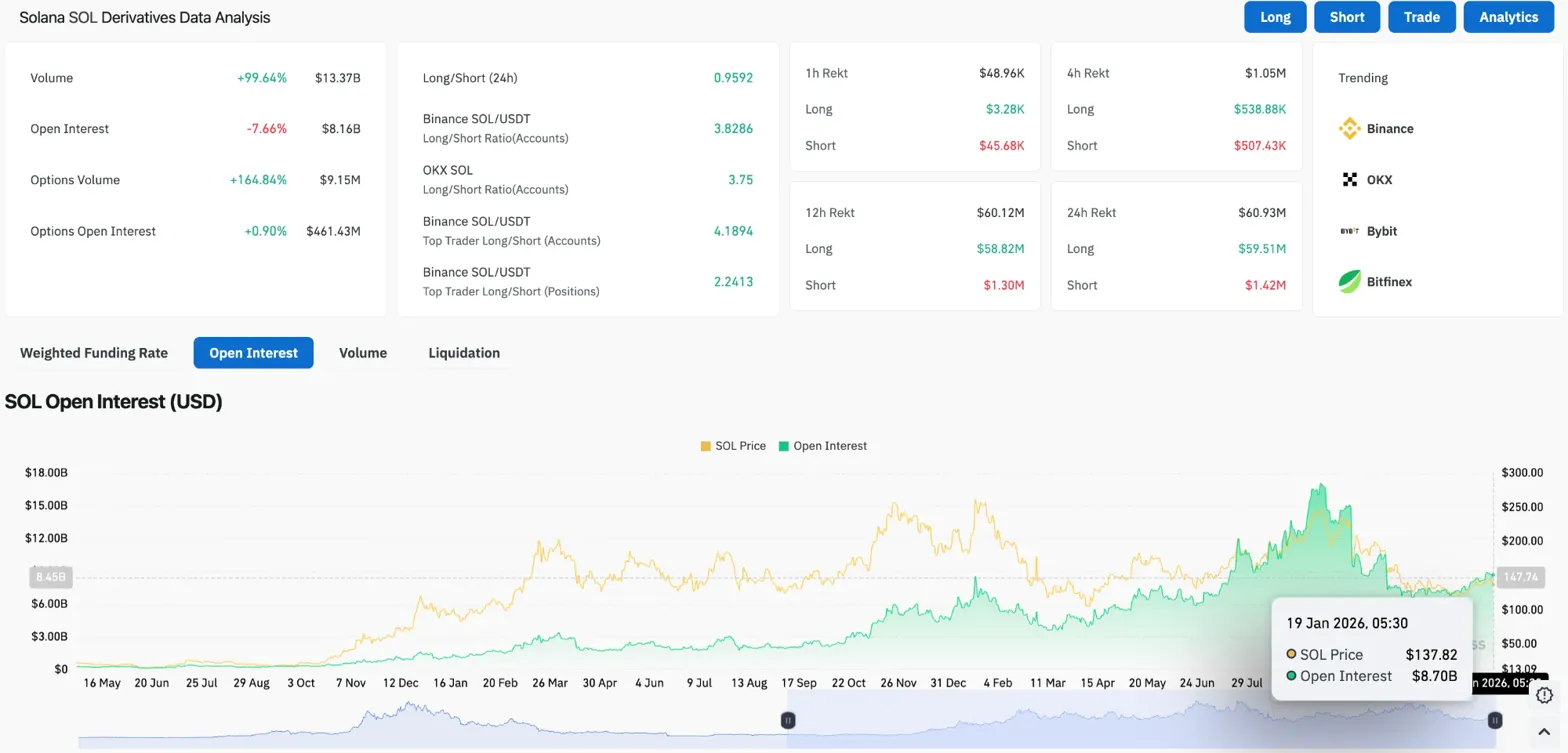

- Based on derivatives information, there was lengthy liquidation of $59.51 million in 24 hours, with open curiosity down 7.66%, suggesting capitulation.

- The RSI crashes to 19.13 on the 30-minute chart, indicating a extremely oversold scenario that might result in a short-term pullback.

Solana worth is buying and selling round $133.42 as we speak after falling sharply under the 20-day and 50-day EMA clusters. This transfer triggered a sequence of long-term liquidations, flushing out leveraged positions amassed in the course of the latest vary market.

Extended liquidation accelerates decline

Derivatives markets have absorbed vital injury prior to now 24 hours. Based on Coinglass, lengthy positions of $59.51 million had been liquidated, whereas quick positions had been simply $1.42 million. This 42:1 ratio displays unilateral positioning that has amassed as merchants search for a breakout.

Open curiosity decreased by 7.66% to $8.16 billion, and buying and selling quantity doubled to $13.37 billion. If OI decreases as quantity will increase, it signifies a compelled closure somewhat than an underlying sale. Leveraged longs acquired caught on the mistaken facet of the transfer and had no selection however to exit.

The lengthy/quick ratio is hovering at 0.95, indicating that sentiment is barely biased in direction of shorts. Binance’s prime merchants nonetheless keep a internet lengthy of three.82, however the general market has repositioned defensively.

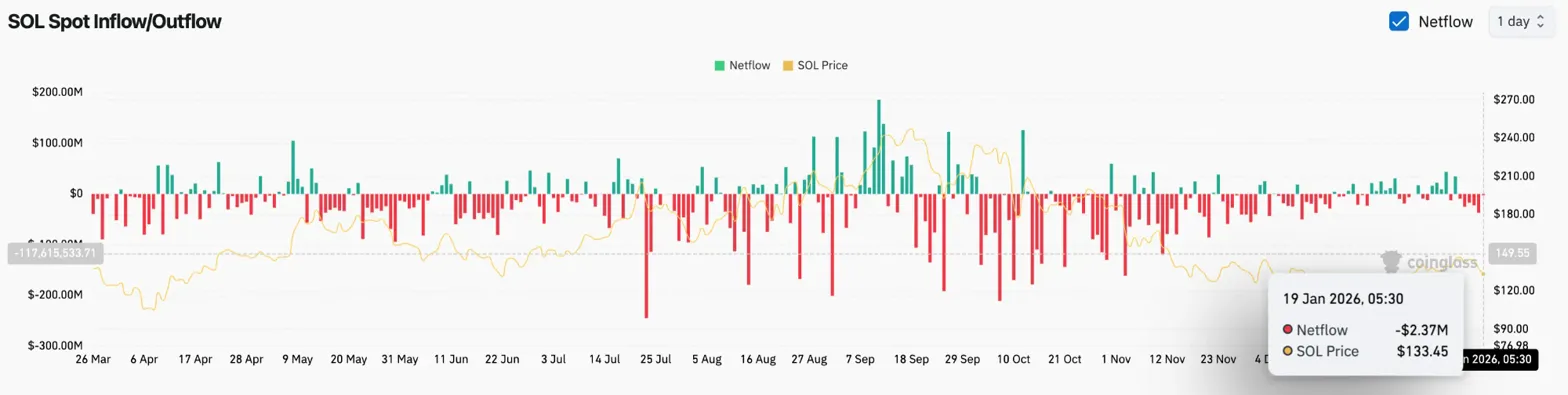

Spot outflows enhance promoting stress

Alternate circulate information confirms that spot holders are additionally exiting. Coinglass recorded internet outflows of $2.37 million on January 19, with promoting stress rising on account of by-product liquidations.

When each the spot and futures markets have a distribution on the identical time, costs sometimes proceed to the draw back. Consumers haven’t stepped in to soak up the promoting, and bidding stays skinny as SOL approaches key help ranges.

Value break under EMA cluster

On the day by day chart, Solana has traded inside a descending wedge sample since its September excessive close to $250. This construction recommended a potential bullish decision, however the concept required a maintain above the EMA cluster.

Immediately’s candle breaks that setting. The value broke under the 20-day EMA at $137.42 and under the 50-day EMA at $137.94 in a single session. Parabolic SAR turned bearish at $148.67, confirming that short-term momentum is in favor of sellers.

Present main stage:

- Quick resistance: $137.42 to $137.94 (20/50 EMA cluster)

- Key resistance: $148.20 (100 EMA)

- Pattern resistance: $159.45 (200 EMA)

- Present help: $130 (decrease wedge trendline)

- Breakdown goal: $118 to $120

The decrease sure of the descending wedge close to $130 represents the final line of protection for the bulls. A day by day shut under this stage will invalidate the sample and start a measured transfer in direction of $118.

RSI reaches oversold excessive

A shorter timeframe signifies the depth of the decline. On the 30-minute chart, the RSI fell to 19.13, nicely under the oversold threshold of 30. Excessive numbers like this typically happen earlier than short-term pullbacks as sellers grow to be exhausted.

The MACD stays bearish and the histogram is increasing downward. The plunge from $144 to $130 cleanly broke the horizontal help and created a brand new resistance zone that the bulls should reclaim.

Associated: DASH Value Prediction: DASH lands on HyperLiquid with 5x leverage as worth rises

Should you try a bounce, you’ll instantly encounter resistance at $140. This stage served as help for a lot of the previous week earlier than falling as we speak. Recovering $140 with confidence exhibits the customer is defending the construction.

Outlook: Will Solana be capable to discover help?

Watch out with this setting. Liquidation cascades have a tendency to search out short-term bottoms as soon as deleveraging happens, but it surely takes time to restore the technical injury. An oversold RSI creates the potential of a pullback, whereas the EMA cluster is presently performing as resistance.

- Bullish case: A rebound from the decrease wedge trendline at $130 would convey it again to $137, which might sign a sell-out. A detailed above the 50 EMA will restore the impartial construction.

- Bearish case: If the value closes under $130 for the day, we are going to break via the wedge help and have a goal of $118. The $118 loss reveals the following main demand zone round $100.

Solana is on the decrease finish of a multi-month vary. The following session will decide whether or not it is a liquidation flush that creates alternatives or the start of a deeper correction.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t chargeable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply