- Solana is buying and selling at $145.42 after defending the help of the uptrend line, with spot inflows of $5.54 million indicating accumulation regardless of the pullback from the $148 excessive.

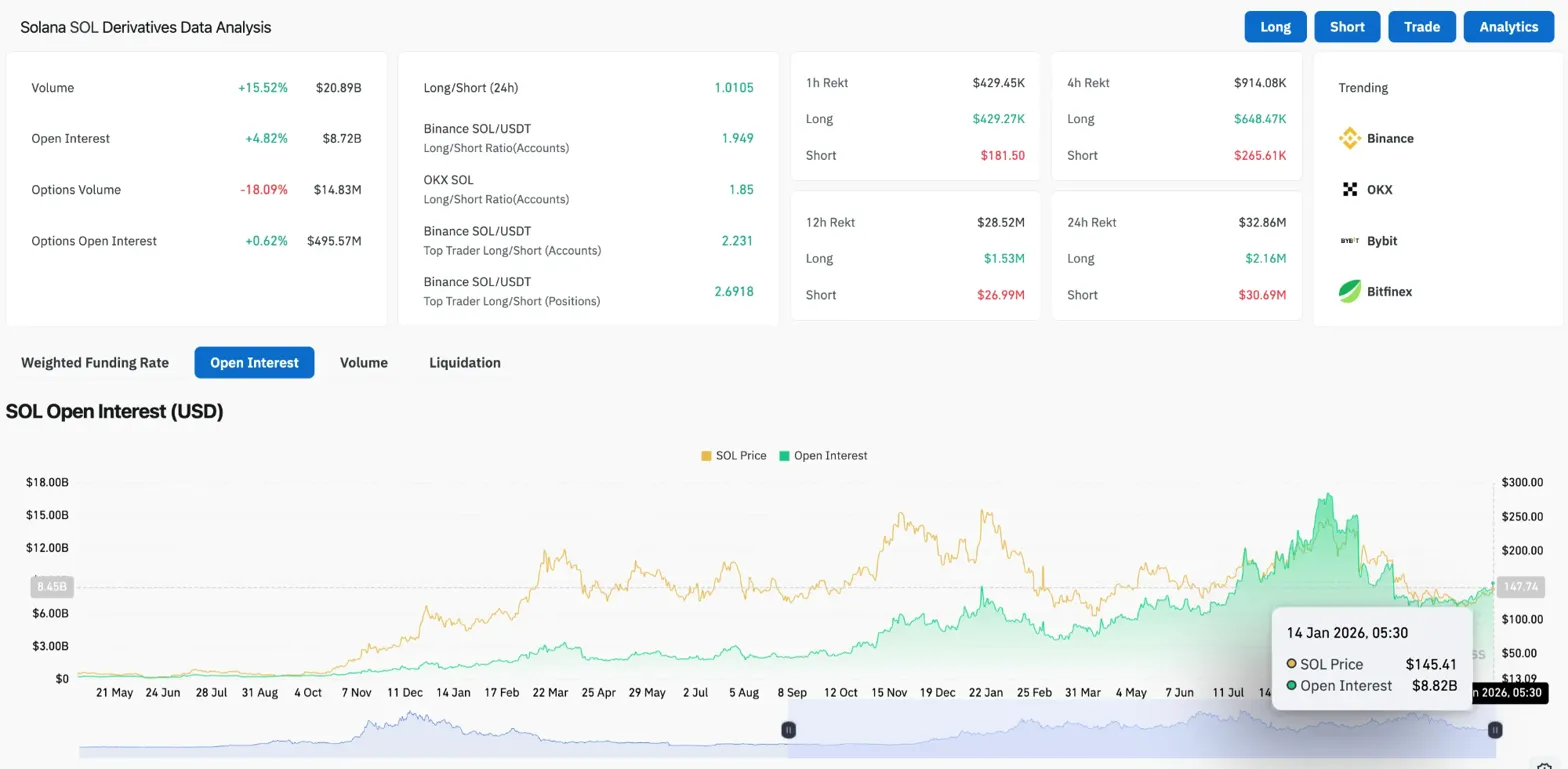

- Open curiosity elevated by 4.82% to $8.72 billion, and quantity surged by 15.52%, indicating merchants are coming into new leveraged positions in preparation for a breakout.

- The lengthy/brief ratio of Binance’s high dealer positions has reached 2.69, however the value is dealing with resistance on the 100-day EMA ($148.99) and 200-day EMA ($160.40).

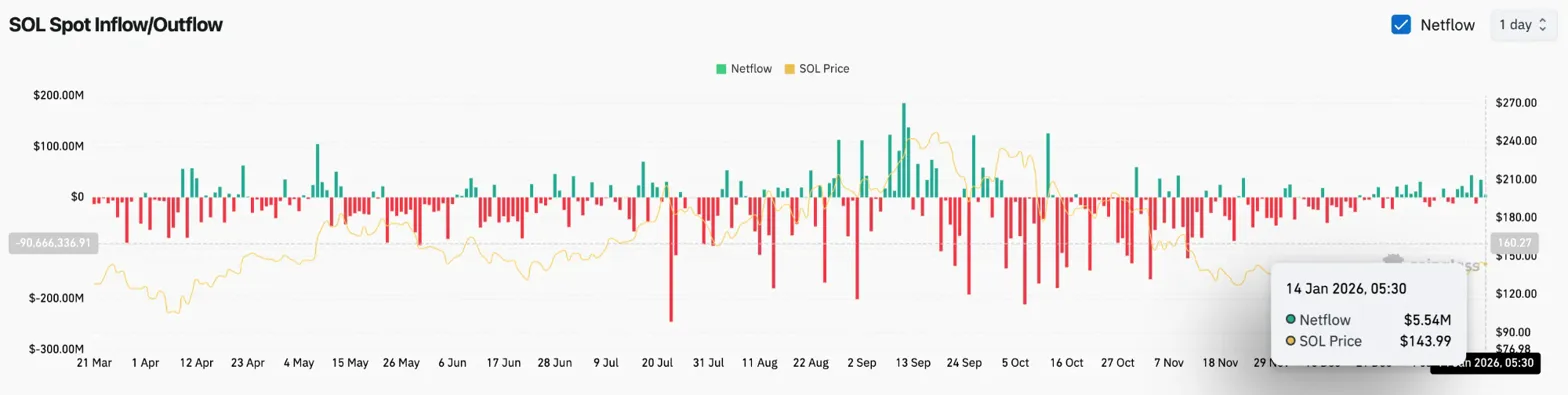

Solana value is buying and selling round $145.42 right now because the token consolidates after falling from current highs round $148 whereas adhering to the uptrend line that has led the worth up from December lows. Spot inflows of $5.54 million and a surge in open curiosity point out that merchants are accumulating regardless of the pullback, making a setup the place trendline protection may precede an excellent larger leg.

The influx quantity of $5.54 million exhibits accumulation even through the downturn.

In line with change movement information, web inflows had been $5.54 million on January 14, indicating constructive accumulation as costs retreat from the $148-$149 rejection zone. When spot inflows happen throughout consolidation fairly than at a peak, it often signifies that patrons are making the most of weak point and including to positions fairly than chasing a rebound.

The sample of flows all through 2025 was blended, with sporadic massive inflows through the upswing and durations of distribution through the correction. The present influx of $5.54 million comes as SOL exams the uptrend line that has supported costs since late December, suggesting that members view this degree as a lovely entry.

The influx coincides with a technical setup that signifies a development line that acts as a purchase zone. If the buildup continues and the worth holds the help, it would set the stage for one more try to interrupt out of the $148.99 resistance.

Open Curiosity Surges as Merchants Place for Breakout

In line with futures information, open curiosity rose 4.82% to $8.72 billion, indicating new leveraged positions are coming into the market. Quantity elevated by 15.52% to $20.89 billion, confirming that this exercise is widespread and never restricted to some massive trades.

The lengthy/brief ratio reveals a reasonably bullish place. Binance accounts confirmed 1.949 favoring longs, whereas high dealer accounts reached 2.231. Most notably, the highest dealer place is at 2.6918, indicating that skilled members are actively leaning lengthy.

Associated: Sprint Value Predictions for 2026: Evolving Good Contracts and the Battle of Privateness Proliferation July 2027 EU Ban

Choices quantity decreased by 18.09% to $14.83 million, whereas choice open curiosity elevated by 0.62% to $495.57 million. The discrepancy between rising futures open curiosity and declining choices buying and selling quantity means that merchants are utilizing directional leverage fairly than hedging constructions.

The 24-hour whole lengthy/brief ratio is sort of balanced at 1.0105. Nonetheless, the account-level place has a protracted bias of two.69, making a squeeze threat if value breaks the trendline. When leverage is closely stacked to at least one aspect and main help fails, follow-through promoting is often amplified.

The uptrend line maintains because the EMA kinds a ceiling.

The each day chart exhibits Solana holding to the uptrend line that has supported the worth since testing lows round $116 in late December. The development line is at present situated slightly below the worth round $135-$137, with the 20-day EMA at $135.60 offering additional help.

The principle technical ranges are:

- 20-day EMA: $135.60

- 50-day EMA: $137.34

- 100-day EMA: $148.99

- 200-day EMA: $160.40

- Supertrend: $127.97

SOL is buying and selling above its 20-day and 50-day EMAs, indicating that near-term momentum stays bullish. Nonetheless, resistance ceilings on the 100-day EMA of $148.99 and 200-day EMA of $160.40 have restricted current upside makes an attempt.

This construction kinds an ascending wedge sample the place the upper low encounters overhead EMA resistance. A break above $148.99 would flip the 100-day EMA into help, paving the way in which for the 200-day EMA at $160.40. Dropping trendline help may put the 50-day EMA at $137.34 and the supertrend ground at $127.97.

Brief-term pullback check Parabolic SAR immunity

The 30-minute timeframe exhibits Solana withdrawing from the $148-$149 rejection with the parabolic SAR at $148.08 serving as overhead resistance. The RSI is at 48.48, impartial after cooling from overbought situations through the current rally.

Costs are consolidating between $144 and $146, forming a slender vary as merchants assess whether or not the development line will maintain or break. A pullback from SAR resistance signifies that short-term momentum has shifted from bullish to impartial, and patrons ought to step in to guard the help.

Quantity through the consolidation has elevated in comparison with current trades, indicating participation fairly than skinny buying and selling. The following directional transfer can happen when the worth regains $148 or loses $144 with confidence.

Outlook: Will Solana Rise?

If the trendline holds, the setup favors continuation. If SOL defends $144 and regains $148 on quantity, the construction will shift to bullish. In that case, the preliminary goal is the 100-day EMA of $148.99, but when momentum builds and the over-leveraged lengthy place proves right, it may transfer larger towards $160 and the 200-day EMA.

If the worth falls by $144 and falls beneath the 20-day EMA of $135.60, the trendline will fail. This places the 50-day EMA at $137.34, and if overextended longs unwind and promoting accelerates, we will count on a deeper correction in the direction of the supertrend help at $127.97.

Holding $144 sustains the rally. If we lose this, we threat breaking the development line.

Associated: Pepe Value Prediction: PEPE eyes restoration as help holds and market exercise stabilizes

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t answerable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply