- After rebounding 20% from a crashing low of $72, Solana rose 0.21% to $87.10 and turned optimistic on February 8 with spot inflows of $7.69 million.

- Whole ETF outflows over the previous week have been $5.68 million, with greater than $1 million outflowing on February 6 alone, marking the seventh such massive outflow.

- A restoration would require a return to $100, however an in depth under $85 opens the draw back for a crashing low of $72.

Solana’s worth is buying and selling round $87.10 at this time after consolidating positive factors from a 20% rebound from the crash lows of $72, which marked the token’s lowest degree since early 2024. Whereas this restoration has occurred in tandem with spot flows turning optimistic, the massive outflows of ETFs point out that institutional traders are nonetheless not satisfied that we’re on the backside.

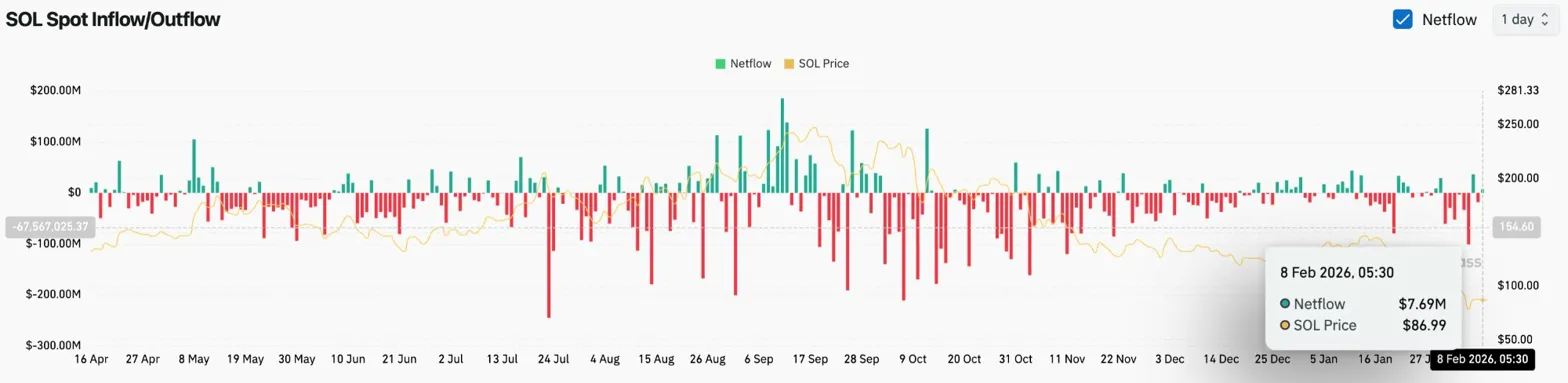

Spot influx turns optimistic at $7.69 million

In line with Coinglass knowledge, spot inflows on February 8 have been $7.69 million, ending the streak of outflows that accounted for a lot of the selloff. This optimistic development means that some patrons see present ranges as a beautiful entry level after falling 66% from September highs.

A reversal of flows from massive outflows to inflows usually signifies that short-term promoting stress is exhausted. If the spot market turns optimistic throughout a rebound from a crashing low, it might point out that weak arms are capitulating and stronger holders are accumulating.

Each day chart exhibits $100 as vital resistance

On the each day chart, Solana is buying and selling under the downtrend line from September that has capped any makes an attempt to maneuver increased. The $100 degree, which beforehand served as a serious assist, has now became resistance.

The value broke via the psychological degree of $100 and located assist at $72, a degree not seen since summer season 2024. A rebound to $87 would characterize a 20% restoration, but it surely stays nicely under the damaged assist construction.

Moreover, the downtrend line continues to say no and is at present above about $95, placing a cap on any restoration try.

ETF outflows counsel withdrawal of monetary establishments

Spot flows have improved, however Solana-focused ETFs proceed to bleed. Whole outflows over the previous week amounted to a staggering 67,632 sols (equal to $5.68 million).

On February sixth alone, $1 million value of Solana was withdrawn, marking the seventh such large-scale outflow.

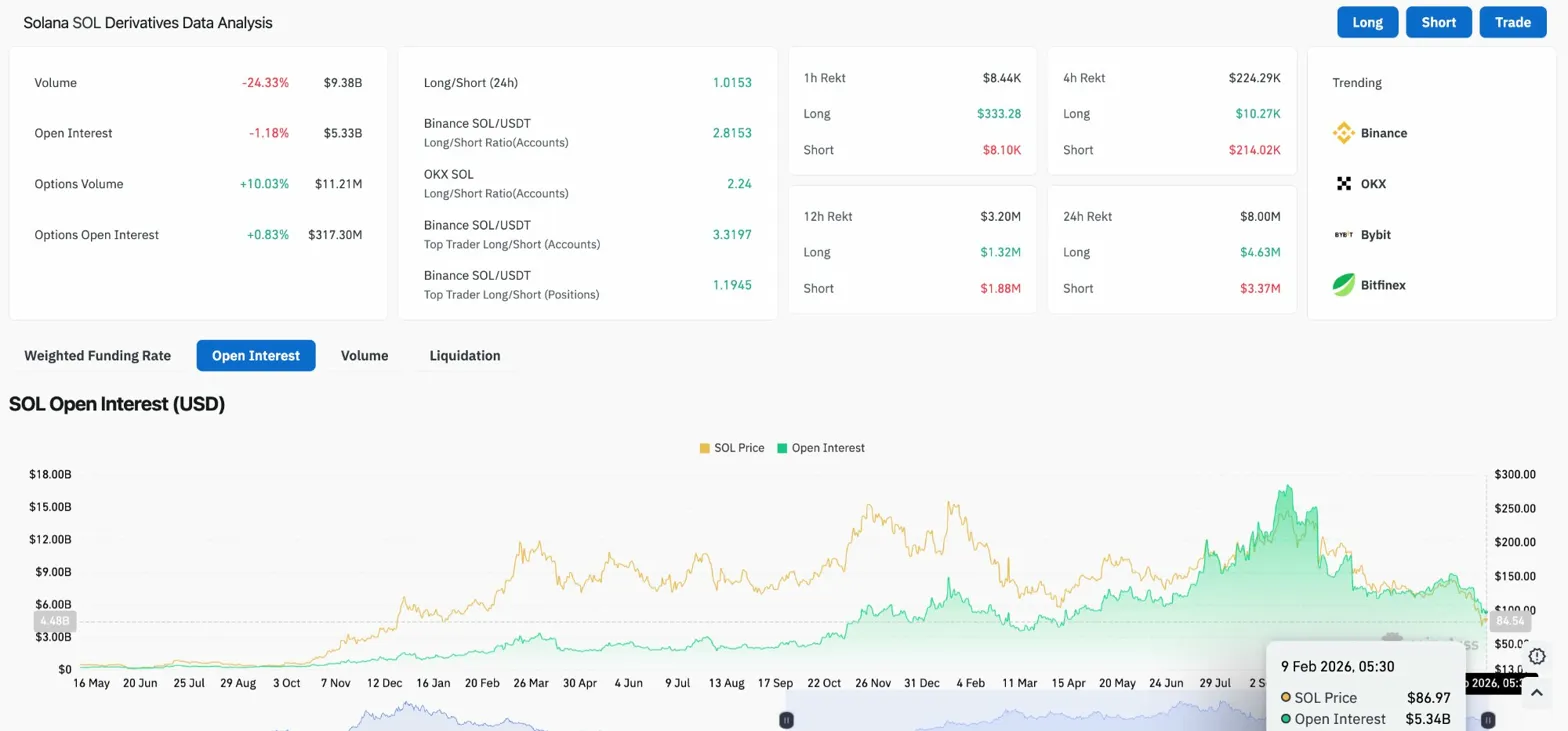

Derivatives knowledge exhibits balanced positioning

Open curiosity was $5.33 billion, down 1.18% because the market stabilized. Buying and selling quantity decreased by 24.33% to $9.38 billion, reflecting a decline in buying and selling exercise following a spike in volatility in the course of the crash.

An extended/brief ratio of 1.01 signifies an almost balanced positioning, a major change from the extremely long-biased market that existed previous to the liquidation cascade. On Binance, prime merchants keep a ratio of three.31 per account, indicating that the bullish bias stays.

Up to now 24 hours, $8 million positions have been liquidated, of which $4.63 million have been lengthy and $3.37 million have been brief. The comparatively balanced liquidations in comparison with the closely long-biased flushes in the course of the crash counsel substantial deleveraging.

Choices open curiosity elevated by 0.83% to $317.3 million, and possibility buying and selling quantity elevated by 10.03% to $11.21 million, indicating that merchants are taking positions on the belief that volatility will proceed reasonably than being assured within the route.

Outlook: Will Solana Rise?

Whereas the development stays bearish whereas costs stay under $100, the rebound from $72 and reversal to optimistic spot circulation means that promoting could also be working out.

- Bullish case: An in depth of the day above $100 would sign damaged assist and a capitulation on the backside of the crash. A reversal in spot inflows and liquidated leverage creates circumstances for a restoration as soon as broad market sentiment stabilizes.

- Bearish case: An in depth under $85 would point out a failed pullback and result in a retest of the $72 low. Weekly ETF outflows of $5.68 million point out that monetary establishments stay unconvinced, and additional Bitcoin weak point may push SOL decrease.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be liable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply