- Cryptocurrency costs rise as Bitcoin leads the general market rally.

- VanEck has issued the primary Bitcoin purchase sign because the 2025 market backside.

- Market sentiment will enhance as extra altcoins begin outperforming Bitcoin.

The cryptocurrency market is experiencing a brand new increase because the 12 months begins, with costs rising on January sixth, with Bitcoin main the best way and most altcoins buying and selling larger.

Bitcoin’s regular rise has helped enhance confidence throughout the market. In contrast to previous rallies pushed solely by Bitcoin, this motion has seen widespread participation, with a number of altcoins outperforming the world’s largest cryptocurrency.

VanEck points Bitcoin purchase sign

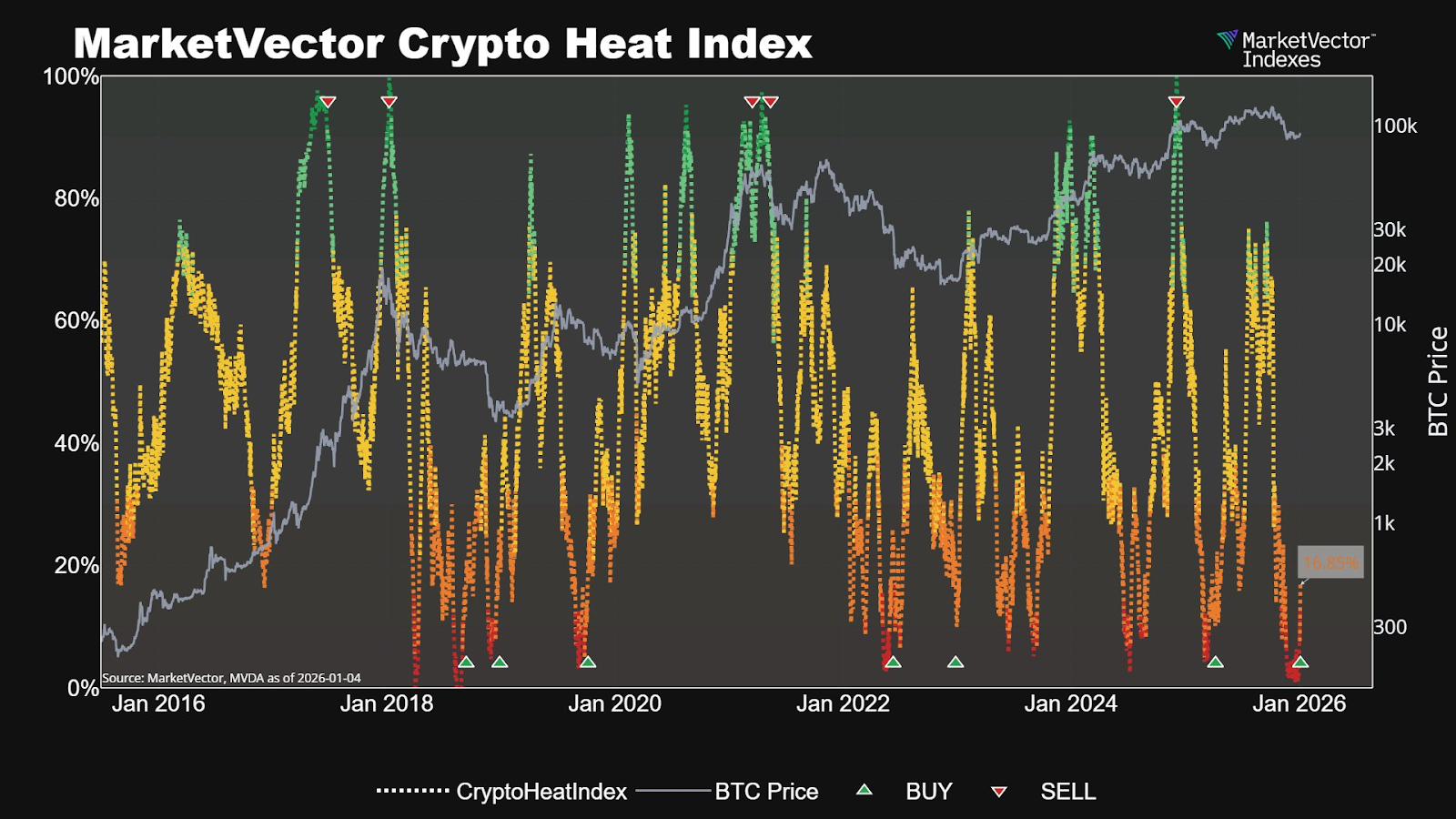

One of many strongest bullish indicators got here from asset supervisor VanEck. Matthew Sigel, head of digital asset analysis at VanEck, revealed that the corporate’s inside market indicators have issued a purchase sign for Bitcoin for the primary time since April 2025, when the value bottomed out. He re-quoted Martin Leinweber’s tweet.

“Trying on the prime 100 crypto index as a complete, we’re seeing broader stabilization, extra constituents outperforming Bitcoin, and indicators that capitulation-level sentiment could also be receding,” Reinweber mentioned.

VanEck’s MarketVector Crypto Warmth Index tracks worth developments, quantity, and general market participation throughout the highest 100 cryptocurrencies. Previously, comparable indicators have appeared proper earlier than Bitcoin’s main uptrends.

Concern fades as market participation improves

Market sentiment, which has remained extremely unfavorable all through a lot of final 12 months, now seems to be nearing cycle lows. Traditionally, these moments usually create alternatives as promoting strain wanes and consumers slowly exit.

Reinweber mentioned buyers who’ve been on the sidelines might wish to rethink their publicity. “For buyers who’re nonetheless under-allocated to cryptocurrencies, this could possibly be a chance to re-evaluate their portfolio exposures quite than reactive to cost momentum,” he mentioned.

The larger query now could be whether or not 2026 would be the 12 months through which income unfold past Bitcoin and into the broader crypto market. Early indicators counsel that change might have already got begun.

Bitcoin approaches main worth take a look at

Technically, Bitcoin is getting into the vital zone. Analysts are watching to see if the double-bottom sample that has led to robust features up to now is confirmed. To verify that, Bitcoin would wish to shut above the low $92,000 vary on the upper time-frame. It will be a stronger sign if the value stays above the mid-$94,000 degree.

Analysts say if confirmed, Bitcoin may goal a spread of $100,000 to $101,000 within the brief time period. Past that, the following main resistance lies close to the $106,000 degree.

As the value rises, brief sellers are pressured to exit their positions, including momentum to the rally.

Associated: Venezuela’s hidden Bitcoin may trigger large provide outage

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not chargeable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply