- The on-chain worth of RWA elevated by 5% to $21.35 billion in early 2026, indicating new development.

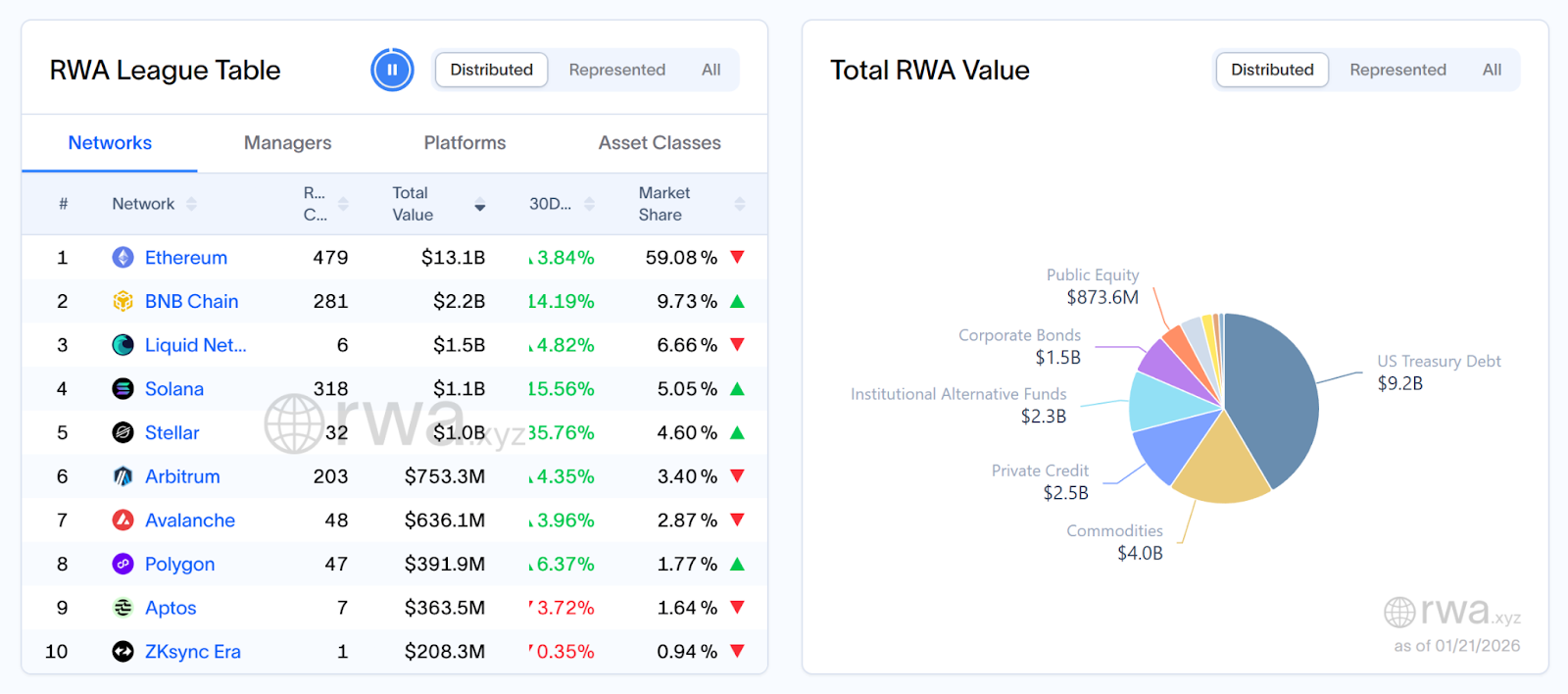

- Ethereum leads the RWA with $13.1 billion and holds nearly all of market share.

- Tokenized authorities bonds dwarfed RWA at $9.2 billion and lead adoption by institutional traders.

The true-world asset market entered 2026 with a transparent acceleration, with on-chain decentralized asset worth growing from $20.33 billion in early January to $21.35 billion. This adopted an adjustment in late 2025, a rise of 5%.

Because the Nov. 19 low of round $19.22 billion, the sector’s web worth has elevated by about $2.13 billion. Capital has returned earlier than the hype, a sample typical of institutionally pushed markets.

In the meantime, RWA holders elevated from about 620,000 in mid-December to about 638,000 by late January, an 8-9% improve in simply over a month. Development has not been explosive and stays regular.

Moreover, month-to-month energetic addresses reached almost 100,000 a few yr in the past and have been on the decline since then, however the complete continues to extend. Slightly than buying and selling tokens, RWA behaves like an asset on a steadiness sheet.

Chain distribution signifies infrastructure lock-in

In line with the information, Ethereum occupies a dominant place, with RWA of round $13.1 billion, properly over half the market.

BNB Chain follows with round $2 billion, adopted by Solana and Liquid Community with $1.1 billion and $1.5 billion, respectively. Stellar rounds out the most important group with about $1 billion.

It’s clear that RWAs want chains with predictable execution, regulatory instruments, and institutional custody assist. New chains could appeal to customers, however worth stays the place fee danger is lowest.

Asset composition: U.S. Treasuries nonetheless lead, rotation underway

US Treasury bonds stay the core product of RWA. At $9.2 billion, U.S. Treasuries are the only largest class and a key entry level for monetary establishments transferring on-chain.

Commodities ranked second with $4 billion, led by gold-backed tokens. Non-public credit score follows with $2.5 billion, adopted by institutional different funds with about $2.3 billion.

The corporate has almost $1.5 billion in bonds. Whole public fairness is roughly $873.6 million, whereas non-U.S. authorities debt is sort of $830 million.

The smaller section contains roughly $423 million in personal fairness, $200 million in actively managed methods, and fewer than $4 million in structured credit score.

Information for the week ended January 20 confirmed that diversified asset worth elevated 4.1% from the earlier week to $216.6 billion, whereas the broader RWA market expanded 23.8% to $350.1 billion.

U.S. Treasuries rose from $89 billion to $91 billion, whereas commodities jumped from $37 billion to $40 billion. Publicly traded shares rose almost 7% in per week. In 2026, capital will slowly rotate away from pure length publicity to belongings with larger return potential.

Development extends past authorities bond merchandise

The Treasury will carry monetary establishments on-chain, and yield demand will additional increase monetary establishments. As rates of interest development decrease, customers are transferring in direction of personal credit score, commodities, vitality belongings, mineral rights, infrastructure claims, and actual asset money circulation merchandise. Though these belongings contain larger danger, they provide higher returns than tokenized banknotes.

RWA-focused platforms are reporting important will increase in person numbers. A number of ecosystems have seen a 10x improve in possession over the previous yr, and adoption is anticipated to extend considerably in 2026 as minimal funding quantities lower and compliance instruments enhance. Slightly than being concentrated in just a few giant wallets, funds are unfold out throughout a bigger variety of customers.

Crypto entrepreneur Stacey Muir predicts that if present traits maintain, complete RWA may attain almost $50 billion by the top of 2026.

Establishments and rising markets set the tempo

Institutional participation continues to quietly improve. Tokenized funds, personal debt merchandise, and structured merchandise are deployed with compliance-first design. Apparently, issuance has elevated with none advertising noise, which is an indication of actual adoption.

Non-public credit score has already proven an early restoration, rebounding to $2.5 billion after consecutive weekly declines. Commodities RWA added $3 billion over the week. Public fairness RWA continues to extend its share.

Rising markets can transfer sooner than developed international locations. With fewer legacy methods to eradicate, on-chain capital rail could be deployed instantly in these areas. Actual property and commodity-backed RWAs dominate within the area, whereas developed markets stay targeted on US Treasuries and cash market-style devices.

Prime RWA tokens

In line with CoinMarketCap knowledge, the highest 5 RWA cryptocurrencies embody Chainlink (LINK), Stellar (XMR), Avalanche (AVAX), Hedera (HBAR), and Ondo Finance (ONDO). Whereas all cash have confronted double-digit losses over the previous week, HBAR is up over 2% up to now 24 hours.

In the meantime, Ondo’s decentralized asset worth has elevated by virtually 10% over the previous 30 days, with holders growing by 24.6% over the identical interval. Ondo’s stablecoin market capitalization has additionally elevated by 23.5% up to now month.

RWA in 2026 is not experimental. Capital is accumulating, asset range is increasing, and infrastructure is strengthening. The expectation is that worth shall be constructed first, and liquidity and velocity will observe.

Associated: China points joint warning to seven organizations, classifying RWA tokenization as unlawful finance

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t accountable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply