- Swissbrock mentioned gold’s lead whereas BTC holds worth suggests a bullish setup.

- In response to Ash Crypto, the gold value will proceed its 28-month parabolic transfer.

- Silver hit an all-time excessive of $101 this week.

Whereas gold and silver have elevated their features this week, Bitcoin has remained flat. Market analysts level out that the divergence between treasured metals and Bitcoin is widening. Historic knowledge exhibits that Bitcoin lags and follows metals throughout macro shifts.

Swissblock identifies gold as main indicator

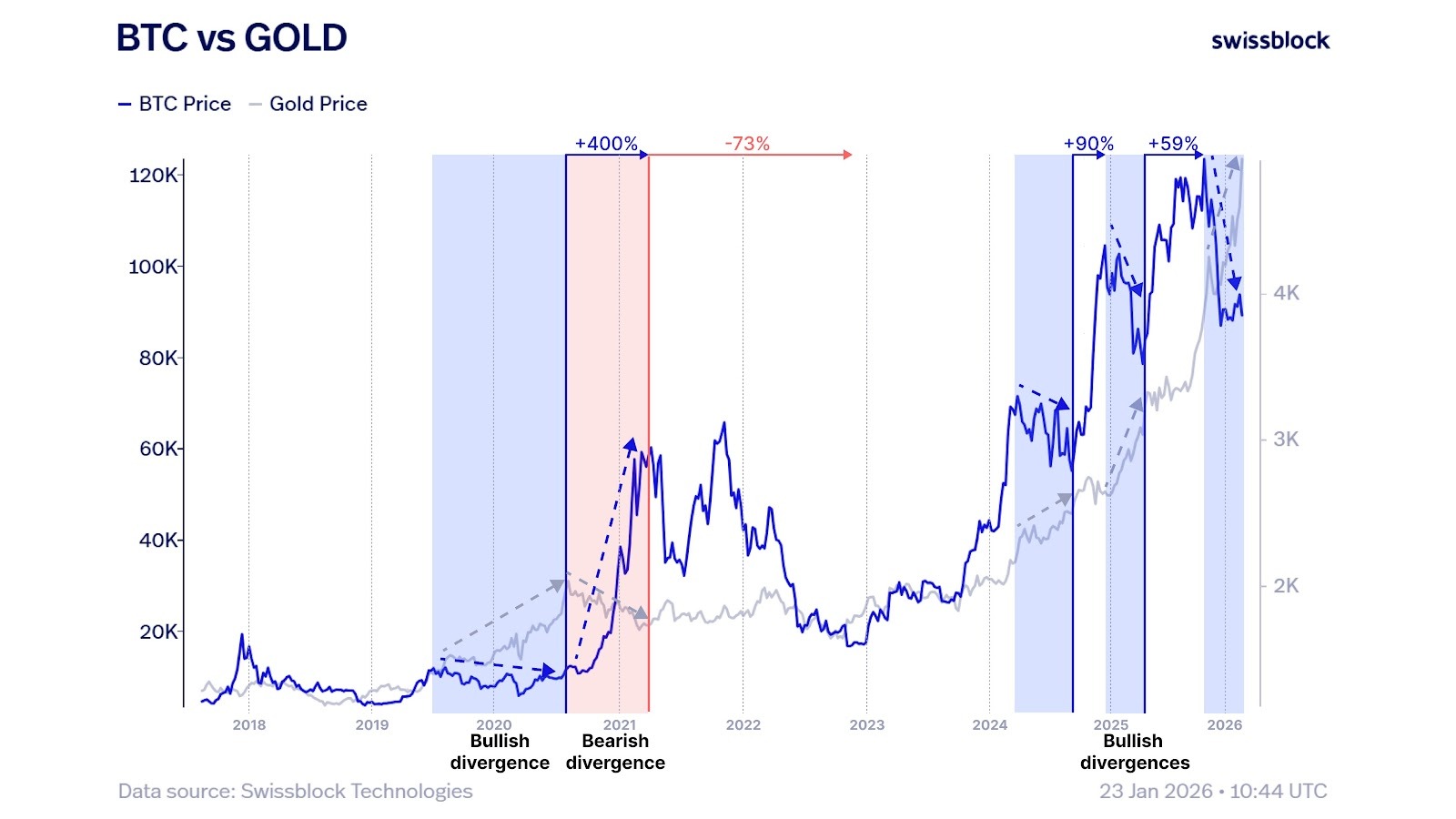

Personal wealth administration agency SwissBlock Applied sciences mentioned that gold continues to function a key sign for Bitcoin value actions. In a submit to

In response to Swissbloc, a bullish divergence will kind if gold rises whereas Bitcoin stays subdued. This lead-lag relationship typically acts as an accumulation section following a pointy rise in Bitcoin. Swissbloc cited the 2020-2021 cycle, the place there was an identical divergence earlier than Bitcoin rose about 400%.

The corporate additionally highlighted opposite alerts. When Bitcoin continued to rise whereas gold fell, the divergence typically signaled liquidity depletion. Within the 2021 cycle, this decoupling occurred earlier than Bitcoin fell by round 73% after the market peak.

Apparently, Swissblock mentioned the present settings stay bullish. Whereas gold continues to rise, Bitcoin is consolidating relatively than dispersing. For context, Bitcoin is buying and selling at $89,538, down 6% over the previous week, lowering its month-to-month acquire to 2.1%.

Earlier evaluation by Ash Crypto mirrored a broader narrative of divergence. The analyst mentioned the 28-month parabolic development in gold costs underscores the continued rise in gold costs within the present financial cycle. He added {that a} delay in Bitcoin’s response might result in a pointy reversal.

Silver soars to all-time highs

Silver has added one other sign to the broader macro image. Yesterday, the value reached an all-time excessive of $101, marking months of regular rise adopted by a pointy acceleration.

Market knowledge exhibits that silver has outperformed Bitcoin in ROI over the previous 5 years. The transfer displays elevated demand for protection property amid heightened international uncertainty.

Geopolitical tensions, corresponding to new commerce disputes and unresolved disputes in Europe and the Center East, are pushing traders towards conventional shops of worth. Issues about US fiscal sustainability and rising authorities debt are additionally weighing on danger urge for food.

Throughout instances of heightened uncertainty, capital sometimes flows first into conventional, secure property. Bitcoin typically strikes after considerations shift from fast dangers to foreign money depreciation and elevated liquidity.

For now, gold and silver proceed to cleared the path. Bitcoin stays vary certain and the market is watching to see if historical past repeats itself within the coming months.

Associated: President Trump’s tariff rollback weighs on gold, growing Bitcoin volatility

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply