- WLFI is above the Ichimoku assist line as consolidation continues close to the breakout determination zone.

- Open curiosity stays excessive, indicating positioning and persistence relatively than capitulation.

- Funds story expands as Spacecoin buying and selling and USD1 introduction assist real-world utilization

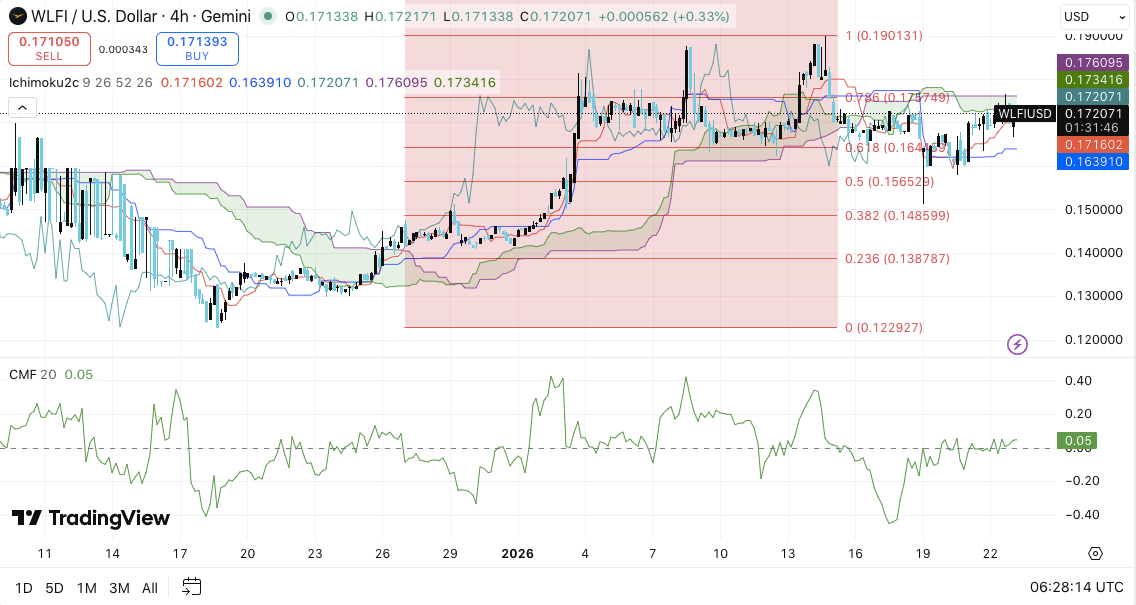

World Liberty Monetary (WLFI) is buying and selling round $0.1720, with each consumers and sellers taking a break after a pointy rally. The token was above the 4-hour Ichimoku cloud, which frequently signifies short-term assist developments.

Nonetheless, WLFI confirmed indicators of slowing. Reflecting the market shift in the direction of unified competitors, gross sales of unified competitors and commonplace competitors remained flat. Merchants now look like centered on whether or not WLFI can shield its near-term fundamentals as new catalysts develop round stablecoin methods and new partnerships.

WLFI Stays Key Assist as Bulls Watch Breakout Zone

The value pattern remained constructive so long as WLFI remained above the $0.1700 to $0.1680 vary. This vary additionally coincides with the highest of the cloud, making it a technical degree that many merchants are intently monitoring.

Nonetheless, a big drop to $0.1640-$0.1650 may check confidence. Analysts usually affiliate this zone with demand at or earlier than the 0.618 Fibonacci retracement. If that ground fails, the chart opens house in the direction of $0.1565, the extent related to the 0.5 retracement.

On the upside, WLFI faces resistance between $0.1734 and $0.1760, with earlier highs possible limiting momentum. Due to this fact, the bulls could must push that zone cleanly to permit for an even bigger transfer.

The subsequent vital prime is round $0.1900-$0.1910, indicating the excessive of the vary. A closing value above this alerts a continuation of the pattern. However, the CMF is hovering round 0.05, suggesting that the influx is gradual however the urgency is restricted.

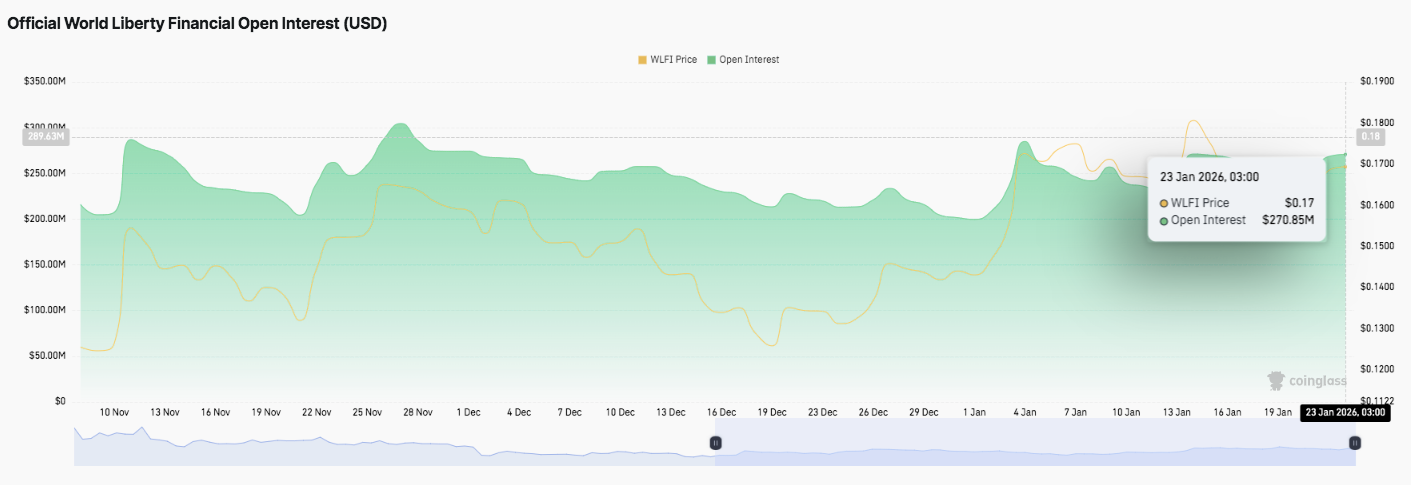

Open curiosity signifies continued positioning relatively than relegation

Derivatives knowledge confirmed that dealer engagement has remained steady regardless of latest value fluctuations. Open curiosity exceeded $250 million in mid-November, however declined by the top of the month. Including to that cooldown, leverage rose once more to almost $300 million in late November.

Open curiosity then trended all the way down to the $220 million to $250 million zone throughout December. Due to this fact, merchants decreased their publicity however didn’t exit utterly.

Early January noticed one other rally, pushing open curiosity again towards $280 million. After that, it stabilized at round $270.85 million. Moreover, this degree means that merchants are holding positions whereas ready for directions.

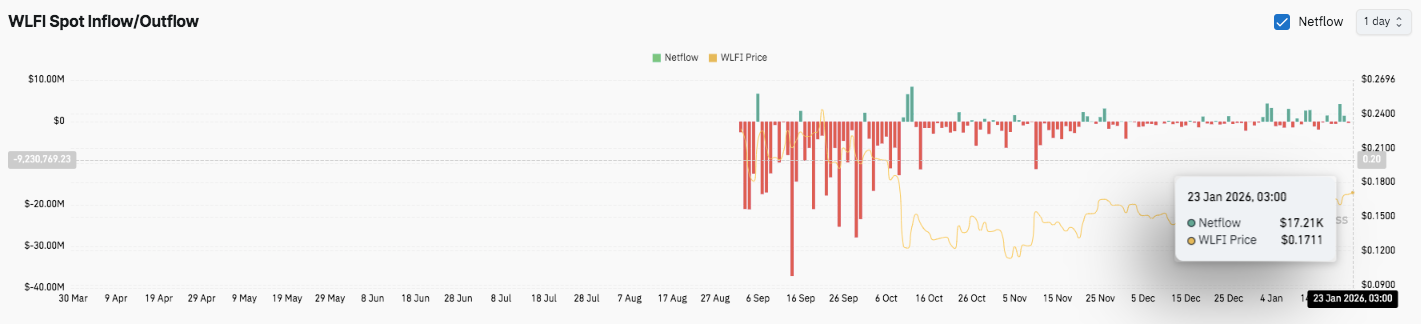

Spot flows stabilize as WLFI expands funds narrative

Spot movement knowledge confirmed heavy outflows in early September, adopted by repeated sell-led surges. Nonetheless, since late October, promoting stress has weakened and exercise has turn out to be nearer to neutrality.

Moreover, latest classes have seen occasional bursts of inflows. Internet flows turned barely optimistic on January 23, suggesting calming sentiment.

Spacecoin buying and selling will deal with funds and underserved areas

Along with value motion, World Liberty Monetary mentioned its partnership with Spacecoin additionally features a token swap, however didn’t disclose phrases. As well as, the 2 initiatives have developed a collaboration centered on increasing monetary entry in areas with restricted banking providers. Spacecoin goals to assist that effort by a community of low-Earth orbit satellites.

Moreover, the corporate plans to launch three satellites to supply broader web protection in hard-to-reach areas. World Liberty additionally continues to advertise the US greenback as a cost asset for real-world actions.

The market worth of $1 has grown to about $3.27 billion. Moreover, Pakistan lately signed an settlement with a World Liberty affiliate to discover remittance use instances.

Technical outlook for WLFI costs

As WLFI consolidates after a sudden impulsive transfer, key ranges stay properly outlined and are buying and selling round $0.1720.

Upside ranges embody the primary resistance cluster at $0.1734 to $0.1760. A clear breakout of this zone may begin a push in the direction of $0.1900-$0.1910, which might turn out to be the excessive of the vary and set off the subsequent massive breakout.

On the draw back, $0.1700 to $0.1680 stays the principle short-term assist space. Consumers should shield this zone to maintain the construction constructive. A break beneath $0.1640-$0.1650 may weaken momentum and shift the bias to bearish, with $0.1565 probably changing into the subsequent deep corrective assist.

The broader setup means that WLFI is compressed into a spread, lowering momentum and flattening the pattern sign. Moreover, barely optimistic capital flows point out modest accumulation, however confidence stays restricted.

Will WLFI go up?

The short-term WLFI value prediction hinges on whether or not the bulls can maintain $0.1680 and get better strongly to $0.1760. If the shopping for stress will increase and the resistance turns into assist, WLFI may revisit $0.1900.

Nonetheless, if the worth is unable to guard itself at $0.1640, there’s a threat that the draw back will speed up in the direction of $0.1565. For now, WLFI is in a pivotal house, the place approval will decide its subsequent transfer.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not answerable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply