- There was a weekly outflow of $446 million from crypto funding merchandise.

- Nevertheless, per CoinShares, the XRP ETF nonetheless collected $70.2 million.

- Since mid-October, XRP merchandise have seen $1.07 billion in inflows.

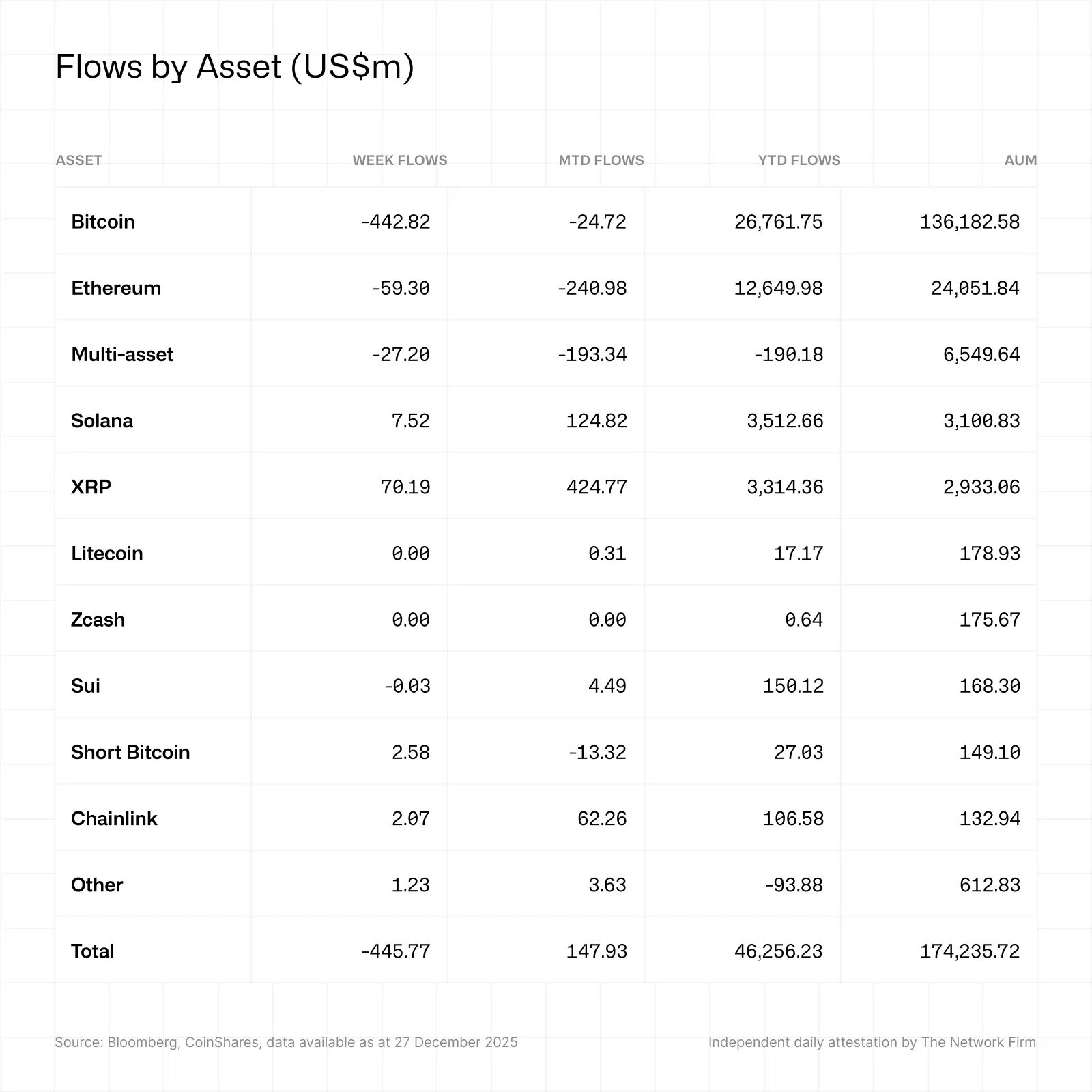

In line with digital asset administration agency CoinShares, there was a internet outflow of $446 million from digital asset funding merchandise final week. This brings whole outflows for the reason that October 10 market shock to $3.2 billion.

Feelings haven’t been reset. Capital continues to steer clear of a variety of market merchandise, notably these associated to main cryptocurrencies Bitcoin (BTC) and Ethereum (ETH).

XRP, SOL ETF continues to withdraw funds

Bitcoin ETPs misplaced about $443 million final week. Ethereum merchandise shaved off one other $59.5 million. Because the launch of the brand new XRP and Solana ETFs in mid-October, Bitcoin merchandise have fallen by about $2.8 billion, and Ethereum has fallen by $1.6 billion.

In line with information offered by CoinShares, it is a clear transfer away from giant benchmark exposures.

Supply: CoinShares

In the meantime, XRP merchandise are standing out. Final week, the XRP ETF attracted roughly $70.2 million. Since its inception, whole inflows have reached practically $1.07 billion. Solana merchandise additionally noticed regular demand, rising by $7.5 million final week and about $1.34 billion since launch.

Associated: Analysts are bearish on Ethereum, bullish on XRP’s document returns

XRP continues to draw new institutional traders as whole crypto ETP flows stay unfavorable, with the US main the best way with $460 million in outflows.

Value development nonetheless exhibits a downward development

In the meantime, the day by day chart under confirms that every one makes an attempt at restoration have been worn out. In line with CoinMarketCap information, XRP-USD is buying and selling between $1.86 and $1.91 after repeated failures on the $2 stage. Since surging above $3.50 in July, the construction has remained corrective, with decrease highs and decrease lows.

Costs are under the 20-day, 50-day, 100-day, and 200-day EMAs, all of that are trending downward. This confirms an energetic downtrend. A day by day RSI under 40 signifies that consumers are unable to take management and promoting strain is rising. So long as XRP stays under $2.00-$2.05, the worth motion signifies consolidation inside a bearish development moderately than a confirmed backside.

Supply: TradingView

Technically, $1.80 to $1.85 is the vital line. This zone has been held a number of occasions, fixing the present vary. If the day by day closing worth falls under this, the door opens to the mid-$1.60 stage. If it fails there, the $1 space primarily based on a bigger double-top construction will likely be within the image.

Associated: There isn’t a XRP provide shock on exchanges – analysts say

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be accountable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply