- Weekly crypto fund outflows reached $446 million, persevering with a broad pattern seen since October.

- German buyers added $35.7 million this week, signaling strategic shopping for through the drawdown.

- XRP and Solana appeal to inflows, whereas Bitcoin and Ethereum proceed to lose capital.

Digital asset funding merchandise closed below stress final week as buyers continued to withdraw cash from the market. Weekly outflows reached $446 million, in response to CoinShares knowledge, extending a pattern that started after a pointy value decline in early October. In consequence, whole withdrawals since that shock now stand at $3.2 billion, reflecting fragile confidence regardless of comparatively sturdy annual numbers.

Yr-to-date inflows stay at $46.3 billion, solely barely decrease than final yr’s $48.7 billion. Nevertheless, belongings below administration elevated by simply 10% over the identical interval.

Due to this fact, many buyers haven’t been capable of obtain constructive returns, contemplating the circulation of funds and value actions. This imbalance means that capital turnover, reasonably than new conviction, continues to outline market habits.

Interregional flows present uneven threat urge for food

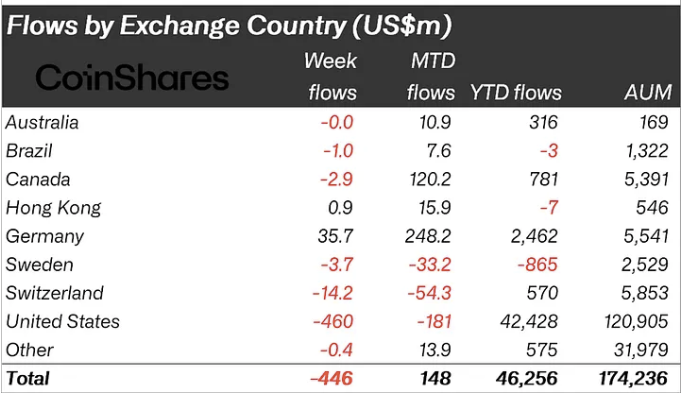

Promoting stress continued to unfold regionally. A lot of the current outflows got here from america, with $460 million misplaced in a single week. Switzerland additionally recorded modest withdrawals of $14.2 million. These numbers present that buyers within the historically dominant crypto market stay cautious.

Supply: CoinShares

Nevertheless, Germany stood out as a transparent exception. Inflows into the nation totaled $35.7 million for the week and $248 million for the month.

Importantly, this sample means that German buyers view the current value decline as a strategic entry level. Along with that, constant inflows counsel a long-term allocation method reasonably than short-term buying and selling exercise.

This discrepancy highlights how a lot regional sentiment is at the moment altering. Some buyers scale back publicity to handle threat, whereas others selectively add to positions throughout drawdowns.

Associated article: XRP ETF overcomes market gloom with $64 million in weekly inflows

XRP and Solana cease widespread leaks

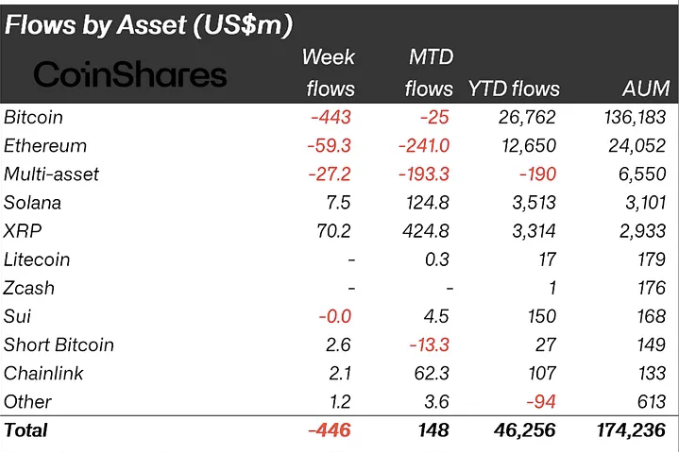

Asset-level knowledge additional emphasize this selective habits. XRP recorded weekly inflows of $70.2 million, adopted by Solana with $7.5 million. Furthermore, each belongings have attracted sustained capital for the reason that launch of the US ETF in mid-October.

Supply: CoinShares

Since these launches, XRP merchandise have recorded $1.07 billion in inflows, and Solana merchandise have added $1.34 billion. In consequence, these belongings have turn out to be disconnected from broader market developments. These performances counsel that buyers more and more choose focused narratives over broad publicity.

In distinction, Bitcoin and Ethereum continued to stall. Bitcoin merchandise recorded weekly outflows of $443 million, whereas Ethereum posted a lack of $59.5 million. For the reason that launch of the XRP and Solana ETFs, Bitcoin and Ethereum have recorded cumulative outflows of $2.8 billion and $1.6 billion.

Associated: XRP value prediction: ETF inflows ease decline as sellers defend downtrend line

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply