- XRP fell 1.24% to $1.59 whilst Ripple secured custody infrastructure for its $280 million Diamond tokenization mission within the UAE.

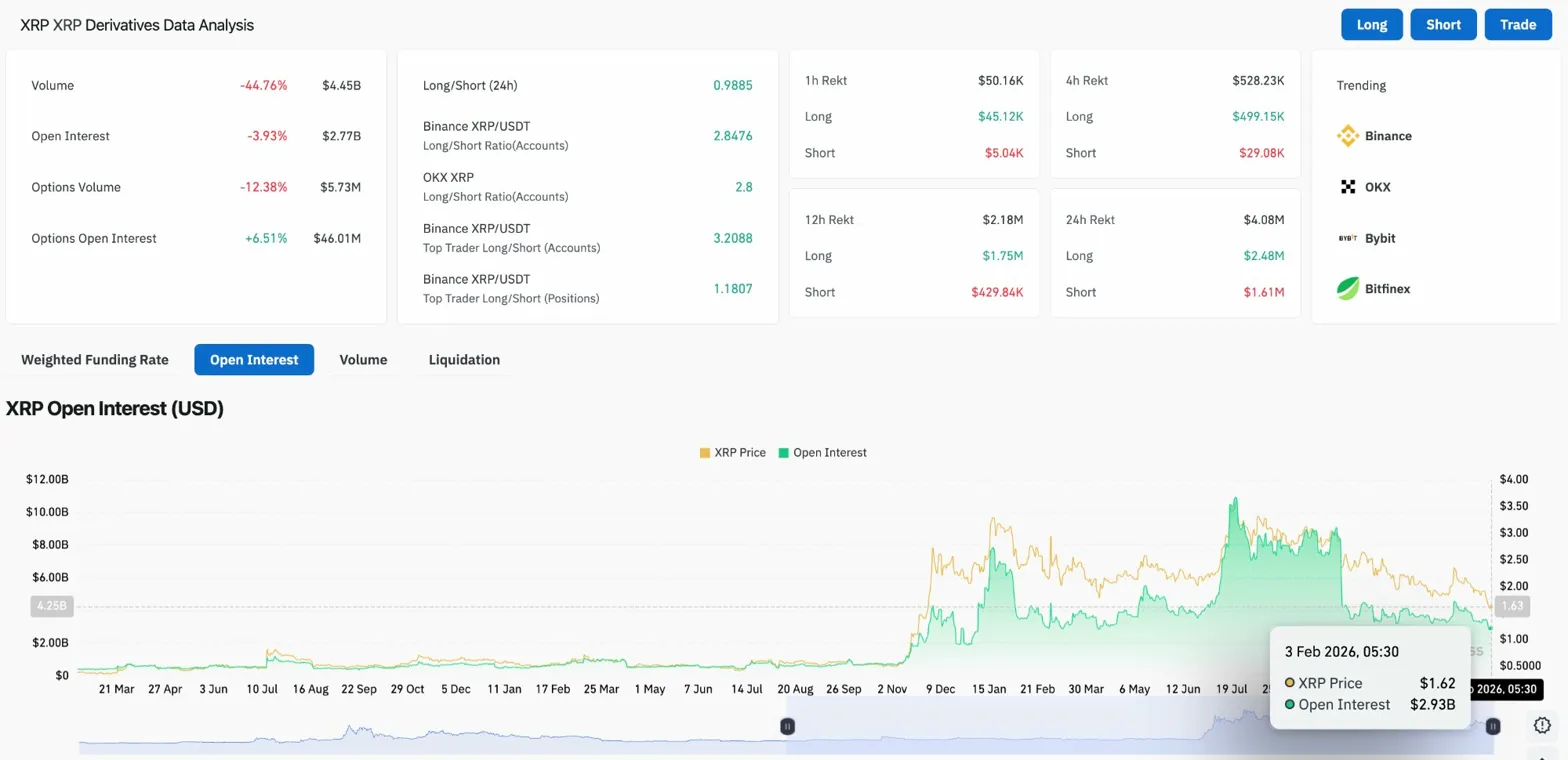

- Quantity decreased by 44.76% and open curiosity decreased by 3.93% to $2.77 billion, indicating a decline in buying and selling exercise after the current selloff.

- A restoration would require a return to $1.82, however an in depth under $1.50 would open the draw back in the direction of the $1.20 demand zone.

XRP value has didn’t maintain the rebound from final week’s low of $1.50 and is buying and selling round $1.59 immediately. The decline continues regardless of Ripple asserting a significant custody deal for its $280 million Diamond tokenization mission in Dubai, highlighting how macro headwinds are overwhelming the token’s particular fundamentals.

Ripple Diamond Tokenization Transaction Provides Enterprise Utility

Ripple’s custody expertise at the moment secures over $280 million of licensed polished diamonds tokenized on the UAE’s XRP ledger. Billiton Diamond and Ctrl Alt have moved over AED 1 billion in diamond stock on-chain, positioning the mission as an institutional-grade tokenization pipeline.

Ripple gives the underlying custody and token infrastructure, whereas XRPL handles issuance and transfers. Dubai’s DMCC coordinated the transaction because the emirate strikes to make tokenization of real-world belongings a core enterprise space.

The mission is awaiting approval from Dubai’s Digital Property Regulatory Authority for broader platform deployment and distribution. Key particulars reminiscent of redemption mechanisms, minimal lot sizes, and pricing stay unclear, elevating questions on how tradable the token shall be past the managed pilot part.

Whereas this deal confirms Ripple’s positioning as an organization, the market response exhibits that institutional partnerships alone can not overcome the present risk-off setting.

Open curiosity and quantity collapse sign depletion

Derivatives markets are displaying indicators of exhaustion following a collection of liquidations final week. Open curiosity decreased by 3.93% to $2.77 billion, and buying and selling quantity decreased by 44.76% to $4.45 billion. Choices quantity decreased by 12.38% to $5.73 million.

The lengthy/quick ratio is roughly balanced at 0.98 after the current flush eradicated leveraged longs. On Binance, prime merchants’ positions have an extended/quick ratio of three.20 per account, indicating that some merchants are bracing for a restoration regardless of the worth droop.

Prior to now 24 hours, $4.08 million positions had been liquidated, of which $2.48 million had been lengthy and $1.61 million had been quick. The comparatively balanced liquidation profile means that the market has reached a brief equilibrium after final week’s risky strikes.

Day by day chart assessments key demand zone at $1.50

On the day by day chart, XRP is buying and selling under all 4 main EMAs inside a well-defined vary construction. The 20-day EMA is $1.82, the 50-day EMA is $1.94, the 100-day EMA is $2.09, and the 200-day EMA is $2.24. All the EMA stack has now turn out to be an overhead resistance.

The worth is testing the $1.50 to $1.85 demand zone that has supported XRP since early 2025. The $1.50 stage represents essential horizontal help that coincides with the session low from February 1st. A breakdown under this stage would expose the $1.20 demand zone highlighted on the chart.

The $2.17 to $2.40 zone marks the primary main resistance space talked about above, and the $2.62 stage represents the breakout level from November that must be regained to shift the macro construction in a bullish route.

Brief-term construction exhibits energy after the crash

On the 2-hour chart, XRP is buying and selling under the supertrend indicator at $1.68, confirming the short-term bearish bias. Following the crash from $2.00, the worth has shaped a consolidating vary between $1.55 and $1.70.

DMI is displaying sturdy bearish momentum with ADX at 42.80, indicating confidence within the downtrend. The destructive DI is 25.96 and the constructive DI is greater than 10.81, confirming that sellers proceed to regulate the short-term route.

Value rejected the supertrend stage throughout a restoration try on February 2nd, establishing $1.68 to $1.70 as speedy resistance. Bulls require an in depth above this zone to point a significant change in momentum.

Outlook: Will XRP rise?

Though costs have fallen under the EMA cluster and are hovering round multi-month lows, the pattern stays bearish.

- Bullish case: A day by day shut above $1.82 would point out a retrieval of the 20-day EMA and help at $1.50. As soon as macro sentiment stabilizes, Diamond’s tokenization deal and continued company adoption may entice patrons.

- Bearish case: If the worth closes under $1.50, the 2025 help construction will collapse and the $1.20 demand zone shall be uncovered. That state of affairs stays seemingly as volumes have collapsed and macro headwinds stay in place.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply