- XRP stays capped beneath the prevailing downtrend line and the 50-200 EMA cluster, with the broader construction remaining bearish.

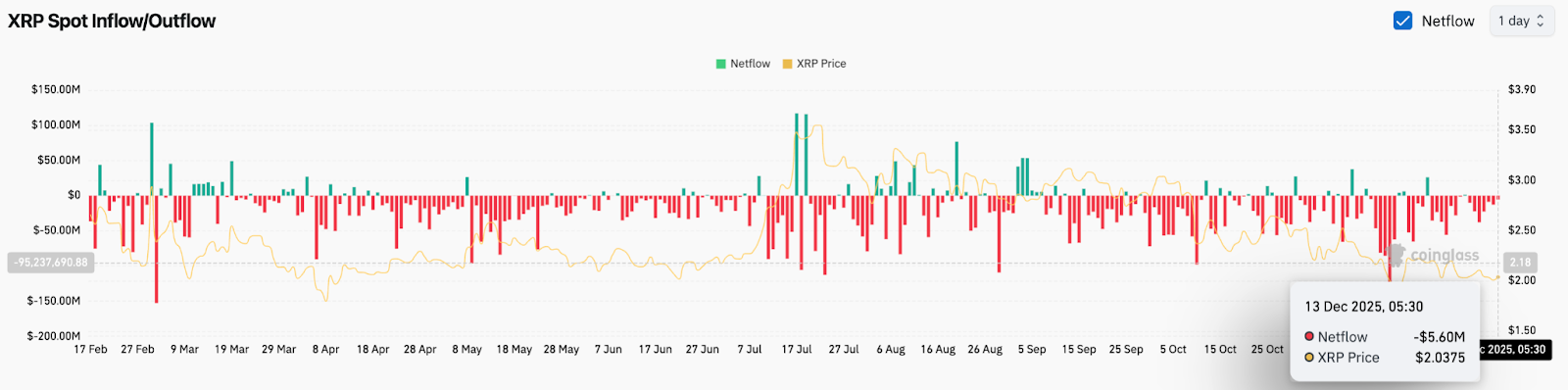

- Spot flows stay destructive with outflows of $5.6 million, with restricted follow-through regardless of near-term stability round $2.

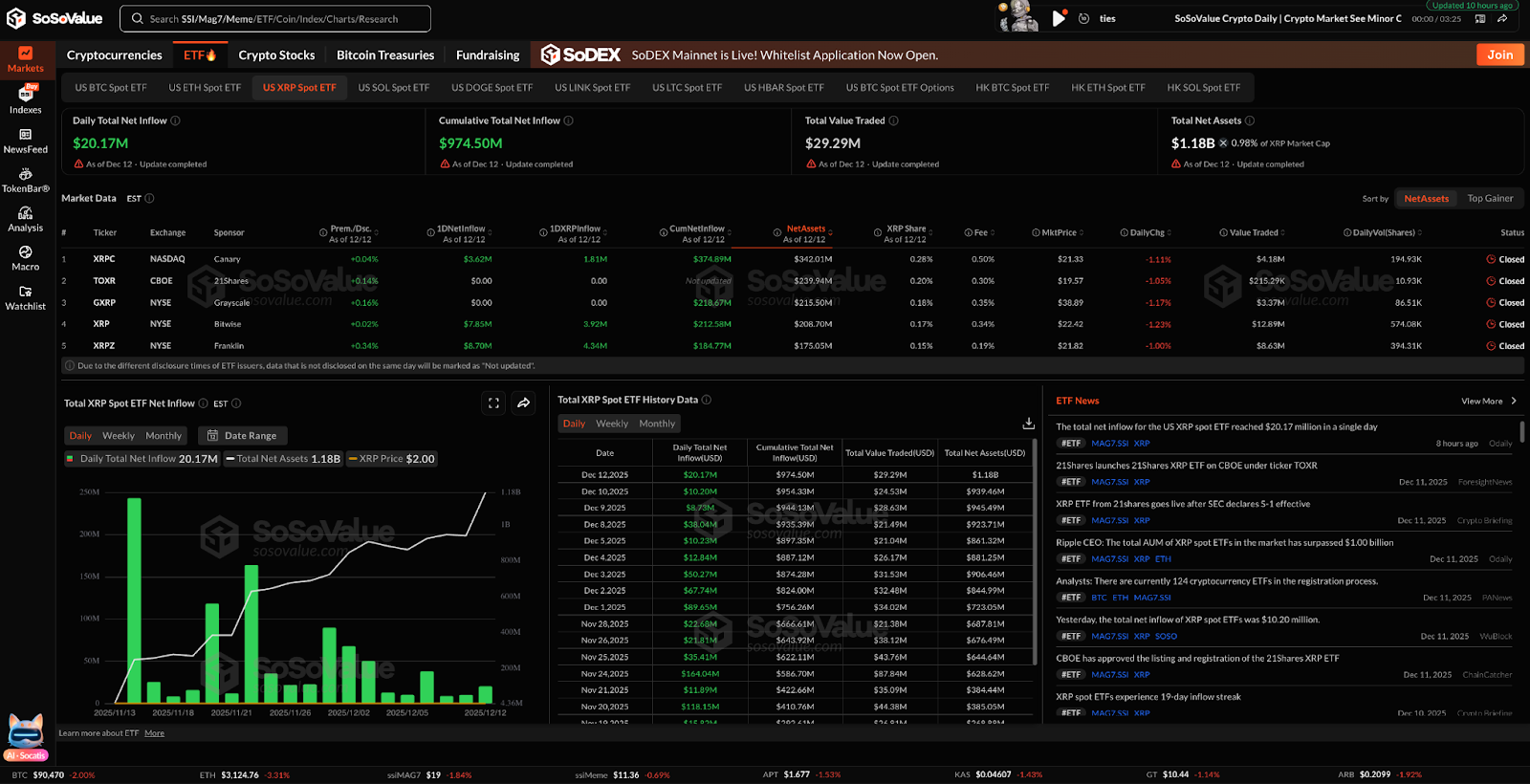

- The ETF has seen over $20 million in inflows in a single session, however the value would wish to shut above $2.15 every day to see a change in pattern.

On the time of writing, XRP is buying and selling round $2.04 after stabilizing above short-term assist after an prolonged downtrend. Consumers wish to construct base, however the market remains to be locked beneath the dominant downtrend line that has capped any positive aspects. The following transfer will rely on whether or not ETF inflows result in acceptance of actual costs above resistance.

Pattern traces nonetheless outline the market

On the every day chart, XRP stays pinned beneath a well-defined downtrend line. Every strategy to that slope has been rejected, confirming that the vendor has constantly adhered to that slope.

The worth is buying and selling beneath the 50-day, 100-day, and 200-day EMAs situated between $2.09 and $2.45. This EMA cluster has been appearing as a ceiling for a number of months. Till XRP regains its zone, any try to maneuver larger will stay correctional somewhat than trend-forming.

The every day supertrend stays bearish, supporting the concept that momentum has not reversed. Though volatility has diminished, the broader construction stays favorable to sellers.

Nevertheless, the tempo of decline is slowing. XRP is not making aggressive lows, suggesting promoting stress is easing somewhat than accelerating.

Intraday break above pattern line lacks follow-through

A shorter timeframe signifies an early try and problem the downtrend. On the 30-minute chart, XRP briefly broke above the intraday downtrend line earlier than stalling round $2.05.

Momentum indicators mirror cautious optimism. The RSI is above 55, indicating enchancment in demand, and the MACD is in optimistic territory. Nevertheless, the amount stays mild. Breakout makes an attempt haven’t attracted lively participation.

This makes motion weak. If quantity doesn’t broaden, intraday power dangers fading again into the vary. The $2.06 to $2.08 zone stays as a direct resistance stage. You will want a clear maintain above that space to construct momentum towards larger ranges.

Spot circulate remains to be on a destructive pattern

Spot market knowledge continues to point out stress. The newest every day netflow print reveals an outflow of about $5.6 million, extending a broader pattern of distribution somewhat than accumulation.

XRP has struggled to maintain positive aspects whereas spot outflows proceed. Even when costs stabilize, the shortage of spot demand will restrict upside follow-through. Till spot flows flip constantly optimistic, the rally stays fragile. Consumers exist, however they aren’t lively.

ETF inflows change the story, however not the chart but

The US Spot XRP ETF recorded every day web inflows of roughly $20.17 million on December 12, bringing the cumulative influx quantity to $975 million. His whole web value is at present over $1.18 billion.

The circulate is constructive. This demonstrates elevated institutional entry and sustained curiosity in regulated merchandise. Nevertheless, the value response has slowed down. This implies that ETF inflows are being offset by spot promoting and long-term positioning elsewhere, somewhat than speedy market shopping for.

Will XRP go up?

XRP is compressed between rising assist and falling resistance. The market is gearing up for a decision.

- A robust case. A every day shut above $2.15 will reverse the pattern construction and goal $2.3, adopted by $2.45 if quantity expands.

- bearish case. If we fail to carry $2, the downtrend will stay intact and the danger of $1.9 will enhance.

ETF inflows are enhancing the long-term image, however the value nonetheless wants affirmation. Till XRP confidently breaks out of the pattern line, the market will stay impartial to bearish, with the stability of danger holding firmly round $2.

Associated: XRP Value Prediction: ETF launch fails to set off breakout, restoration of downtrend line reaches higher restrict

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t chargeable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply