- XRP consolidates at $2.06, caught between the 20/50 EMA cluster and descending triangular resistance as momentum stalls.

- Inflows into ETFs continued on January sixteenth with $1.12 million, marking the eleventh consecutive day of inflows from institutional traders.

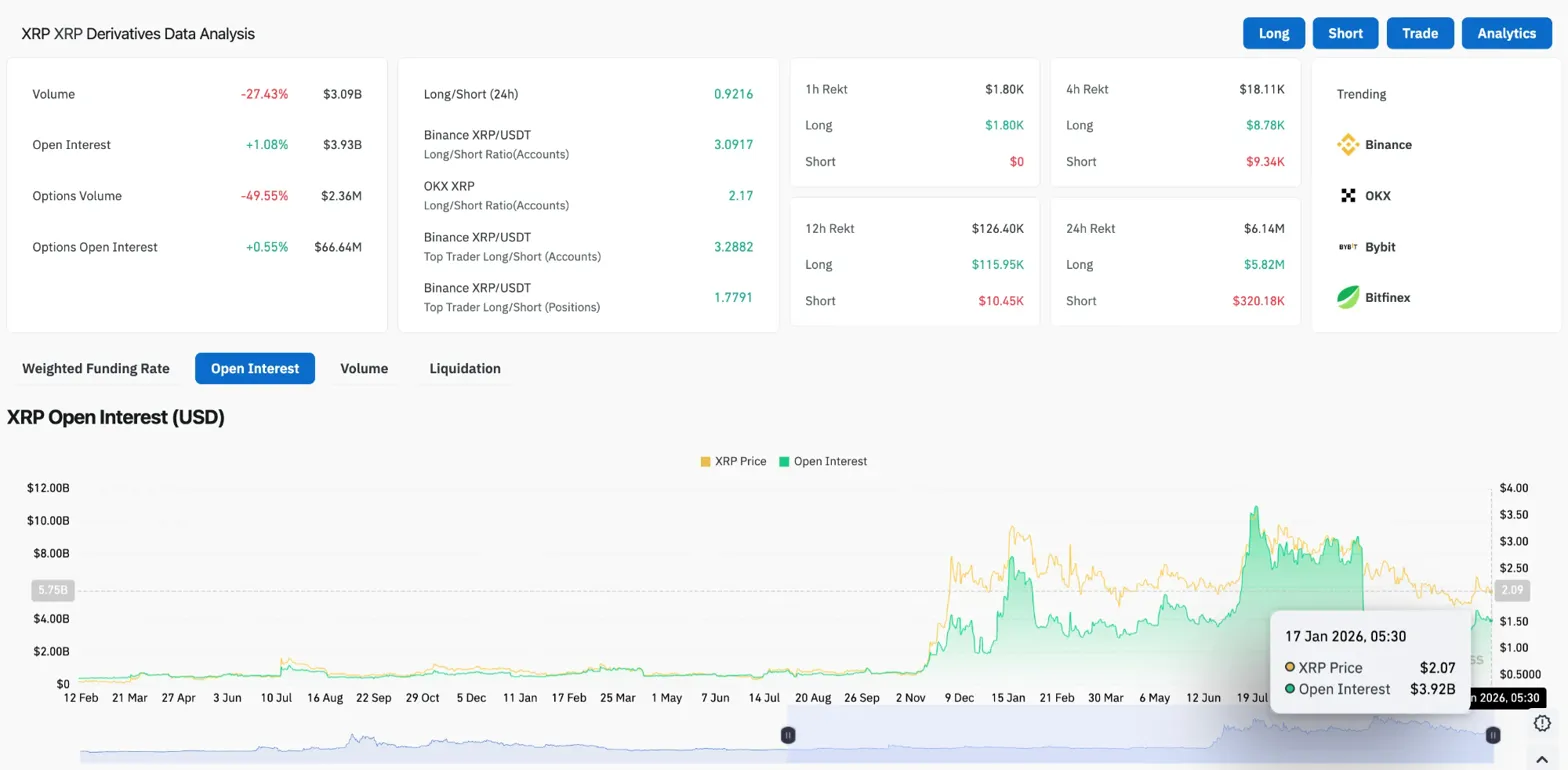

- Derivatives knowledge exhibits $5.82 million in lengthy liquidations in 24 hours, whereas the lengthy/quick ratio is tilted to 0.92, reflecting cautious positions.

Immediately, XRP value is buying and selling round $2.06 as a descending triangle sample compresses the worth motion right into a narrowing vary. This setup places consumers at a key determination level, the place the $2.04 triangle help holds whereas the overhead resistance continues to fall.

Triangle sample weighs on value motion

The hourly chart exhibits a typical descending triangle that has been forming since January 14th. The worth has made a collection of lows from $2.19 to $2.08, however the horizontal help stays firmly held at $2.04.

This sample is normally resolved by a breakdown, however the course is determined by which degree breaks first. A detailed beneath $2.04 confirms the bearish bias and predicts a cautious transfer in the direction of $1.90. A break above the downtrend line close to $2.10 will invalidate the sample and shift momentum to the bullish facet.

The RSI is at 48.95, reflecting indecision. This indicator has been fluctuating between 45 and 55 for the previous three days with out committing in both course. The parabolic SAR at $2.0403 coincides with the triangular help degree, and this degree turns into the sandy short-term line.

ETF inflows proceed, however at a slower tempo

Regardless of the stagnation in value actions, institutional investor flows have remained optimistic. In line with SoSoValue, the XRP Spot ETF recorded web inflows of $1.12 million on January 16, extending this streak of inflows to an 11-day cumulative whole.

The tempo has slowed because the starting of this month. On January fifteenth, there was an influx of $17.06 million, and on January 14th, there was an influx of $10.63 million. The decline to $1.12 million means that institutional consumers are retreating as costs consolidate, reasonably than aggressively including to their positions.

The ETF at the moment has $1.52 billion in whole property below administration, with cumulative web inflows of $1.28 billion since inception. Regular accumulation supplies a flooring for the worth, however it was not sufficient to push XRP previous the overhead resistance.

Lengthy pants flash as quick pants enhance

Derivatives positions replicate a cautious temper. Open curiosity elevated by 1.08% to $3.93 billion, however buying and selling quantity decreased by 27.43% to $3.09 billion. This divergence means that merchants are holding positions however aren’t opening new positions with confidence.

The lengthy/quick ratio is 0.92, indicating a slight inclination in the direction of quick positioning. Previously 24 hours, $5.82 million got here to market in lengthy liquidations, in comparison with simply $320,000 in brief liquidations. This imbalance exhibits that leveraged bulls stay caught on the fallacious facet of the vary.

The positions of high merchants on Binance inform a special image, with a protracted/quick ratio of three.09 for giant accounts. This divergence within the positions of outlets and institutional traders typically precedes sharp strikes as one facet capitulates.

Every day construction caught in EMA cluster

On the every day time-frame, XRP sits straight within the 20-day and 50-day EMA clusters between $2.06 and $2.08. Since December, this zone has been performing as a pivot, with costs fluctuating up and down with out establishing a transparent pattern.

Present main degree:

- Fast resistance: $2.08 (50 EMA)

- Essential resistance: $2.20 (100 EMA)

- Pattern resistance: $2.32 (200 EMA)

- Triangle help: $2.04

- Tremendous pattern help: $1.9555

- Demand zone: $1.80

The supertrend indicator stays bullish at $1.9555, suggesting that the broader restoration construction will maintain so long as costs stay above this degree. Nevertheless, the downtrend line from the October excessive close to $3.40 continues to cap the rally, forming a compression zone that can quickly be resolved.

Outlook: Will XRP collapse or rise?

Triangle patterns require excessive decision. Worth can’t compress indefinitely between $2.04 and draw back resistance. The course is prone to be determined within the subsequent 48 to 72 hours.

- Bullish case: A detailed above $2.10 will break the downtrend line and goal $2.20. Clearing the 100 EMA with quantity confirms the resumption of the pattern in the direction of $2.50.

- Bearish case: A every day shut beneath $2.04 confirms the breakdown of the triangle and targets the $1.95 supertrend help. Shedding $1.95 opens up a $1.80 demand zone.

XRP is at an inflection level. ETF flows present bidding enter, however slowing momentum and extended liquidations counsel consumers want a catalyst to interrupt the stalemate.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version is just not liable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to carry out due diligence earlier than taking any motion associated to our firm.

Leave a Reply