- XRP fell 3.73% because the ETF’s outflows reached $92.92 million on January 29, the biggest single-day redemption since its inception.

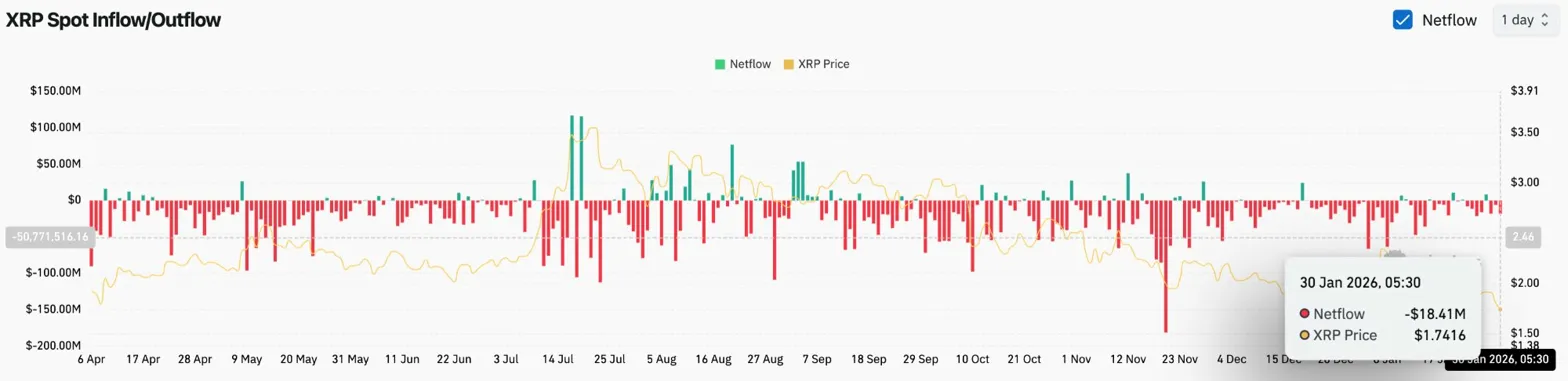

- Spot outflows amounted to $18.41 million, pushing the worth beneath the $1.80 assist zone that held via most of January.

- A restoration would require a return to $1.92, however an in depth beneath $1.71 would open the draw back in direction of the $1.50 demand zone.

XRP value is buying and selling round $1.73 at this time after falling beneath the $1.80 assist stage that has supported value actions since early January. This transfer follows document single-day ETF outflows and sustained spot promoting, inserting the token on a key long-term pattern line that can outline the 2025 construction.

File ETF outflows shake up institutional positioning

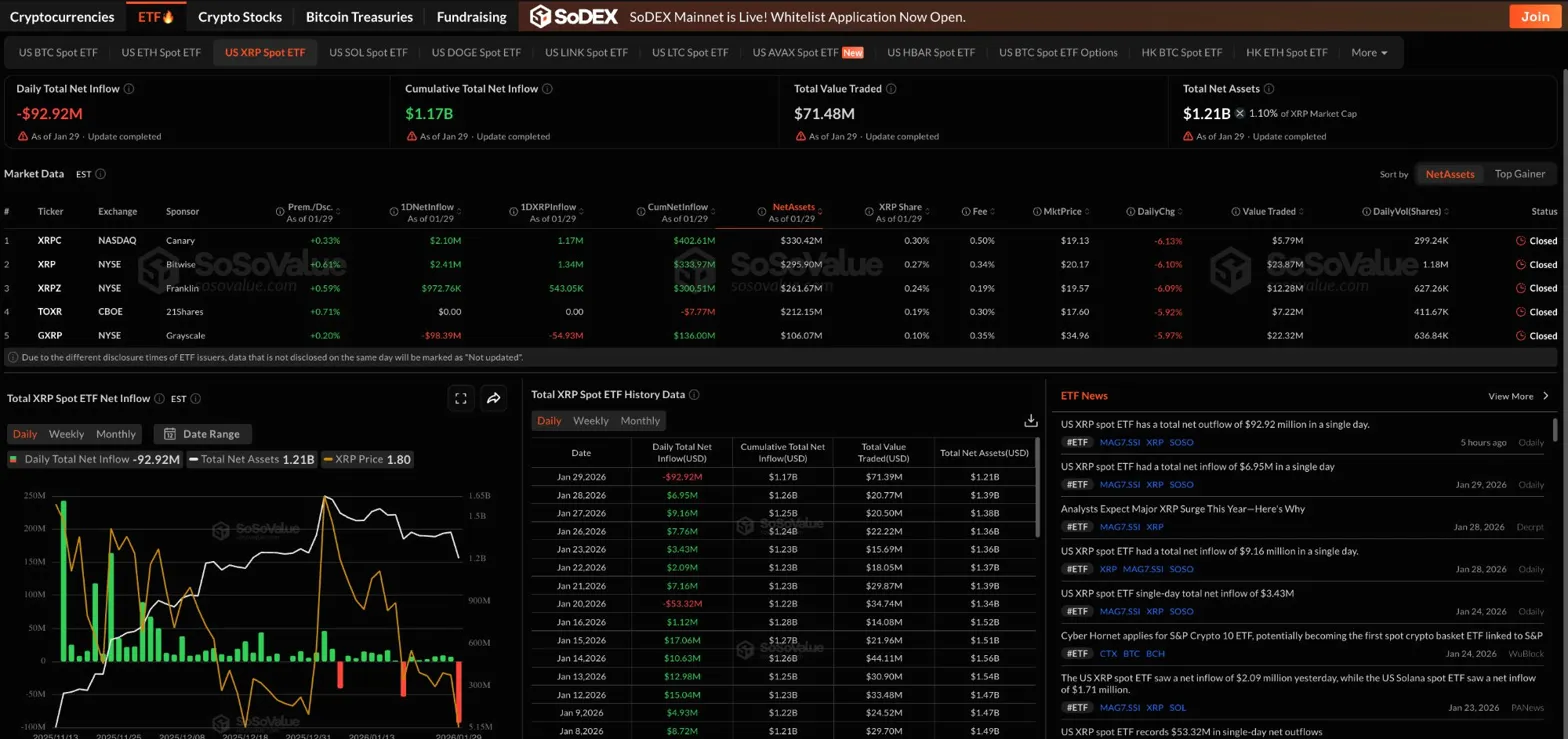

XRP ETFs recorded web outflows of $92.92 million on January 29, the biggest single-day redemption quantity because the launch of those merchandise. Grayscale GXRP funds led the promoting with outflows of $98.39 million, whereas Canary and Bitwise noticed modest inflows of $2.1 million and $2.41 million, respectively.

The full web belongings of the complete XRP Spot ETF at the moment are $1.21 billion, down from latest highs of over $1.39 billion. Though cumulative inflows stay at $1.17 billion, the sharp reversal in each day inflows signifies that institutional buyers are actively lowering their publicity.

Associated: Bitcoin value prediction: BTC dangers additional losses as market construction turns defensive

The timing coincides with broader altcoin weak spot and a powerful greenback surroundings that’s drawing capital to conventional protected havens. The XRP ETF has constantly attracted inflows via mid-January, making this reversal notably noteworthy.

Spot outflows improve promoting stress

Based on Coinglass information, spot outflows on January 30 have been $18.41 million, extending the distribution sample that lasted the previous week. The mixture of ETF redemptions and spot promoting creates twin stress, which explains the accelerated breakdown beneath $1.80.

When each institutional and retail channels exhibit web outflows on the similar time, costs sometimes comply with the route of flows. With no patrons stepping in to soak up provide at present ranges, the market stays weak to additional declines.

Long run pattern line take a look at defines the commerce

On the each day chart, XRP checks an uptrend line drawn from the June 2025 low. This trendline has supported costs via a number of corrections, together with a drop to $2.30 in November and a retest close to $1.80 in December.

Worth is at the moment buying and selling beneath all 4 main EMAs. The 20-day EMA is $1.92, the 50-day EMA is $2.00, the 100-day EMA is $2.13, and the 200-day EMA is $2.26. Parabolic SAR stays bearish at $1.94, confirming the downtrend.

Associated: Canton Worth Forecast: Canton Community Appears to be like Upward as Spot Demand Regularly Recovers

The downtrend line from the August excessive round $3.60 continues to cap the rise, forming a narrowing wedge sample. Worth is sitting close to the decrease finish of that wedge at $1.73, a stage that’s crucial to the broader construction.

Intraday momentum exhibits weak bounce makes an attempt

On the 30-minute chart, XRP has proven a collection of lows since January twenty eighth, when the worth traded above $1.95. The downtrend line has rejected all rebound makes an attempt, with the most recent rejection occurring close to $1.81.

The RSI is at 37.53, a slight restoration from the oversold stage that reached the session low of $1.71. The MACD has turned optimistic on the histogram, suggesting near-term promoting stress could also be easing, however the sign stays weak.

The low of $1.71 since January thirtieth supplies quick assist. A break beneath that stage will verify a trendline breakdown and the construction will transfer from consolidation to continued weak spot.

Outlook: Will XRP rise?

The pattern stays bearish regardless of costs buying and selling beneath the EMA cluster and ETF outflows persevering with.

- Bullish case: A each day shut above $1.92 would point out a retracement of the 20-day EMA and the pattern line holding as assist. This transfer would require a reversal in ETF flows and will goal the $2.00 to $2.13 resistance zone.

- Bearish case: A detailed beneath $1.71 would verify the breakdown of the long-term uptrend line and expose the $1.50 demand zone. That situation turns into extra possible as institutional promoting accelerates.

A change in ETF sentiment is required to stabilize XRP. Sellers management the tape till redemptions sluggish and spot move improves.

RELATED: Chainlink Worth Prediction: Hyperlink Drops 22% in Two Weeks Regardless of ETF Inflows and Turtle Partnership

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be chargeable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply