- XRP is buying and selling under the Ichimoku cloud, indicating that short-term bearish momentum continues.

- Vital assist lies at $1.42, and the danger of breakdown lies on the $1.36 and $1.12 ranges.

- Derivatives and spot flows are displaying warning, highlighting decrease leverage and weaker demand.

Regardless of regular company messages from Ripple, XRP stays underneath strain as short-term charts recommend continued weak point. The 4-hour value motion reveals that sellers are nonetheless answerable for the momentum.

Subsequently, merchants proceed to give attention to assist motion reasonably than upside enlargement. Market knowledge means that XRP is at the moment buying and selling in a cautious atmosphere created by technological limitations and suppressed demand.

Management the bears with short-term construction

XRP has continued its downward development after failing round $2.40 to $2.30 earlier this 12 months. Importantly, the worth stays under the Ichimoku cloud, confirming a continued draw back value construction. The rebound from the February low of $1.12 lacked follow-through. Subsequently, merchants view this transfer as a correction reasonably than a reversal.

The assist at $1.42 stays necessary within the brief time period. Nonetheless, a loss at this stage would instantly expose you to $1.36. Moreover, a break under $1.12 may speed up strain on the $1.00 space.

On the upside, $1.53 is a right away resistance stage. Moreover, sellers had been beforehand actively defending the $1.62 Fibonacci stage. A break above $1.77 would sign the primary structural enchancment. Nonetheless, a broader restoration may require a restoration of $1.92.

The ADX studying close to 17 confirms the dearth of development power. Nonetheless, draw back threat nonetheless dominates as costs sit under the cloud.

Watch out for derivatives and spot stream indicators

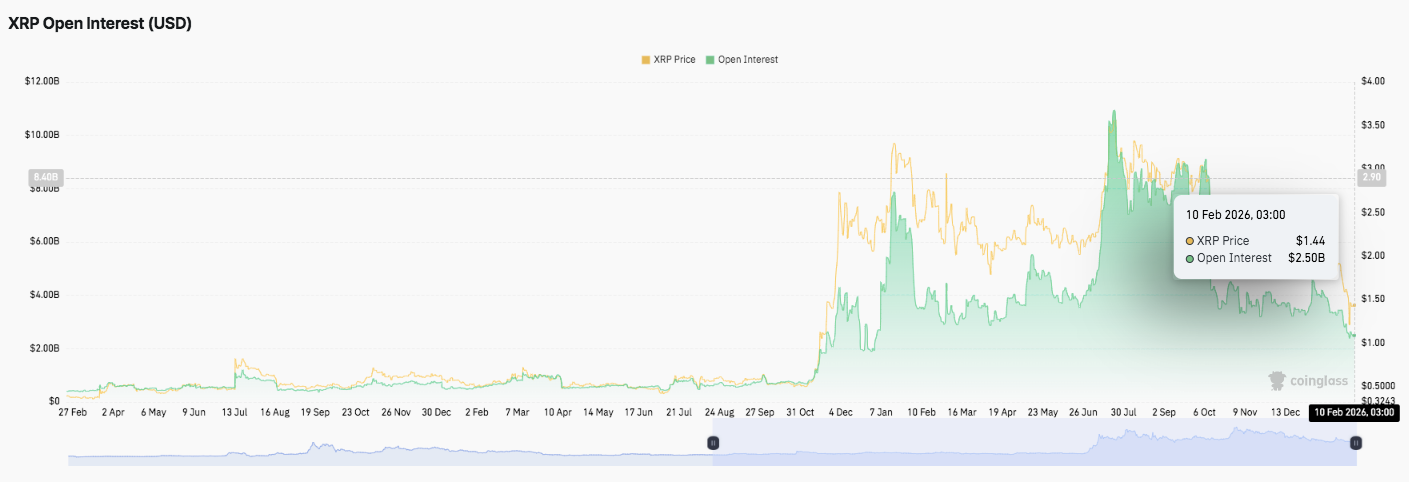

XRP spinoff knowledge displays accomplished leverage cycles. Open curiosity expanded quickly within the second half of the fourth quarter as costs soared. Subsequently, open curiosity decreased as volatility elevated. Subsequently, pressured liquidations and place closures lowered speculative publicity. Regardless of occasional value stabilization, confidence in leverage continued to wane.

Just lately, open curiosity has stabilized at a low stage. This alteration means that extreme leverage has been eliminated. Consequently, the market at the moment favors consolidation over bets in an aggressive course.

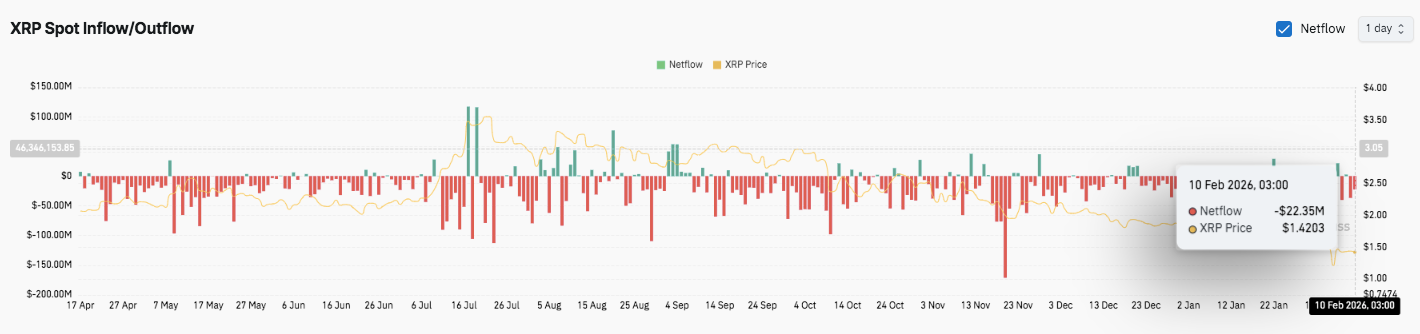

Spot stream knowledge helps this cautious development. Internet outflows have dominated in current months, indicating continued distribution pressures. Moreover, the pink stream session intensified in the course of the value decline. Sometimes, short-term influx spikes occurred. However it failed to vary the bigger traits. Subsequently, spot demand stays restricted, reinforcing the bearish construction.

Ripple reaffirms the function of XRP in its institutional technique

In the meantime, Ripple continues to emphasise the function of XRP in its funds technique. CEO Brad Garlinghouse addressed neighborhood issues concerning the product’s focus. He emphasised that XRP stays on the heart of institutional funds design. Moreover, Ripple builders have outlined XRP as the first bridge asset for on-chain liquidity.

This place aligns with Ripple’s broader compliance and infrastructure objectives. Furthermore, regardless of short-term value declines, it helps the long-term utility story. Nonetheless, the market is at the moment prioritizing technical indicators over strategic messages.

Technical outlook for XRP value

Key ranges stay well-defined as XRP trades by means of a fragile short-term construction.

Upside ranges to look at embrace the primary hurdle at $1.53, adopted by $1.62 close to the 0.382 Fibonacci retracement. A stronger breakout may pave the best way to the 0.618 Fibonacci stage and $1.77, and later $1.92, indicating a broader development restoration zone.

On the draw back, $1.42 acts as rapid assist. Beneath this stage, the main focus will shift to $1.36, with $1.12 serving because the February low and the final main line of protection earlier than $1.00.

The technical state of affairs means that XRP stays under the Ichimoku cloud, indicating a bearish bias and weak momentum. Worth traits point out consolidation threat reasonably than rapid reversal.

Will XRP go up?

The near-term course of XRP will rely upon whether or not consumers can defend $1.42 and reclaim the $1.53-$1.62 resistance cluster. A sustained rise above $1.77 would point out structural enchancment and renewed upward momentum.

Nonetheless, if the worth is unable to maintain $1.42, there’s a threat that promoting strain will resume at $1.36 and $1.12. For now, XRP stays within the important zone, with technical compression and cautious flows setting the stage for elevated volatility forward.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not chargeable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply