- Bitcoin’s decline has fueled widespread threat aversion throughout crypto markets, with XRP down 4.79% to $1.43, erasing all positive factors since President Trump’s election victory.

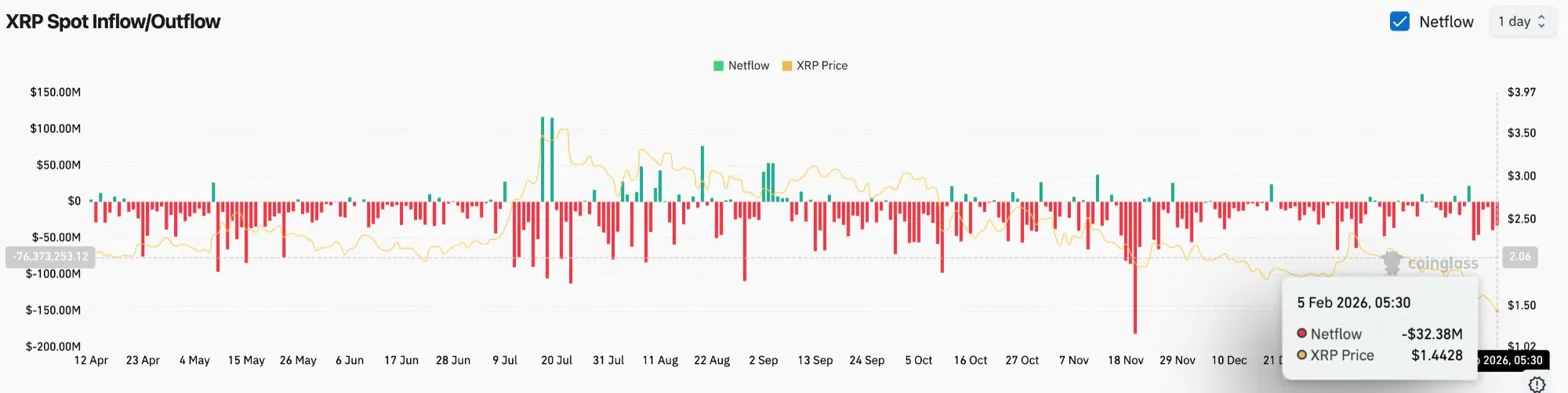

- Spot outflows quantity to $32.38 million because the token falls under the $1.60 demand zone from the April selloff, leaving restricted help at $1.00.

- A restoration would require a return to $1.75, however an in depth under $1.40 would affirm a continuation in direction of the psychological goal of $1.00.

XRP value is presently buying and selling round $1.43 after crashing to its lowest value since November 2024, the identical month that President Trump received the US election along with his pro-cryptocurrency insurance policies. The token worn out all post-election positive factors as Bitcoin’s steep decline sparked threat aversion throughout crypto markets.

Submit-election rallies have been utterly erased.

President Trump’s marketing campaign rallies that when pushed XRP above $3.50 are an entire reversal. The preliminary bullish response to pro-crypto coverage pledges peaked at $3.65 in July 2025, however the token has been on a steady downward development since then.

XRP rose greater than 150% from November 2024 to July 2025 on hopes of regulatory incentives. Ripple makes use of XRP to facilitate cross-border transactions, and a clearer regulatory outlook is seen as a serious catalyst.

This principle collapsed together with broader cryptocurrency vulnerabilities. The token has now returned each penny of its marketing campaign rally and returned to pre-election ranges, however the promised regulatory readability stays elusive.

The breakdown under $1.60 is technically important. This degree served as a requirement zone through the April selloff and represented the value vary into which consumers had beforehand stepped with confidence.

With the break above $1.60, analysts imagine there’s restricted technical help to the psychologically vital $1.00 degree. Deribit choices buying and selling is displaying elevated demand for draw back safety, suggesting merchants are bracing for additional declines.

Promoting accelerates, spot outflow reaches $32 million

In accordance with Coinglass information, spot outflows on February fifth have been $32.38 million, confirming that holders are decreasing their publicity somewhat than accumulating at decrease ranges. The outflow sample from January to February exhibits a constant distribution, with no significant influx dates.

If spot promoting continues whereas main help is damaged, it signifies vendor confidence. The shortage of shopping for curiosity at $1.60 and now $1.44 means that the market has not but discovered a degree the place demand can soak up provide.

Every day chart exhibits acceleration of downtrend

On the every day chart, XRP is buying and selling properly under all 4 main EMAs inside the descending channel that has guided the value motion since July. The 20-day EMA is $1.75, the 50-day EMA is $1.90, the 100-day EMA is $2.06, and the 200-day EMA is $2.22.

Associated: Hyper-Liquidity Worth Prediction: HYPE Worth Pauses After Rising as Treasury Opens New Yield Channel

The Supertrend indicator stays bearish at $1.79. The distinction between the present value of $1.43 and the current EMA of $1.75 signifies how far the market is from significant resistance.

The $1.40 to $1.45 zone highlighted on the chart represents the following help space. A break under this degree will see an acceleration in direction of $1.00 with minimal technical hurdles.

The consolidating vary from early February collapses.

On the 30-minute chart, XRP was in a consolidating vary between $1.50 and $1.70 from February 1st to February 4th. That vary decisively broke to the draw back, inflicting a decline to $1.41.

The RSI is holding at 30.03, coming into oversold territory after the break. The MACD has turned barely constructive at 0.0022, however the sign line stays deeply damaging, indicating that the histogram rebound is a pause somewhat than a reversal.

The vary of failed consolidation turns into resistance. Any try at restoration would require a return to $1.50 to point stabilization, with the earlier vary excessive of $1.70 representing the primary significant resistance zone.

Outlook: Will XRP rise?

The worth stays under all EMAs and the $1.60 help has failed, however the development stays bearish.

- Bullish case: A every day shut above $1.75 would point out a resumption of the 20-day EMA and supertrend ranges and maintain the $1.40 help. This transfer requires a change in broader cryptocurrency sentiment and stabilization of Bitcoin.

- Bearish case: If the closing value falls under $1.40, the breakdown will probably be confirmed and the psychological degree of $1.00 will come into play. With minimal technical help between present ranges and $1.00, this state of affairs represents a possible for an additional 30% decline.

Associated: Solana Worth Prediction: $71M Liquidation Causes Weekly Breakdown, SOL Loses $100

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not accountable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply