- XRP fell 2.83% to $1.3894 as spot outflows reached $19.57 million, and open curiosity fell 3.97% to $2.44 billion amid persistent promoting stress.

- The each day RSI is 32.01, which places the token near oversold territory because it trades 62% under its July excessive close to $3.65.

- A restoration would require a return to supertrend resistance at $1.45, however a detailed under $1.37 would open the draw back for a crashing low of $1.10.

XRP worth is buying and selling round $1.38 right this moment after falling under the $1.40 assist stage that had stored the worth contained via weekend consolidation. The decline comes as spot outflows speed up and the token approaches oversold situations on the each day timeframe, elevating questions as as to whether the rebound from the crash lows has already been exhausted.

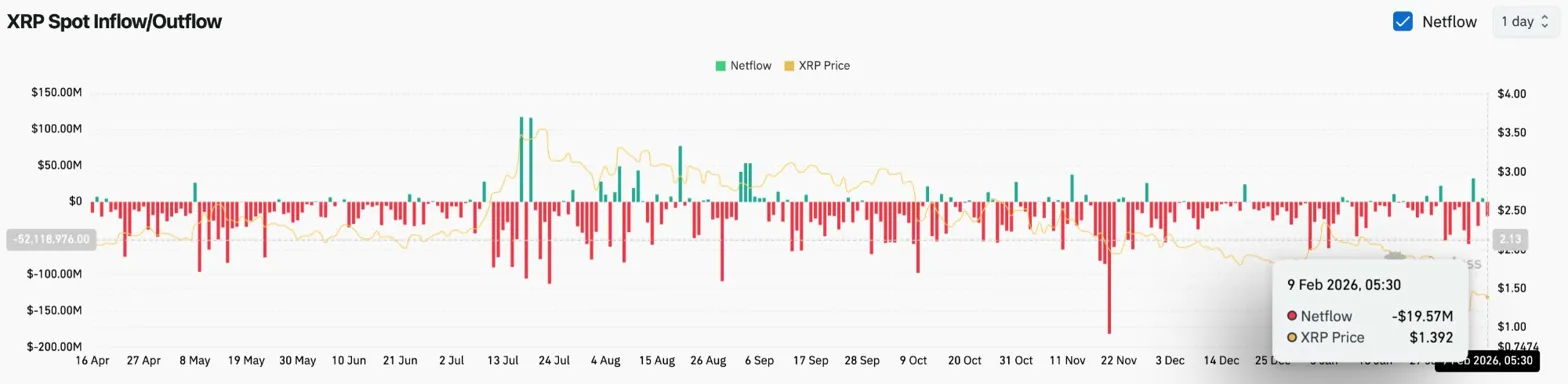

Spot outflows speed up to $19.57 million

In keeping with Coinglass knowledge, spot outflows on February ninth have been $19.57 million, a big enhance from $6.96 million in outflows two days earlier. Accelerating promoting stress means that the consolidation section could also be ending with a decline reasonably than a continued rebound.

The stream sample via February exhibits a persistent distribution with no significant influx days for the reason that crash. If outflows speed up throughout the consolidation section, it often signifies that sellers are exiting to benefit from the rebound, reasonably than consumers coming into to build up.

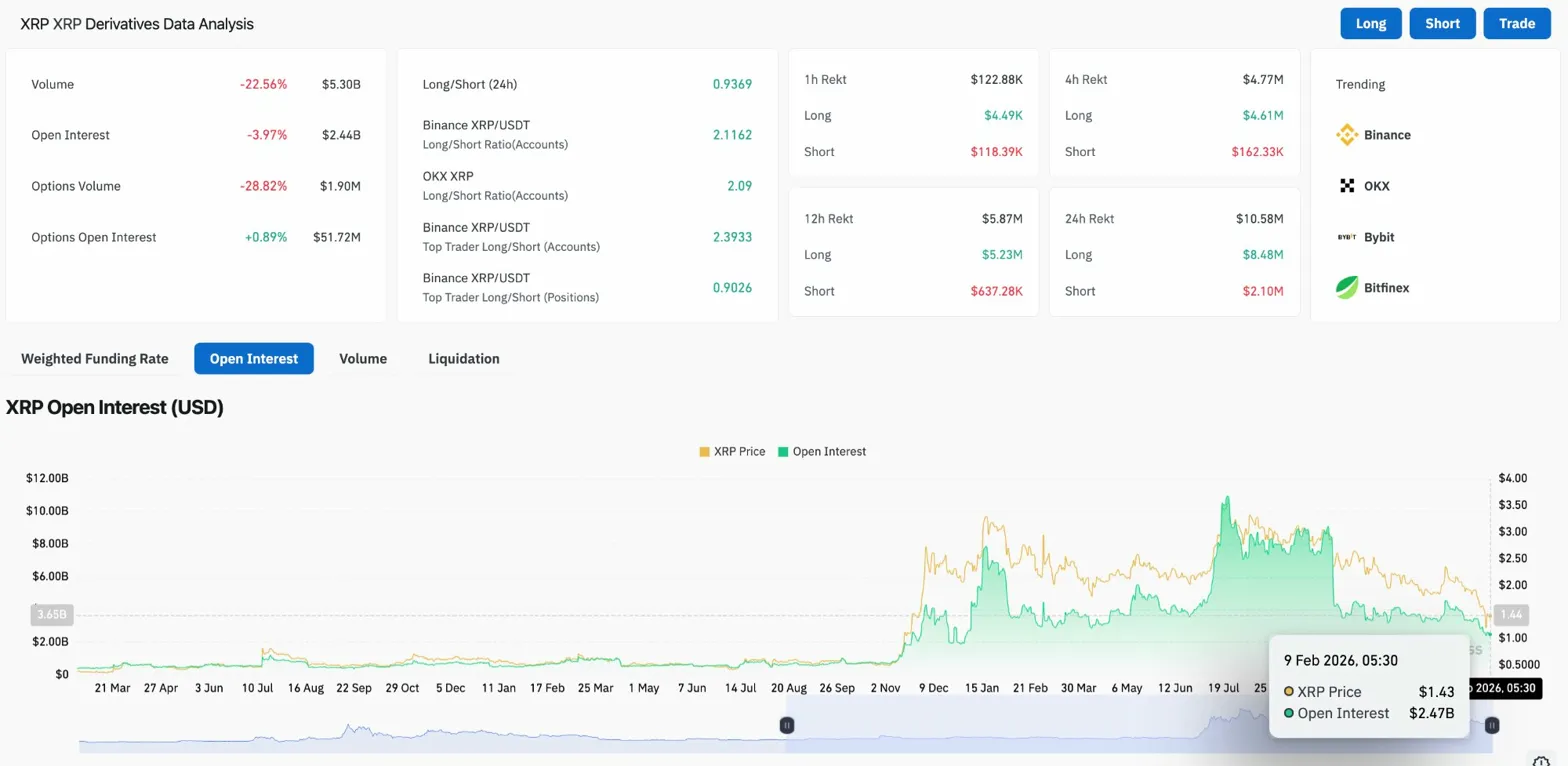

Derivatives knowledge exhibits continued deleveraging

Open curiosity decreased by 3.97% to $2.44 billion, and buying and selling quantity decreased by 22.56% to $5.3 billion. Choices quantity decreased 28.82% to $1.9 million, reflecting exhausted buying and selling exercise.

The lengthy/brief ratio was 0.93, indicating a slight brief bias for the primary time on this decline. On Binance, high merchants keep a ratio of two.39 per account, whereas positions by measurement exhibits a ratio of 0.90, indicating that giant merchants are taking brief positions.

Associated: Ethereum Worth Prediction: ETH Stays Stable After Drop, However Bears Nonetheless Management Development

Up to now 24 hours, $10.58 million positions have been liquidated, of which $8.48 million have been lengthy and $2.1 million have been brief. The 4x imbalance signifies that the longs proceed to get caught offside as the worth is unable to maintain the assist stage.

The open curiosity chart exhibits dramatic deleveraging from a peak of over $10 billion throughout the rally to the present stage of $2.47 billion. This 75% discount in open curiosity eliminates the pressured promoting stress that fueled the crash, but additionally displays lowered speculative curiosity.

Day by day chart exhibits RSI approaching oversold

On the each day chart, XRP is buying and selling inside a descending channel that has guided worth actions since July. The token is effectively under all 4 main EMAs, with the 20-day worth at $1.63, 50-day worth at $1.82, 100-day worth at $2.01, and 200-day worth at $2.19.

The RSI has fallen to 32.01, approaching 30, which is traditionally the oversold threshold that precedes at the very least a bailout rally. The final time RSI reached the same stage was throughout the crash to $1.10, suggesting that draw back momentum could also be working out.

Associated: Bitcoin worth prediction: BTC falls into correction regardless of indicators of bullish shopping for

The present worth is down 62% from July’s excessive of round $3.65. Help for the descending channel is at the moment all the way down to round $1.20, offering the following main technical goal if the assist at $1.37 fails.

Supertrend reversal warning displayed on hourly chart

On the hourly chart, XRP fell under the supertrend assist at $1.40 and the indicator is now bearishly reversing at $1.45. The parabolic SAR is at $1.45, forming a confluence of resistance that the bulls should overcome to sign a restoration.

After breaking out of the supertrend, the worth discovered assist at $1.38, however the rebound was weak. The failure to shortly get better $1.40 after the break means that promoting stress continues to be prevailing.

The consolidation vary between $1.40 and $1.55 from February sixth to February eighth has now damaged to the draw back. The earlier assist at $1.40 turns into resistance and creates a technical ceiling on any restoration try.

Outlook: Will XRP rise?

The development stays bearish because the token breaks via key assist ranges and spot outflows speed up.

- Bullish case: If the worth closes above $1.63 for the day, it should retake the 20-day EMA and point out that the promoting has been exhausted. If broader sentiment stabilizes, the RSI is near oversold at 32, which might appeal to contrarian consumers.

- Bearish case: A detailed under $1.37 would verify the consolidation breakdown and goal a crash low of $1.10. The accelerating outflow of $19.57 million and the reversal of the supertrend counsel that sellers are nonetheless in management.

Associated: Cardano worth prediction: ADA holds $0.27 as Hoskinson’s $3 billion loss highlights cycle stress

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be answerable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply