- After the latest surge, XRP has stabilized within the $2.02 to $2.20 vary, awaiting a brand new set off.

- Open curiosity in derivatives fell to almost $3.98 billion, suggesting a decline in speculative publicity.

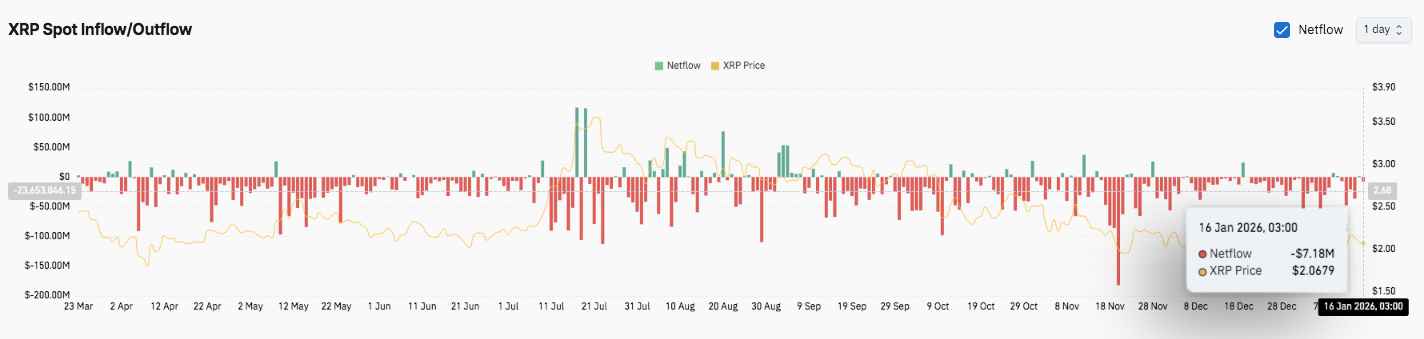

- Whale remittances to exchanges have decreased, indicating potential provide tightness and help.

XRP continues to commerce in a slim vary as market information reveals a pause after the latest surge. Worth developments, derivatives exercise, and on-chain flows collectively recommend that the market is ready for a brand new set off. Though near-term momentum has slowed, a number of indicators level to modifications in elementary dynamics that merchants proceed to look at carefully.

XRP worth maintains slim vary

On the 4-hour chart, XRP is buying and selling sideways after a pointy rally and a managed return. The value holds help above the $2.02-$2.05 zone that defines the decrease finish of the present vary. Consumers proceed to defend this space, stopping a deeper retracement.

Nonetheless, sellers stay energetic round $2.10 to $2.20. This ceiling limits some climb makes an attempt and limits follow-through. In consequence, XRP fluctuates between well-defined boundaries moderately than a definitive development.

Technically, XRP is buying and selling above the 200-period EMA close to $2.05, reinforcing structural help. The short-term averages round $2.09-$2.10 proceed to stress the value from above. Subsequently, the bulls have to firmly regain this zone to reopen larger targets round $2.18 and $2.28.

Momentum indicators present restraint, not fatigue. Chaikin’s cash movement stays barely constructive, indicating sluggish accumulation with out energetic demand. This stability displays prudence moderately than weak spot.

Open curiosity alerts cooling hypothesis

Derived information provides one other layer to the picture. XRP open curiosity soared throughout the important worth rally, reflecting elevated leverage and dealer confidence. Nonetheless, that elevated stage didn’t final.

Because the latest peak, open curiosity has declined and stabilized round $3.98 billion. This modification signifies a discount in speculative publicity and a decrease threat of compelled volatility. Moreover, the cooldown means that merchants closed leveraged positions moderately than doubling down.

Such conditions usually help vary buying and selling. Markets normally require new participation to regain momentum. With out it, worth motion shall be compressed.

Figuring out currents and whale conduct offers clues

Spot market information reveals a distinct development. Latest periods have been dominated by outflows, with internet flows hovering round -$7 million. Merchants look like shifting cash out of bodily holdings throughout the rally. In consequence, worth rebounds are short-lived.

However whale conduct tells a contrasting story. Transfers from giant wallets to Binance have declined to ranges not seen since 2021, in accordance with Cryptoquant information. This lower signifies that enormous holders are much less keen to promote.

Moreover, comparable patterns have occurred in previous cycles previous to stronger advances. Giant traders usually journey out consolidation phases whereas provide is tight. Subsequently, restricted forex inflows may assist ease promoting stress over time.

Technical outlook for XRP worth

The first stage stays clearly outlined as XRP buying and selling all through the mixing part.

Upside resistance lies at $2.09-2.10 as the primary hurdle, adopted by $2.17-2.18 and $2.28 as larger breakout targets. A sustained transfer above $2.28 may reopen the trail to latest highs at $2.42.

On the draw back, $2.05-$2.02 stays the key help zone and stays inside that vary. A breakdown beneath this space would probably see publicity at $1.93 subsequent, with deeper help round $1.77 to $1.78.

The broader construction means that XRP is compressing after a earlier rally, with worth holding above the 200 EMA whereas short-term averages are capping positive factors. This setting is usually finished after the route has settled however earlier than volatility will increase.

Will XRP go up?

XRP’s near-term prospects rely upon whether or not patrons can maintain onto the $2.02-$2.05 base lengthy sufficient for patrons to reclaim $2.10. A clear break above this stage may speed up momentum in the direction of $2.18 and $2.28.

Nonetheless, if the help fails to carry, there’s a threat that the vary will broaden downward in the direction of $1.93. For now, XRP stays at a vital inflection level the place quantity, inflows, and confidence will decide the subsequent leg.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t accountable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to carry out due diligence earlier than taking any motion associated to our firm.

Leave a Reply