- XRP stays beneath the important thing EMA, confirming bearish management and a fragile short-term construction.

- Falling open curiosity and continued spot outflows point out a decline in leverage, not panic.

- Ripple Treasury provides institutional utility and offsets weak value actions with fundamentals.

XRP stays underneath near-term strain because of cautious derivatives positioning and technical weaknesses related to sustained spot outflows. On the 4-hour chart, the token is buying and selling across the $1.90 to $1.91 zone, struggling to regain traction after a pointy rejection earlier this cycle. Whereas value traits replicate continued promoting strain, broader developments round Ripple’s company technique add a elementary layer of distinction to the story.

XRP’s technical construction suggests continued vigilance

XRP continues to be locked in a short-term downtrend on the 4-hour time-frame. The worth stays beneath the 50, 100, and 200 exponential transferring averages and continues to development downward. Due to this fact, this construction displays sustained bearish management relatively than non permanent weak point.

The decline started after a pointy pullback round $2.40 to $2.47. This zone coincided with a big Fibonacci extension and triggered aggressive profit-taking. Since then, XRP has fashioned a collection of decrease highs and decrease lows, reinforcing the fragility of the development.

Quick-term help lies round $1.87-$1.88, and the worth has discovered patrons within the current rally. Nonetheless, a break beneath that vary may expose the earlier consolidated base of $1.80 to $1.81. Importantly, the $1.77 stage exists as a key draw back marker tied to the broader Fibonacci construction.

On the upside, sellers proceed to defend the $1.93-$1.95 zone, the place Fibonacci resistance overlaps with the crowded EMA. Moreover, a stronger provide space stays between $2.17 and $2.28, limiting restoration makes an attempt.

Derivatives and spot flows reflecting threat mitigation

XRP derivatives information reveals a transparent cooling part. Open curiosity expanded quickly throughout the rally within the second half of 2025, peaking at over $10 billion. Nonetheless, it has since fallen to round $3.4 billion. Due to this fact, merchants seem like loosening leverage relatively than constructing aggressive brief publicity.

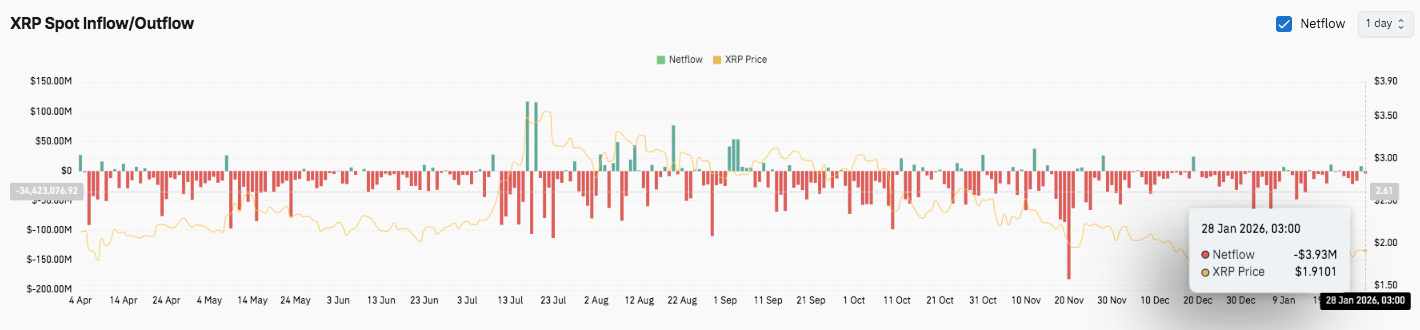

Spot move information reinforce this cautious development. Internet outflows dominated for an prolonged time frame, together with throughout non permanent value rebounds. Moreover, the surge in inflows throughout the rally was not sustained, suggesting dispersion relatively than accumulation. General, the move construction displays the restricted conviction of spot patrons.

Ripple targets establishments with new monetary platform

Past market traits, Ripple has launched Ripple Treasury, a platform aimed toward company cash managers. The system integrates GTreasury’s enterprise software program with Ripple’s blockchain infrastructure.

Ripple Treasury focuses on sooner cross-border funds, liquidity administration, and asset reconciliation. Transactions utilizing Ripple’s RLUSD stablecoin are settled inside seconds, in comparison with conventional multi-day cycles. Moreover, the platform integrates fiat and digital belongings right into a single interface, lowering reliance on handbook processes.

Technical outlook for XRP value

XRP’s key ranges stay well-defined as short-term weak point continues on a shorter time-frame.

Upside ranges lie at $1.93-$1.95 as the primary hurdle, adopted by $2.02-$2.05, which marks an essential pre-breakdown zone. A confirmed breakout above $2.05 may pave the best way to $2.17-$2.28, a high-supply space tied to the next Fibonacci retracement.

On the draw back, $1.87-1.88 acts as instant help after a number of wick rejections. This stage of loss may expose it to the earlier consolidated foundation of $1.80 to $1.81. Beneath that, $1.77 is a significant structural help and exists as a key Fib 0 stage.

Technical situations recommend that XRP continues to be trapped in a bearish continuation construction, with value buying and selling beneath main transferring averages. Momentum stays tilted to the draw back, however compression close to help alerts potential elevated volatility.

Will XRP go up?

The near-term course of XRP will rely upon whether or not patrons are capable of defend the $1.87 space and regain $1.95 on quantity. If the worth sustains above $2.05, the bearish strain will ease and momentum will decide up.

Nonetheless, if the worth can not maintain $1.87, there’s a threat of a deeper fall to $1.80 or $1.77. For now, XRP is situated in a pivotal zone and affirmation from flows and value construction will decide the following leg.

Associated: Flare XRP DeFi improvement aligns with FLR technological strain

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be accountable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.

Leave a Reply