- Grayscale has filed its first-ever Privateness Coin ETF for Zcash, with a Q1 2026 resolution to permit inflows from giant institutional traders.

- The halving and elevated defend adoption from 2024 onwards has resulted in additional than a 3rd of ZEC provide being faraway from the liquidity market.

- Regulatory readability favors Zcash’s compliant privateness mannequin, putting it forward of Monero for institutional use instances.

Zcash enters 2026 recent off a 650-1,000% rally that noticed it overtake Monero and turn out to be the biggest privateness coin by market capitalization. The 4 catalysts converge. Grayscale’s historic first privateness coin ETF utility focused for approval within the first quarter, halving the inflation charge from 4% to 2% in November 2024, 30% of provide now locked in sealed swimming pools (up from 8% in 2024), and the CLARITY Act, which offers a regulatory framework that distinguishes between compliant privateness and unlawful mixers.

Technical setup reveals excessive volatility

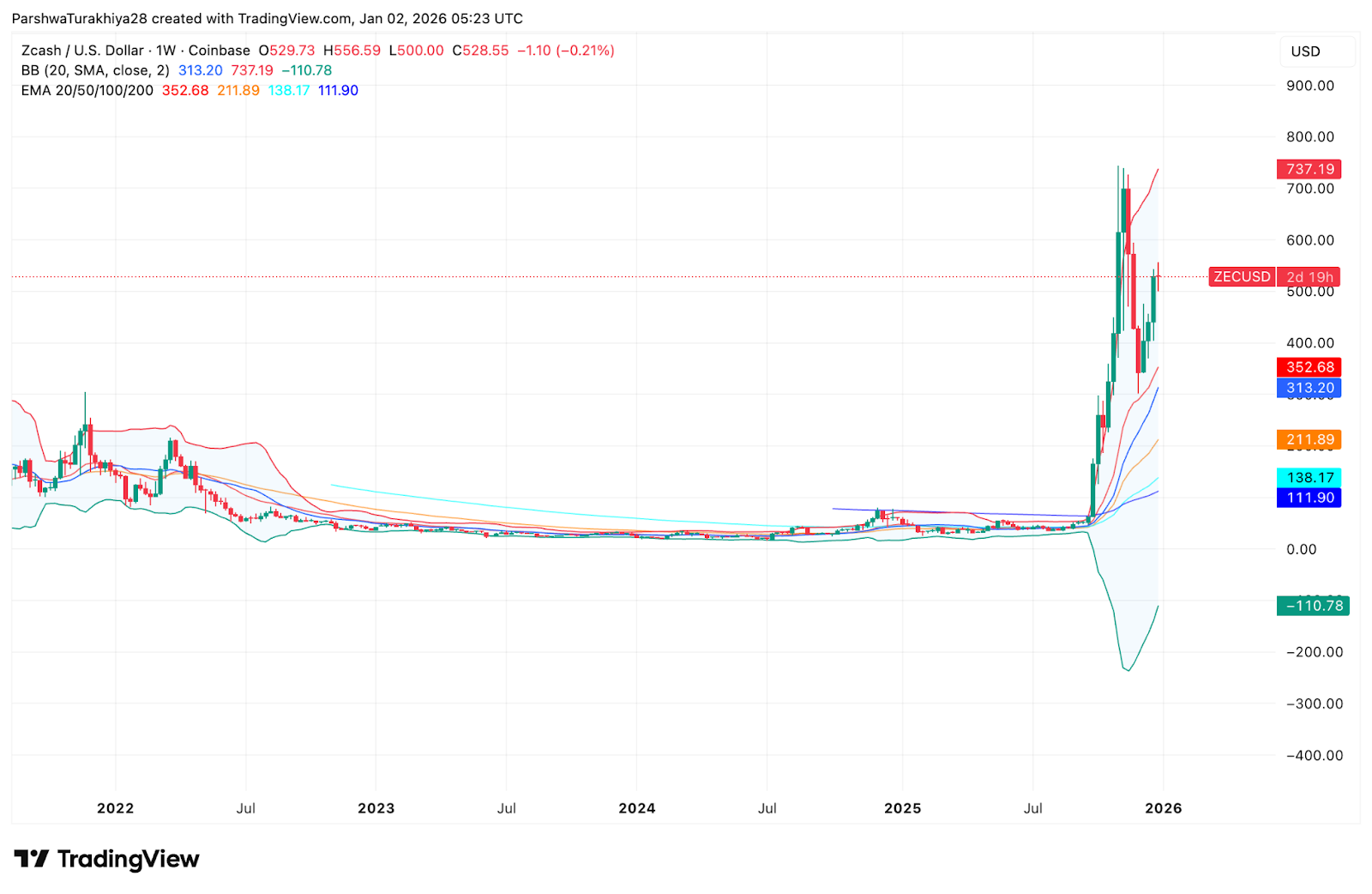

ZEC is buying and selling round $528.5 after a parabolic transfer from about $50 to $737 and a subsequent drop of about 28%. On the weekly chart, the value stays strong between $500 and $560, whereas remaining properly above the important thing EMAs of $352/$212/$138/$112, confirming situations which have tightened after the historic rally.

The Bollinger Bands have a decrease band close to $313 and an higher band close to $737, highlighting the intense volatility following the breakout. Instantaneous help stays at $500-520. A breakdown under this zone reveals $400 to $450. The bulls want sustained acceptance above $600 to retest the $730-740 highs. As a consequence of skinny liquidity, rebound and restoration actions proceed to develop.

4 catalysts drive institutional change

- Grayscale ETF submitting: On November 26, 2025, Grayscale filed with NYSE Arca for the first-ever Privateness Coin ETF to transform the $137 million Zcash Belief (5% of provide) right into a spot ETF (ZCSH). A call is predicted to be made within the first quarter of 2026, decreasing the approval timeline from 240 days to 75 days. Anticipated inflows: $500 million to $2 billion for property with a market cap of $6 billion.

- Provide shock after half-life: In November 2024, the block reward might be diminished by 50% (from 3.125 to 1.5625 ZEC) and the inflation charge will fall from 4% to 2%. The each day provide decreased from 3,600 ZEC to 1,800 ZEC. The ZIP 1015 Lockbox holds an extra 12% of your rewards. Outcomes: 92% restoration in This fall 2025 as provide tightness materialized.

- A surge in shielded adoption: 30% of provide is locked in shielded swimming pools, in comparison with 8% in early 2024, a four-fold development. 5 million ZEC might be used for the precise privateness transaction. When mixed with 5% grayscale holdings, as much as 35% of off-market provide amplifies volatility.

- Regulatory readability: The CLARITY Act (Home handed in July 2025, Senate voted on in January 2026) separates compliant privateness from unlawful mixers. Zcash’s hybrid mannequin with show keys permits for selective disclosure. This implies that it’s the solely privateness coin that establishments can legally maintain, versus Monero, which is totally non-public (delisted from exchanges).

Institutional capital enters privateness

$76.88 million institutional traders introduced. Cypherpunk Applied sciences acquired 1.43% of the whole provide ($150 million backed by Winklevoss Capital). MaelstromFund (Arthur Hayes) and Reliance International Group expanded their positions. Grayscale’s 2026 outlook clearly states that ZEC is “appropriate for portfolios searching for worth options.”

Associated: 2026 BNB Worth Prediction: Token Burn and ETF Functions Goal $1,400 Amid Tight Provide

Institutional concept: Monetary surveillance accelerates globally, CBDCs threaten privateness, and clear blockchains expose each transaction. Privateness is shifting from a “darkish net device” to an institutional necessity comparable to payroll confidentiality, M&A confidentiality, monetary operations, and asset safety.

Maturity of expertise infrastructure

Zebra 3.1 (December 2025) offered a Rust-based node implementation with reminiscence security, multi-architecture Docker help (ARM64/AMD64), and RPC optimized for organizational integration. Community Improve 7 (NU7) is focused for 2026 with Tachyon scaling (the very best degree of group help) and Internet Sustainability Mechanism for long-term funding.

Zashi pockets enhancements embody {hardware} help (Keystone), P2SH multisig for custody, cross-chain swaps (BTC/ETH to shielded ZEC by way of NEAR intent), and ephemeral addresses for enhanced privateness. Objective: Make shielded transactions as simple as transparency.

ZEC vs. Monero: Totally different markets

Zcash overtook Monero for the primary time in market capitalization in 2025 ($6-7 billion vs. $5-6 billion). Monero provides stronger default anonymity (required privateness), however faces regulatory impasses comparable to delisting from main exchanges, zero institutional entry, and no ETFs. Zcash’s non-compulsory transparency permits you to obtain compliance whereas sustaining privateness options.

Funding Implications: Monero serves privateness purists, Zcash targets institutional/regulated privateness. Each can coexist and serve totally different markets.

ZEC Worth Forecast: Quarterly Breakdown

Q1 2026: $450-$650

Grayscale ETF resolution, CLARITY Act Senate vote. Excessive volatility concerning binary outcomes. Maintain the $500 help or retest the $400. Approval situations attain $650-$700.

Q2 2026: $550-$750

If permitted, ETF inflows will start, and the defend adoption goal is 35-40%, with the allocation scale by institutional traders. $600-$700 built-in if catalyst is carried out.

Q3 2026: $600-800

Introducing NU7, enhancing Tachyon scaling, and monitoring alternate itemizing stability. The bulls are concentrating on the resistance between $750 and $800.

This fall 2026: $650-$900

12 months-end analysis of implementation indicators, institutional positioning in the direction of halving in 2028. Reaching the utmost upside of $850-$900 requires excellent execution.

Zcash value prediction desk 2026

| quarter | low aim | excessive targets | most important catalyst |

| Q1 | $450 | $650 | ETF Determination, CLARITY Act Vote |

| 2nd quarter | $550 | $750 | ETF inflows, development restraint 35%+ |

| Q3 | 600 {dollars} | 800 {dollars} | Geared up with NU7, transaction stability |

| This fall | $650 | $900 | Adoption indicators, half-life set in 2028 |

What portfolio managers have to know

- Base case ($450 to $700): Average ETF influx ($500 million to $1 billion), passage of the CLARITY Act, 35-40% defend adoption, secure alternate itemizing. Conservative institutional place.

- Bull case ($800-$1,200): Grayscale ETF and REX-Osprey ETF permitted with over $2 billion in inflows, 40-50% defend adoption, privateness coin sector rotation, crypto bull market. Institutional verification might be accelerated.

- Bear case ($180-$350): ETF rejections, regulatory crackdowns, a plateau in adoption, a cascade of delistings, and a macroeconomic downturn. Narratives about privateness can’t be realized.

Zcash isn’t a secure wager. It is a calculated wager that privateness will transfer from a distinct segment to a necessity. $76 million in institutional capital, Grayscale ETF filings, and 30% protected adoption recommend this transition is starting. The present value of $522 is 29% off the excessive, however greater than 10x from the 2024 low. Uneven alternatives exist if instructional establishments select ZEC as their privateness measure, however regulatory and adoption failures undermine this concept. Query of 2026: Validation or Denial?

Associated: Dogecoin Worth Prediction for 2026: X Funds Hypothesis Faces Inflation and Improvement Deficit

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t answerable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Leave a Reply