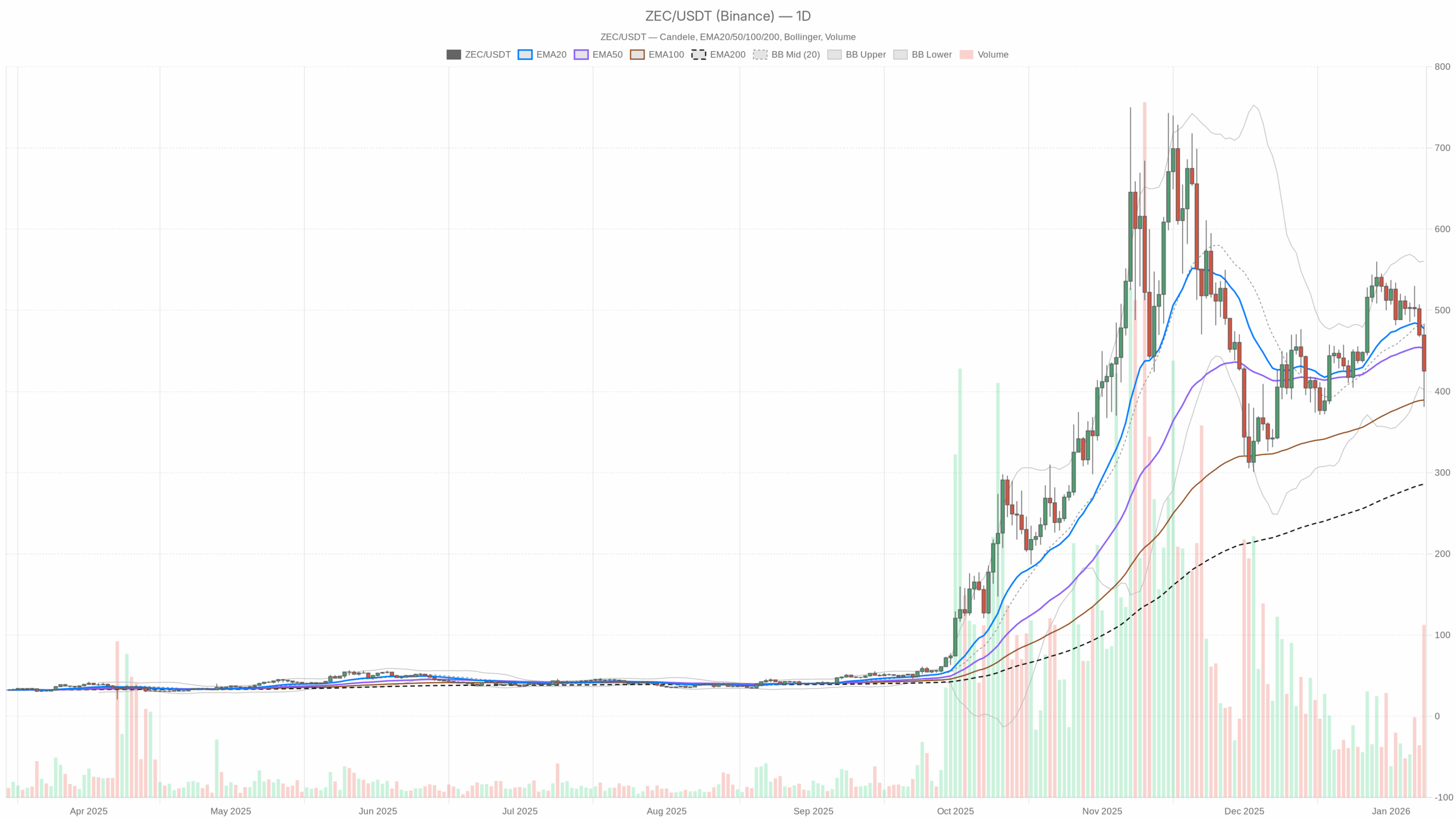

At this stage, the Zcash cryptocurrency is buying and selling in a correction setting the place short-term weak spot collides with a nonetheless resilient long-term construction.

Each day chart (D1): Macro bias – impartial regime, bearish skew

Development construction: EMA

Each day common holidays: 425.13 USDT

EMA 20: 477.44 USDT

EMA 50: 453.35 USDT

EMA200: 285.91 USDT

ZECUSDT is being traded Under 20-day and 50-day EMA however nonetheless Considerably above the 200-day EMA. This mix sometimes represents a correction section inside a bigger uptrend. So whereas the long-term construction continues to be constructive, short-term momentum has reversed in favor of sellers.

The 20-day EMA is at the moment effectively above worth and under Bollinger’s midband, performing as short-term dynamic resistance. Moreover, the 50-day EMA simply above worth 453 is a extra structural line. So long as ZEC trades at this stage, a rebound is uncertain and might be worn out by short-term merchants.

Implications: The pattern on larger time frames holds, however for now. 450–480 USDT You usually tend to meet your provide than begin a brand new impulse excessive.

Momentum: RSI (14)

RSI (14) D1: 41.72

The each day RSI is within the low 40s, under the midpoint, however not oversold but. That is normally characterised by a consolidation with a managed downtrend or bearish pattern. There may be room for costs to fall earlier than the momentum builds up sufficient to power short-covering or shopping for the dip.

Implications: Though sellers have the higher hand, this isn’t a panic leg. Except technical aid comes quickly, the decline is more likely to proceed progressively.

Mixing traits and momentum: MACD

MACD line: 9.48

Sign line: 16.40

histogram: -6.92

The MACD line is under the sign and the histogram is destructive. That is the usual setup for a promote section after a earlier rally. Though the unfold is just not excessive, the indicators up to now are clearly in favor of the bears, confirming that the latest momentum swing is downward relatively than sideways.

Implications: The each day momentum cycle continues to be within the bearish leg. Till the MACD ranges off or begins to rise, a each day pullback is more likely to be a countertrend motion.

Volatility and Vary: Bollinger Bands + ATR

Bollinger bands (20):

Midband: 481.47 USDT

Higher band: 560.66 USDT

Decrease band: 402.27 USDT

ATR (14) D1: 41.65 USDT

worth is buying and selling Close to the underside of the Bollinger band ZEC has entered the volatility ground and is at the moment hovering simply above it. It is a typical late-game down leg motion. Though no reversal has been confirmed but, imply reversal trades begin to get fascinating as soon as patrons seem.

A each day ATR of roughly 42 USDT means a typical each day fluctuation of roughly 10% of the worth. Volatility has elevated sufficient that assist and resistance ranges are extra like zones than exact strains.

Implications: The market is nearing the decrease finish of its latest volatility vary. Additional declines are potential, however the risk-reward of a contemporary quick will get worse the nearer you get to the decline. 400–380 USDT Except volatility will increase once more.

Key Degree: Each day Pivot

Pivot level (PP): 429.92 USDT

Resistance 1 (R1): 478.84 USDT

Assist 1 (S1): 376.21 USDT

Costs are at the moment in contact Below each day pivot At 429.92. This retains the intraday bias barely destructive whereas staying under that line. The R1 of 478.84 strains up intently with the 20-day EMA and Bollinger’s mid-band cluster. 470–480 USDT Areas with thick resistance bands. If the present assist under 420 breaks down, S1 can have its first well-defined draw back goal with a decline at 376.

Implications: The market is buying and selling within the decrease half of the each day pivot vary. A decisive recapture of 430 after which 470-480 could be wanted to shift the narrative again within the bulls’ favor.

Hourly chart (H1): Sellers take management, however momentum slows down

The construction of the time unit is full bearishextra aggressive than Daly.

Finish of first half: 425.46 USDT

EMA 20: 435.55 USDT

EMA 50: 462.33 USDT

EMA200: 491.21 USDT

administration: bearish

Value is under all three main EMAs on the hourly timeframe and is stacking in bearish order (20 < 50 < 200) with a transparent downslope. That is what it appears to be like like when a short-term downtrend is totally underneath management.

Implications: For energetic merchants, the primary half chart says: 435–460 USDT Till the EMA flattens out and the worth can maintain above the 20-EMA, it has been and can doubtless proceed to be a promoting alternative.

H1 Momentum: RSI and MACD

RSI (14) H1: 40.67

MACD H1: Line -20.58, Sign -19.01, Hist -1.57

The hourly RSI mirrors the each day and is within the low 40s, indicating a sustained however not excessive sell-off. The MACD is under the sign and has a small destructive histogram. This mix signifies that the downtrend is alive however has misplaced some punch. The stage of constructive momentum has already handed.

Implications: Shorters are nonetheless in management, however chasing new positions at these ranges within the first half of the yr comes with higher danger. Except we see new extensions of draw back momentum, a greater entry is on a bounce relatively than a breakdown.

Volatility and ranges within the first half

Bollinger Mid (H1): 442.39 USDT

Higher restrict: 508.02 USDT

Decrease restrict: 376.76 USDT

ATR (14) H1: 19.85 USDT

Pivot (PP): 423.58 USDT

R1: 437.17 USDT

S1: 411.88 USDT

ZEC is simply sitting Beat the time pivot This units up a pleasant intraday construction. 424 is the fast battle line, 437-442 is the primary resistance zone the place sellers are more likely to reassert, and 412 is intraday assist the place patrons will attempt to maintain the road.

Implications: The hourly chart permits for a tactical pullback in the direction of 437-442, however inside the present regime that space is extra of a brief zone than the start of a full pattern reversal.

15-minute chart (M15): Execution standing – short-term aid rebound

The 15 minute chart is simply about timing. The core idea stays the identical.

M15 Shut: 425.71 USDT

EMA 20: 411.77 USDT

EMA 50: 424.91 USDT

EMA200: 463.70 USDT

administration: impartial

The value on this quick interval is at the moment Above the 20-EMA and roughly above the 50-EMAnonetheless effectively under the 200-EMA. It is a basic micro-relief bounce setup throughout a bigger downturn.

RSI (14) M15: 59.36 – Approaching bullish with out being overbought.

MACD M15: Line -0.56, Sign -5.48, Hist 4.91 – Optimistic histogram indicating a short-term bullish momentum burst.

Implications: Within the very quick time period, patrons wish to get their land again after a decline. That is extra more likely to be a pause or a counter-trend rebound relatively than the start of a full pattern reversal except it propagates to the hourly chart.

M15 Bollinger Bands:

Mid: 404.09 USDT

Higher restrict: 424.97 USDT

Decrease restrict: 383.21 USDT

ATR(14)M15: 8.58 USDT

Pivot (PP): 426.47 USDT

R1: 429.90 USDT

S1: 422.28 USDT

The value is 15 minute bollinger band prime It is proper subsequent to Native Pivot. It is a signal of a short-term rally. Nonetheless, with hourly and each day timeframes nonetheless trending bearish, these quick timeframe squeezes usually change into liquidity for bigger gamers to promote.

Implications: Count on uneven two-way motion in the course of the day. Microbounces can stretch out a bit, however the burden of proof is on the client to convey it to an extended timeframe.

Adjusting time frames: the place the strain lies

The story throughout time frames is constant however tense.

- every single day: Impartial regime with a bearish bias – a correction section inside a long-term uptrend.

- Hourly: Clear downtrend – sellers management the tape.

- quarter-hour: Brief-term aid rebound – Consumers are aggressive, however solely tactically.

That is precisely the sort of setting the place impatient merchants get ripped aside. Increased timeframes point out promoting power, whereas intraday actions tease a pullback that appears larger than it truly is.

ZECUSDT State of affairs

bullish situation

For the bulls to take over, ZEC wants to show this micro-rebound right into a structural restoration.

What bulls need to see:

- in hourly chartsustained motion and return to the highest 437–442 USDT (H1 R1 and Bollinger Intermediate), then pulled again and held above the 20-EMA.

- in each day chartpushed again up after which pushed again up. Each day pivots are roughly 430and extra importantly, the decisive break and shut above. 50-day EMA is round 453.

- The each day RSI has risen above 50 and the MACD histogram has flattened and turned constructive.

When this sequence is executed, the primary ascent goal zone is: 470–480 USDT (20-day EMA, each day R1, Bollinger Mid Band confluence). On prime of that, we have now the next logical extension, 500–520 USDT area.

What invalidates the bullish situation: A pleasant break and finish of the day Lower than 400-390 USDT (continued buying and selling on the decrease finish of the each day Bollinger Band and a push in the direction of S1 round 376) signifies that the patrons have utterly misplaced the vary and the correction is popping right into a deeper downtrend.

bearish situation

The bears have already got a bonus. Their situation is one in all continuation, not reversal.

What bears need to see:

- collect by hour 435–450 USDT After a collection of failures, the worth was unable to maintain above the 2020 H1 EMA.

- Each day costs are fastened at 430 pivot and under the 50-day EMA of 453.

- Each day RSI is grinding from the low 40s to the mid 30s, with no sharp reversal spikes and low managed bleed.

On this script, the following draw back magnet is:

- 402–400 USDT: Decrease certain of the each day Bollinger Band space – first exams the sting of the present volatility envelope.

- 380–376 USDT: Concentrated round each day S1 – extra significant bullish shopping for curiosity could emerge.

break and maintain 376 USDT Though the precise stage is just not included within the knowledge set, it opens the door to a deeper regression in the direction of the earlier consolidation zone close to the 200-day EMA.

What invalidates the bearish situation: A number of each day closing costs transfer again up 50-day EMA (~453) And if we clearly see the each day RSI again above 50, it might point out that the correction is over and the bears who bought the breakdown are being squeezed out.

Click on right here for ZEC’s place, dangers, and philosophy

ZECUSDT is just not in a breakout pattern. it’s inside Corrective downtrend inside a broader uptrend. It is a tough zone for either side. Late shorts face poor risk-reward close to the decrease band, whereas early dip buys nonetheless danger stepping in entrance of a sound promoting program.

Listed here are some sensible takeaways from the present construction.

- of Increased timeframe bias is cautious-bearish Whereas the worth stays under 450–480 USDT.

- The volatility (each day ATR ~42) means the assist is a zone relatively than a exact line. Dimension and stopping distance are extra essential than ordinary.

- There’s something clear timeframe rigidity: Intraday lengthy setups can nonetheless work in bearish each day situations, however they’re countertrend and needs to be handled as such.

For merchants, it is a market the place endurance is usually rewarded greater than aggression. Let the degrees converse: 400–380 USDT The draw back and 450–480 USDT The following huge transfer for ZEC can be a key battleground that may decide whether or not it’s a resumption of the upward pattern or a deeper decline in the direction of the long-term transferring averages.

If you wish to monitor the market utilizing skilled charting instruments and real-time knowledge, you may open an account at: make investments Utilizing companion hyperlinks:

Open an Investing.com account

This part incorporates sponsored affiliate hyperlinks. We could earn commissions at no extra value to you.

This evaluation is for informational and academic functions solely and shouldn’t be thought-about funding, buying and selling, or monetary recommendation. Markets are unstable and unpredictable. All the time do your personal analysis and contemplate your danger tolerance earlier than making any buying and selling choices.

Leave a Reply